Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

2026 Market Outlook video: Available now

The Making Sense team reflects on 2025 and discusses key headwinds and tailwinds for 2026.

Our Travel Rewards credit card is the perfect companion for those who love to roam. We've made it easier than ever to earn extra points when you travel.

Get more to travel

Earn more points when you spend on airlines, hotels and other travel purchases.

Exclusive benefits

Spend points on travel rewards and enjoy many other great credit card benefits.

Transfer a balance

Get 0% intro APRD on balance transfers within the first 12 monthsD as a special offer.

Redeem your points for credit card rewards including airlines, hotels, car rentals and other travel experiences.

0% introductory APRD for first 12 monthsD on balance transfers, then variable purchase rate of 16.74% to 25.74% based on creditworthiness applies

$95, waived for the first yearD

0% fee on transactions outside the US

Tap your card to pay

Make quick and secure purchases with contactless payments.

Get alerts

Track your accounts and transactions with text and email alerts.

Pay your bills

Automate your bill payments with Digital Banking for extra peace of mind.

First Citizens offers several credit cards, but the best credit card for you depends on how you like to shop and spend your money. When it comes to earning reward points, which of our credit cards will be the most rewarding for you? Use this handy credit card rewards calculator to find out.

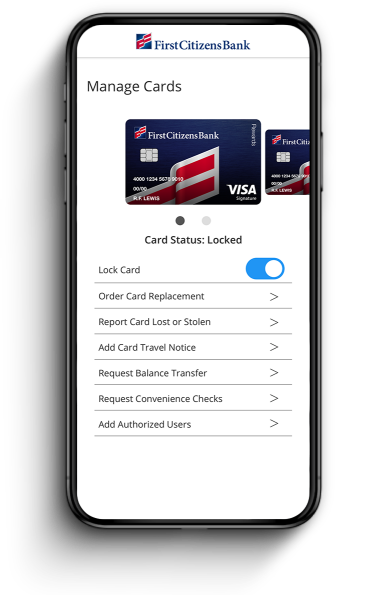

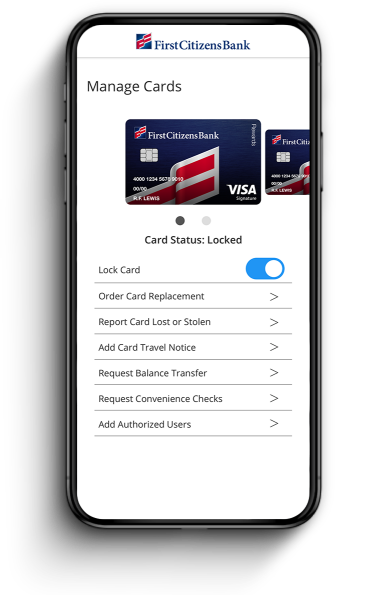

Temporarily lock your card

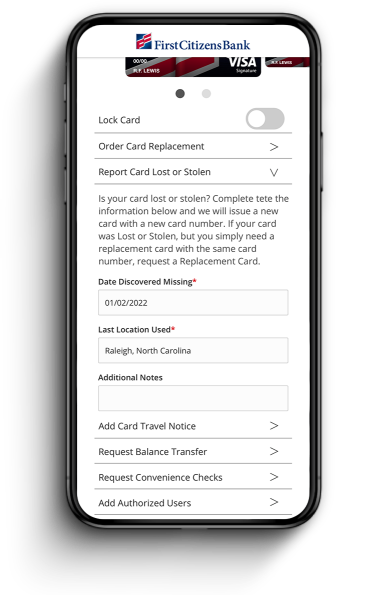

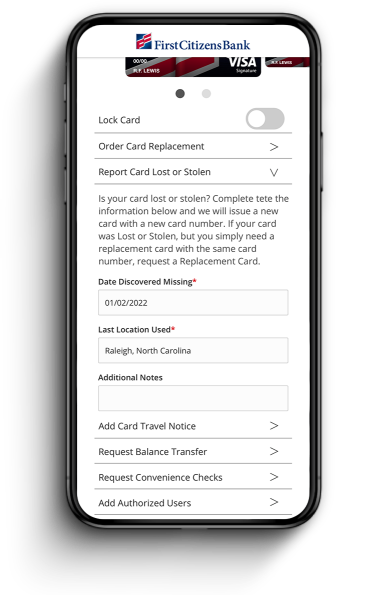

Report a lost or stolen card

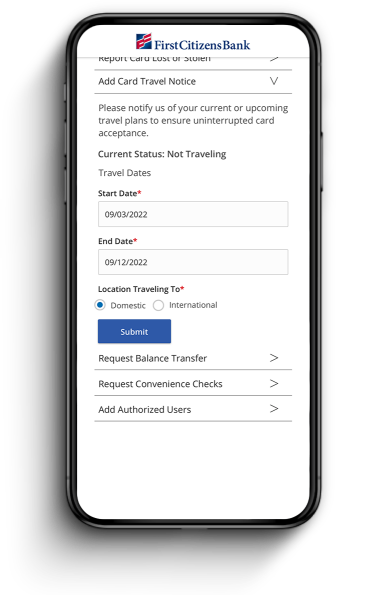

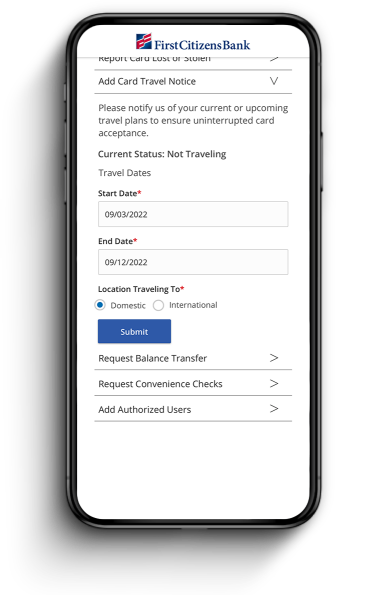

Notify us if you're traveling

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling

With our Travel Rewards credit card, you earn points for both travel purchases—3 points per $1 spent—and everyday purchases—1.5 to 2 points per $1 spent. You can redeem your points for flights, hotel stays and more. If you travel often, a travel rewards card can help make your travel more affordable.

With the Travel Rewards credit card, you earn additional points on travel-related purchases. You also receive a $100 annual ancillary travel credit that can be applied toward baggage fees, TSA PreCheck® fees, airline club memberships and more. Plus, there are no foreign transaction fees when using this card outside the US, making it a great travel companion for your wallet.

No. There's no limit on the number of points you can earn with your Travel Rewards credit card.

No. Your points won't expire as long as your credit card account remains open and in good standing.

Because air travel costs vary by flight time, destination and departure city, the number of points required will vary from flight to flight. If you know the cost of a flight, you can estimate how many points you'll need—simply multiply the cost by 100. For example, you'd need 17,766 points to cover a flight costing $176.66.

Redemption fees also apply. Airline tickets booked by calling the First Citizens Rewards Center have a redemption fee of $20 or 2,000 points. Airline tickets booked online through the Rewards website have a redemption fee of $15 or 1,500 points.

Please note you don't have to cover the entire cost of your flight with points. If you don't have enough points to pay for a flight in full, you can use your points to pay a portion of the cost and use your Travel Rewards card for the remaining balance.

Yes. You can earn and redeem points for a variety of credit card rewards. Use your points for rewards including travel, cash as a statement credit or as a deposit into your First Citizens checking or savings account, donations to Teen Cancer America, gift cards, and merchandise.

Yes. You can transfer some or all of the points in your Rewards account to another First Citizens Rewards account. Point-gifting is limited to consumer cardholders and must be completed online.

Points are posted within 3 business days of your purchase, except for holidays.

Your credit score is an important factor in determining your creditworthiness. Learn more about credit scores and how they impact lending decisions in our guide to credit scores.

Normal credit approval applies.

For more information, please see the First Citizens Consumer Credit Card Cardholder Agreement and Disclosure (PDF).

Purchases are defined as gross retail purchases less any returns or credits.

APR (Annual Percentage Rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of October 31, 2025, is 7.00% and may vary in the future. The transaction fee for cash advances is $10 or 5% of the amount of the cash advance, whichever is greater. The transaction fee for foreign transactions is 3% (0% for Travel Rewards) of each transaction after conversion to US dollars.

Balance transfer must occur within the first 90 days of account opening to qualify for the 0% APR (annual percentage rate) introductory offer and will be subject to a balance transfer fee of $5 or 3% of the amount of each transfer, whichever is greater. After the 12 billing cycle period, your APR will default to your purchase APR.

Pay Me Back redemptions must be made within 60 days of original qualifying purchases of $100 or greater. Some exclusions apply to certain categories of transactions. No statement credit card will be applied against any monthly minimum payment due.

The $95 initial Annual Fee will be waived the first year but charged to your Travel Rewards Credit Card Account every 12 months thereafter.

Merchants who accept Visa credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making reward offers to you. We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Earning Points

With Travel Rewards, you will earn three (3) points on travel, two (2) points on dining, and one and a half (1.5) points for each net dollar you spend (gross purchases less any returns or credits). Earned points are calculated on actual dollars spent rounded up or down to the nearest point. Points will be deducted from the available rewards account balance for all returned purchases.

There's no monthly point cap and points don't expire.

Redeeming Points

Each point is worth $0.01, which means that 100 points equals $1 in redemption value. Redemptions start as low as 10,000 points. Some limitations may apply.

You may redeem points back into other First Citizens banking products:

Cash back and account credit redemptions must be completed through the program website, however a statement credit back to your First Citizens Card can also be redeemed through the First Citizens Rewards Call Center. The redemptions will post within 2 to 8 business days. No First Citizens card or mortgage account credit will be applied, in whole or in part, against any monthly minimum payment due, however, account credits to your First Citizens consumer loan will be applied first to your outstanding interest and any remaining amount will be applied to your principal.

Redemptions are also available for travel, including airline tickets, hotel, car rentals, cruises and tours, retail gift cards and certificates, donations and merchandise.

You may use points for a Pay Me Back® redemption, meaning a statement credit for the corresponding dollar amount will be applied to your First Citizens Travel Rewards card that was used for the purchases over $100. Some exclusions apply to certain categories of transactions. No statement credit will be applied, in whole or in part, against any monthly minimum payment due.

Airline Ancillary Fee Credit

You're eligible for one statement credit of up to $100 each calendar year if you make qualifying airline ancillary fee transactions with a First Citizens Travel Rewards card. Qualifying transactions are those purchases made on select US domestic-originated flights on certain US domestic airline carriers that include seating upgrades, ticket change or cancellation fees, checked baggage fees, in-flight entertainment, onboard food and beverage charges, and airport lounge fees affiliated with eligible airline carriers. Airline ticket purchases, mileage point purchases, mileage point transfer fees, gift cards, duty-free purchases, award tickets and fees incurred with airline alliance partners do not qualify.

These terms are only a summary. Other restrictions and requirements apply. The full First Citizens Rewards® Program Rules will be provided upon enrollment and are accessible through the program website at FirstCitizensRewards.com.

Program rules are subject to change or cancellation without notice.