Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

December FOMC meeting commentary: Available now

This month, the Fed lowered interest rates by another 0.25%. Read highlights and key takeaways from the Making Sense team.

Explore the perks of Premier banking—and gain access to a wide range of valuable benefits.

Earn interest income

Make your money work with an interest-bearing Premier checking account.

Get preferred rates

Get better ratesD on our CDs and home equity lines of credit.

Bank when you want

Enjoy free Digital Banking,D bill pay and 24/7 mobile deposits.

Avoid the $18 monthly fee when you meet any one of these criteria.

Your Premier checking account comes with a Visa® debit card, which you can use for a fast, touch-free, secure way to pay.

Put your money to work today with a $100 minimum opening deposit.

You'll earn 0.05% APYD on your account balance with an interest-bearing Premier checking account.

Save with our preferred ratesD on home equity lines of credit.

Choose the right level of overdraft protection coverageD for your account.

Get alerts

Securely keep track of your account activity with text and email alerts.

Spot spending trends

Use the Manage My Money trends tool to visualize your spending habits.

Pay with your phone

Link your debit card to digital wallets like Apple Pay® and Samsung Pay®.

Pay off debt

Analyze balances and interest rates to come up with a payoff plan.

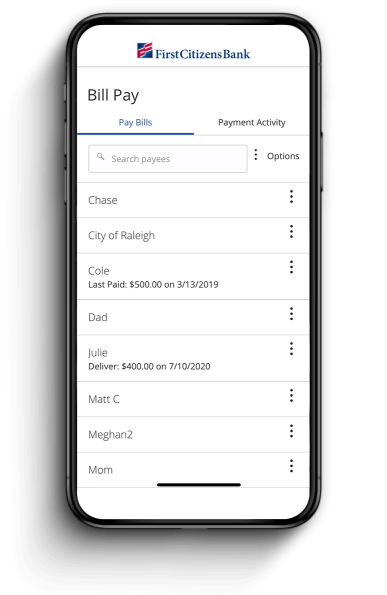

Automate your bills

Know your bills are paid through Digital Banking.

Manage wealth

See the full picture by tracking all your accounts, even from other financial institutions.

Pay your bills from any device

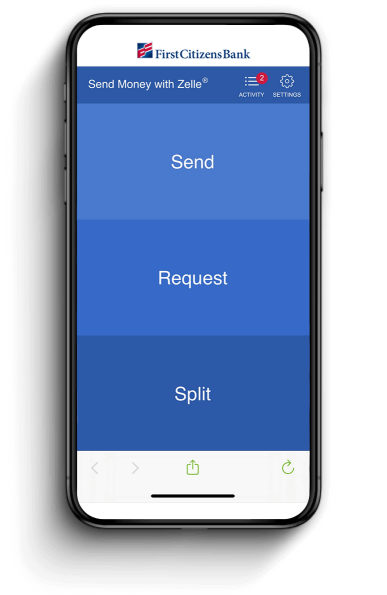

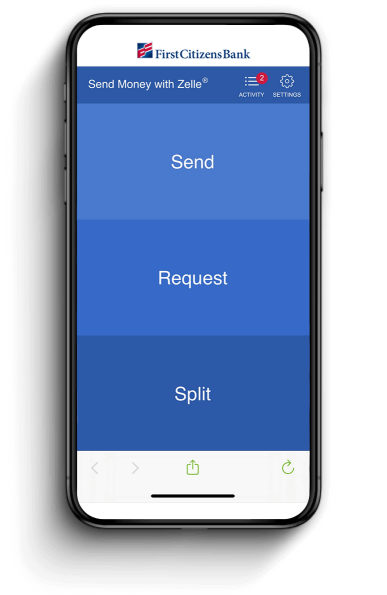

Send money with Zelle®

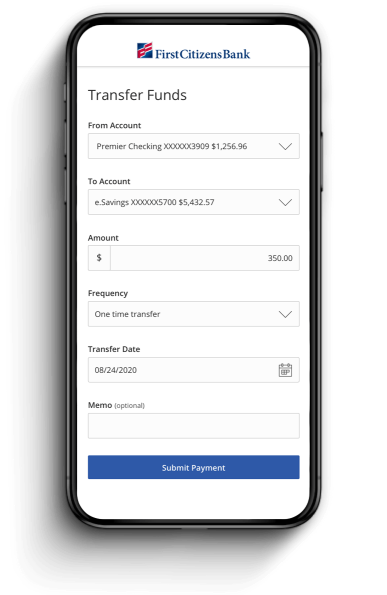

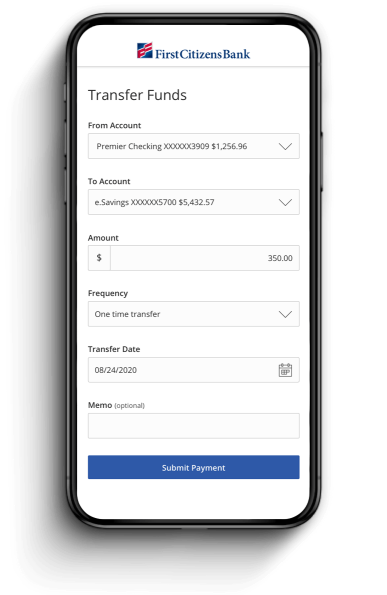

Transfer funds to other accounts

Pay your bills from any device

Send money with Zelle®

Transfer funds to other accounts

A Premier checking account is an interest-bearing account that allows you to earn interest on the money you deposit. It also offers better rates on CDs and home equity lines of credit, along with convenient features like free Digital Banking, bill pay and 24/7 mobile deposits.

To qualify for and open a Premier checking account, you must make an initial deposit of at least $100 and undergo the standard ID verification process.

The Premier checking account has a fee of $18 per month, but the fee is waived if one of the following requirements is fulfilled:

Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

Apple, the Apple logo and Apple Pay are trademarks of Apple, Inc., registered in the US and other countries.

Samsung and Samsung Pay are trademarks of Samsung Electronics, Ltd.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

For current rates, please call or visit your local branch.

First Citizens does not charge fees to download or access First Citizens Digital Banking, including the First Citizens mobile banking app. Mobile carrier fees may apply for data and text message usage. Check with your carrier for more information. Fees may apply for use of certain services in First Citizens Digital Banking.

$5,000 combined daily balance in Together Card, Regular Savings, Online Savings, Tiered Money Market Savings, Premier Relationship Money Market Savings, CDs, IRAs or Investor Services Account.

New or used auto, light or heavy truck, boat, aircraft, unsecured personal loan, or mortgage (excludes mortgages that First Citizens Bank does not retain servicing).

APY (annual percentage yield) is accurate as of ${date-today}. After that time, the rate is variable and may change. Other account-related fees may apply. Fees could reduce the earnings on the account.

With the exception of the Sure Advantage and Together Card products (which are ineligible for overdraft service), if the available funds in your account are insufficient to pay an item when presented, First Citizens Bank will make a decision on whether to pay the item or return it unpaid. When we pay an item for which there are insufficient funds, it results in an overdraft. The following overdraft fee structure applies to eligible Consumer accounts: First Citizens Bank will charge you $25 each time we pay an item resulting in an overdraft, up to our limit of three (3) overdraft charges per business day. We will not charge you for overdrafts caused by transactions of $5.00 or less, nor for items returned unpaid. You are obligated to repay overdrafts immediately. Consumers have the option to decline overdraft service. First Citizens Bank also offers overdraft protection programs. Please see our Deposit Account Agreement (PDF) for additional details.

Your investments in securities and insurance products and services are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands and Services Offered: First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares are the entities through which FCW products are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. ("FCIS"), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. and SVB Wealth LLC, all SEC registered investment advisors. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions or to all investors. Insurance products and services are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products and services are offered by First-Citizens Bank & Trust Company, Member FDIC and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

For more information about FCIS, FCAM or SVBW and its investment professionals, visit FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Make life easy with our simplest personal checking account.

Get the upgrade with the personal checking account that pays you interest.

Sign up for the VIP experience—an interest-bearing personal checking account with the best features.

Still not sure? Compare Accounts

Need to make a change?