Manage your cash flow more effectively

Every day, our experienced professionals deliver personalized treasury services to meet your unique challenges and goals. Choose from a variety of treasury management products, tools, advice and services to achieve your objectives.

Receivables

Optimize your cash flow by simplifying account receivables with traditional or electronic methods.

Payables

Keep your business moving forward by streamlining processes, expenses and transactions.

Zero Balance Accounts

Easily manage your money with automatic transfers between accounts for disbursements or deposits and your master account.

ACH Services

Keep employees and customers happy with swift, secure electronic deposits.

Purchasing Card

Simplify business purchases, reduce paperwork and monitor expenses.

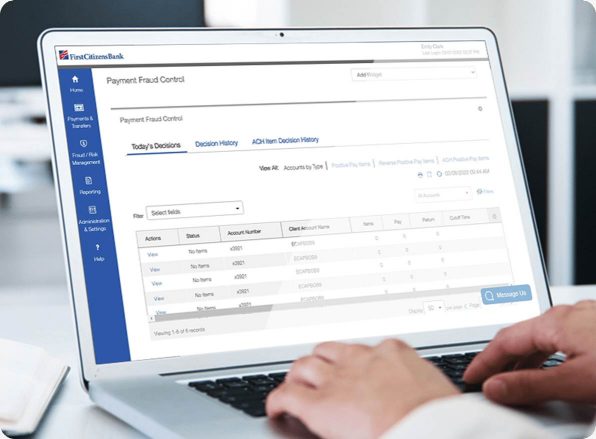

Fraud Prevention

Implement the latest fraud prevention controls to protect your business accounts against suspicious activity.

Information Management Services

Our secure products and services help digitally manage your business data.

Reporting and Reconciliation

View collections, payments and other details in a way that's designed to suit your needs.

Liquidity Management

Put idle funds to work for your business in interest-bearing accounts by investing, minimizing interest or paying down debt.

Smart Safe and Provisional Credit Services

Improve your cash flow while reducing risk.

We're here to help with your treasury management needs

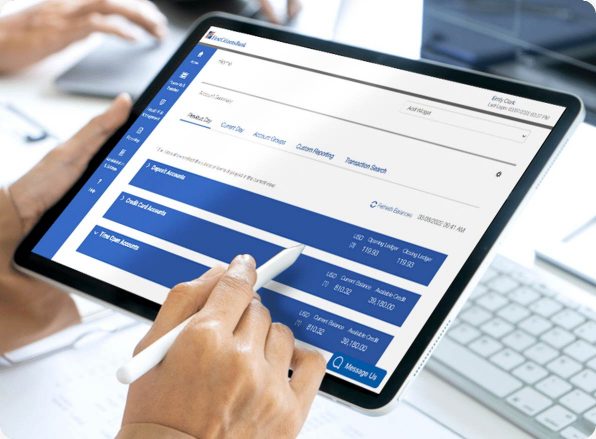

Digital Banking

Commercial Advantage

Accurately track cash flow

Manage your business on the go

Keep your assets secure