Smart Option Credit Card

Our lowest interest rate credit card and no annual fee

Do more with lower interest

Our low-interest Smart Option credit card puts you in charge. Consolidate your credit with lower interest, no annual fee and added protection wherever you make purchases.

Forget the fees

Pay no annual fee and get our lowest interest rate.

Enjoy benefits

Convenient credit card benefits help protect you and your purchases.

Balance transfer

Use our introductory offer on balance transfers to consolidate your debt.

Visit your local branch to apply

Smart Option Credit Card Benefits

Big purchases, smart options

Manage your spending or consolidate higher interest rate balances on our lowest-APR, no-fee credit card.

Smart Option Credit Card Details

Card details and transaction fees

Balance transfers

0% introductory APRD for the first 12 monthsD on balance transfers, then variable purchase rate of 14.24% to 23.24% based on creditworthiness applies

Purchase rate

Variable 14.24% to 23.24% APR based on creditworthiness

Cash advances

Variable 26.24% to 29.24% APR based on creditworthiness; each transaction is subject to a 5% fee (minimum $10)

Annual fee

$0 with this no-fee credit card

Pay with your phone

Add your cards to your mobile device and pay securely with Digital Wallet.

Get alerts

Track your accounts and transactions with text and email alerts.

Pay your bills

Automate your bill payments with Digital Banking for extra peace of mind.

Credit Card Balance Transfer Calculator

Should you transfer your balance?

Whether you should transfer your balance depends on several factors. In some cases, it can save you money. Use our handy balance transfer calculator to see if it's worth it for you.

Not quite sure? Answer a few questions to find the right credit card for you.

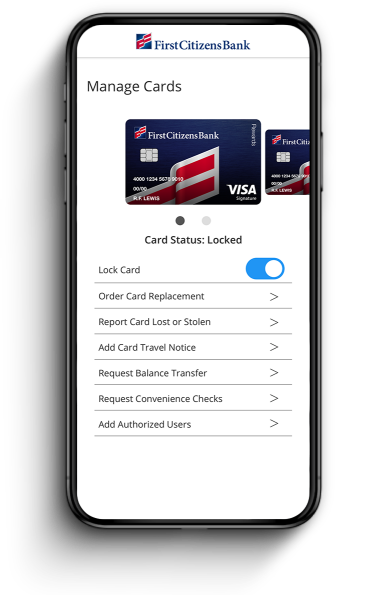

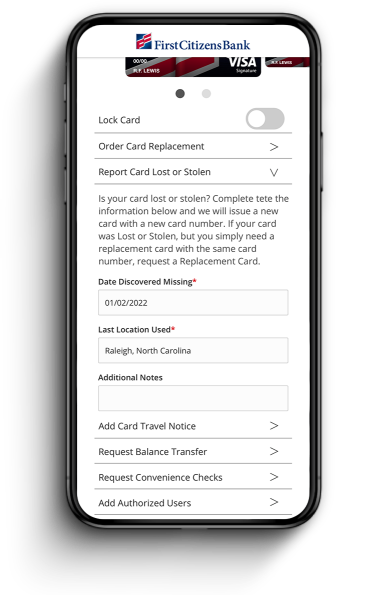

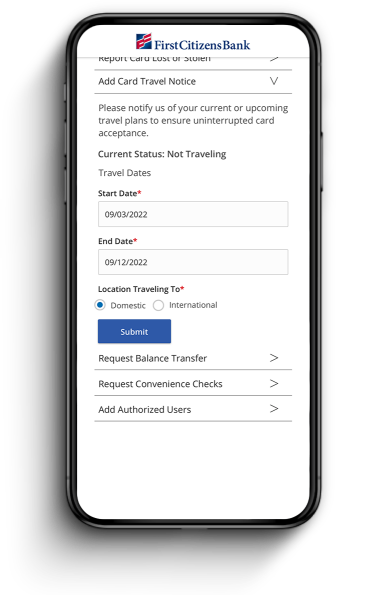

Manage Your Cards

Access any of our card services from your phone

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling