Prestige Checking Account

The checking account that gives you the VIP treatment

Upgrade your banking experience with Prestige checking

Prestige checking offers exclusive benefits for customers with high checking account balances. Become a VIP banking customer and enjoy perks like the competitive banking rates, free checks and no banking fees—available exclusively by visiting a First Citizens branch location.

Exclusive benefits

Enjoy free cashier's checks,D money orders and travelers checks.

Our best rates

Save on home equity lines and earn more on CDs.

Superior convenience

Access your prestige account online and use any ATM.D

Prestige Banking Pricing

Get a Prestige checking account

Avoid the $25 monthly fee when you meet any one of these criteria.

Get a Visa Debit Card

Use your First Citizens debit card to make payments anywhere

Your Prestige checking account comes with a Visa® debit card, which you can use for a fast, touch-free, secure way to pay.

Prestige Banking Benefits

Access everything we offer with a Prestige checking account

Open with less

Put your money to work today with a $100 minimum opening deposit.

Unlimited use of non-First Citizens ATMs

Use any ATMD that's convenient and get reimbursed.

Earn interest

You'll earn 0.05% APYD on your balance with a Prestige account.

Get our best rate on your home equity

Save the most with our preferred ratesD on home equity lines of credit.

Get overdraft protection

Choose the right level of overdraft protection coverageD for your account.

Bank when you want

Enjoy free Digital Banking, bill pay and 24/7 mobile deposits.

Get alerts

Securely keep track of your account activity with text and email alerts.

Pay with your phone

Link your debit card to digital wallets like Apple Pay® and Samsung Pay®.

Spot spending trends

Use the Manage My Money trends tool to visualize your spending habits.

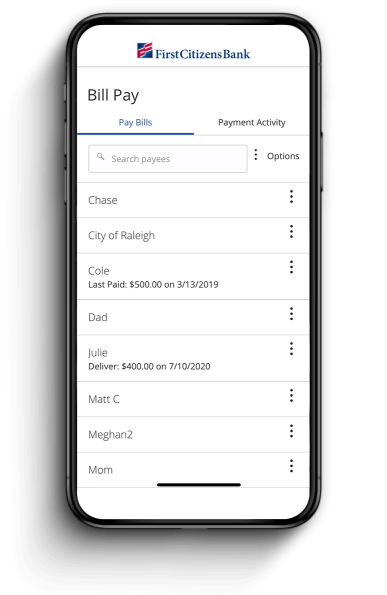

Automate your bills

Know your bills are paid through Digital Banking.

Manage wealth

See the full picture by tracking all your accounts, even from other financial institutions.

Not quite sure? Answer a few questions to find the right checking account for you.

Payments & Transfers

Instantly move your money wherever you need it

Pay your bills from any device

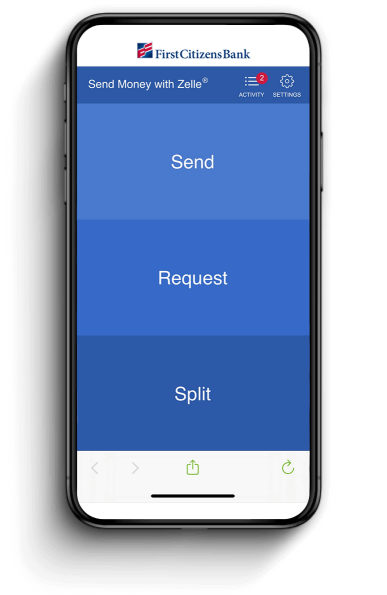

Send money with Zelle®

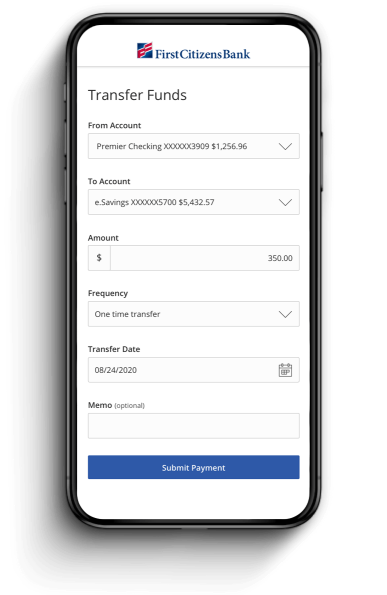

Transfer funds to other accounts