Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

December FOMC meeting commentary: Available now

This month, the Fed lowered interest rates by another 0.25%. Read highlights and key takeaways from the Making Sense team.

You can count on convenience when you open a First Citizens online savings account. Track your balance and deposit checks anytime, anywhere.

No minimum balance

Save as much or as little as you're ready to save.

No monthly service charge

You won't pay a fee to keep your online savings account open.

Competitive rates

Earn interest on your daily balance, and receive monthly credits.

Open your online savings account with a low minimum opening deposit of $50.

Earn 0.10% APYDD on your daily balance, compounded daily and credited monthly.

Your first two withdrawals or transfers per month are free, then cost $3 each.

Choose the right level of overdraft protection coverage for your account.

Bank when you want

Enjoy free Digital Banking, bill pay and 24/7 mobile deposits.

Get alerts

Securely keep track of your account activity with text and email alerts.

Spot spending trends

Use the Manage My Money trends tool to visualize your spending habits.

It's easy to open a savings account online in just three steps.

To start your application, we'll ask for your personal details such as name, address, email address and Social Security number.

Make an initial deposit of $50 or more with your credit or debit card, or by transferring funds from an existing First Citizens checking or savings account.

Get access to your online savings account right away when you enroll in Digital Banking.

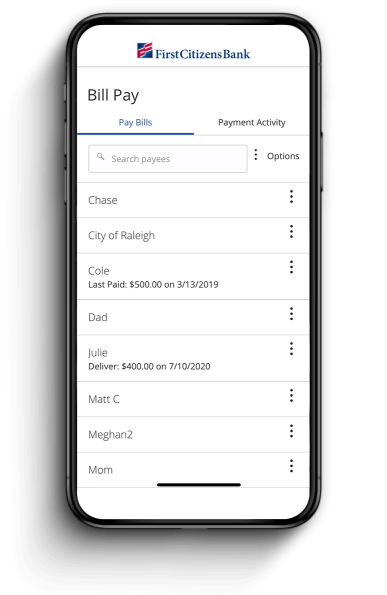

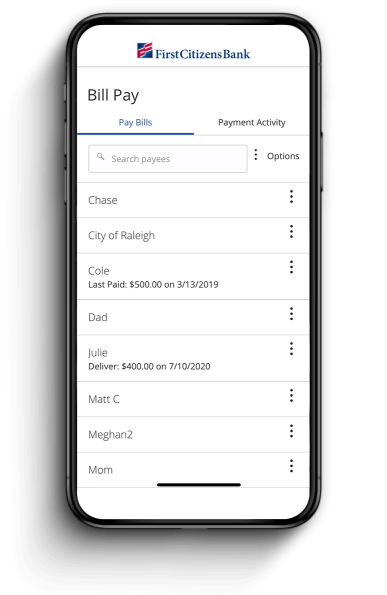

Pay your bills from any device

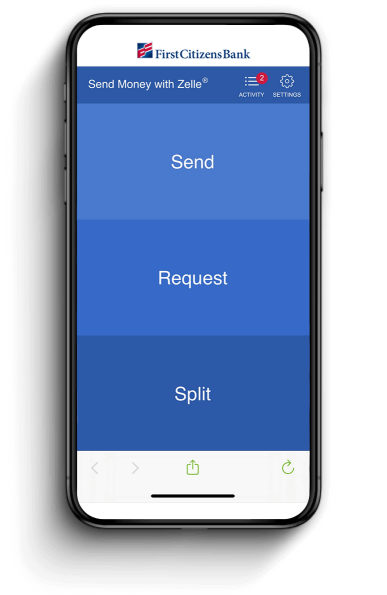

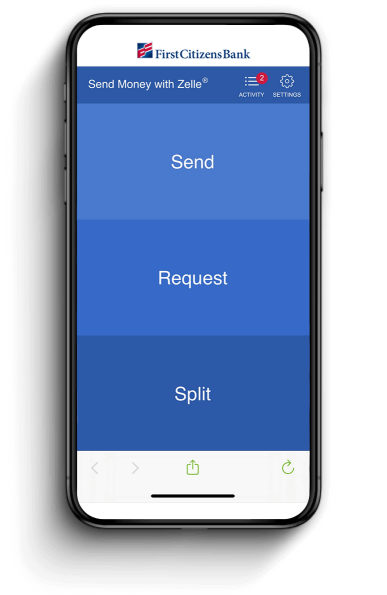

Send money with Zelle®

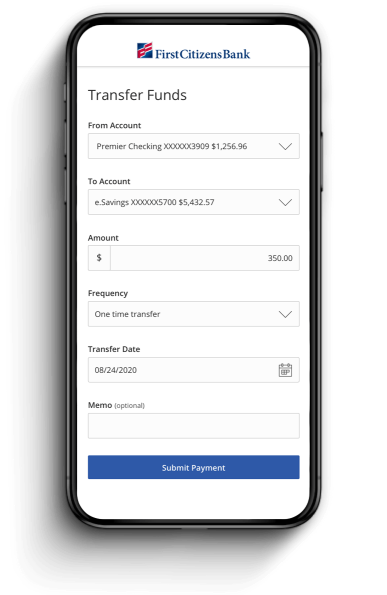

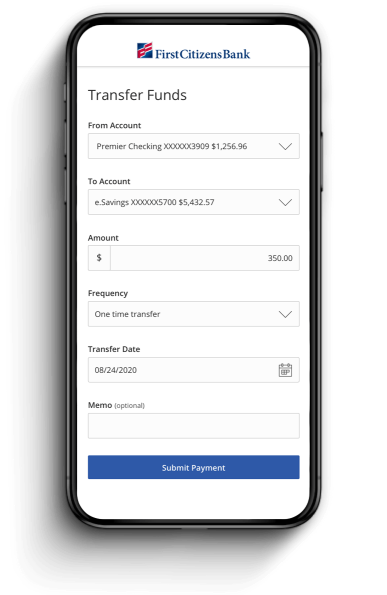

Transfer funds to other accounts

Pay your bills from any device

Send money with Zelle®

Transfer funds to other accounts

An online savings account is a convenient way to save money without having to visit a local branch. You can open a savings account online with as little as $50, and you can deposit or transfer funds by using a computer or mobile device connected to the internet.

Yes. You can open a First Citizens savings account online with no monthly fee. To get started, we'll ask you for some personal details and guide you through making your first deposit. You can make the first deposit by transferring funds from an existing First Citizens checking or savings account, or by using your credit or debit card. Then you can enroll in Digital Banking to access and manage your account online.

With Digital Banking, you can access your online savings account at home or on the go. Download the First Citizens mobile app to deposit checks quickly and securely, simply by taking pictures of the check. Accessing your funds is easy with two free transfers or withdrawals per month, and you can make additional transfers or withdrawals for $3 each. Interest is compounded daily and credited to your account monthly to help your funds grow over time.

Yes. You can access your online savings account at an ATM. And, if you have a First Citizens checking account, both accounts can be linked to your First Citizens Visa® debit card.

Yes. Your online savings account is FDIC-insured up to $250,000.

Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

First Citizens does not charge fees to download or access First Citizens Digital Banking, including the First Citizens mobile banking app. Mobile carrier fees may apply for data and text message usage. Check with your carrier for more information. Fees may apply for use of certain services in First Citizens Digital Banking.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

APY (annual percentage yield) is accurate as of ${date-today}. After that time, the rate is variable and may change. Other account-related fees may apply. Fees could reduce the earnings on the account.

Minimum opening balance of $50 in new funds to First Citizens, maximum of $1,000,000, required to receive the advertised APY.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.