Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

2026 Market Outlook video: Available now

The Making Sense team reflects on 2025 and discusses key headwinds and tailwinds for 2026.

Consolidate Debt

Combine your credit card balances into one convenient monthly payment.

Save Money

You could save on interest and potentially pay down your balance faster.

Easy Process

Transfer your balance online in three quick and simple steps.

0% APRD

0% introductory APRD for the first 12 months, then the purchase rate of 16.74% to 25.74% for all cards except Smart Option, which is 13.74% to 22.74%.

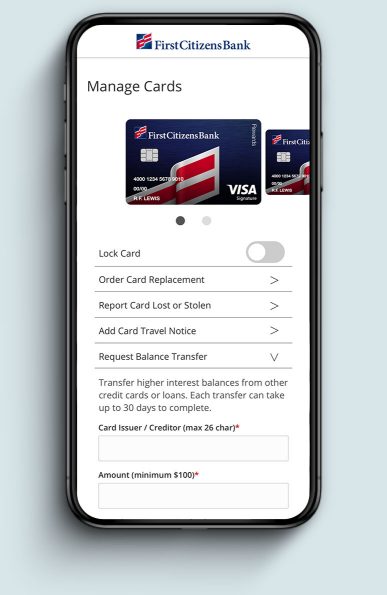

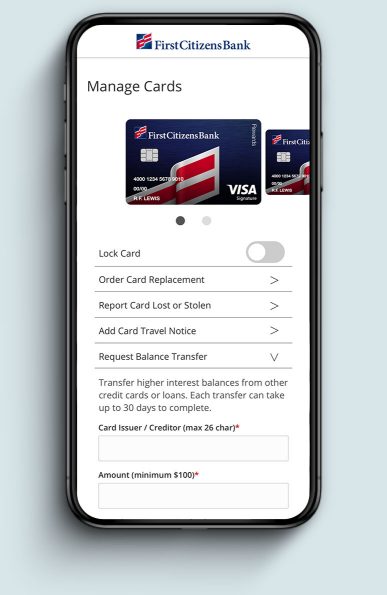

Log in and go to Manage Cards

Specify your card, select Request Balance Transfer

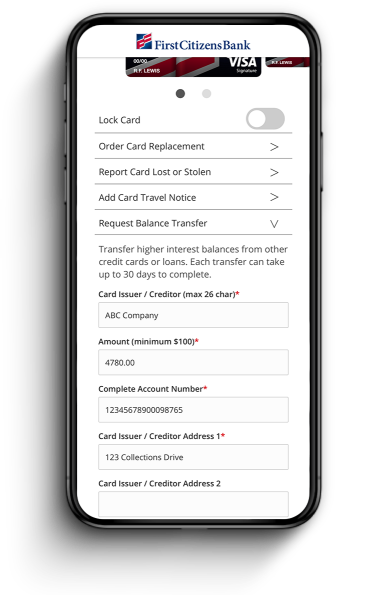

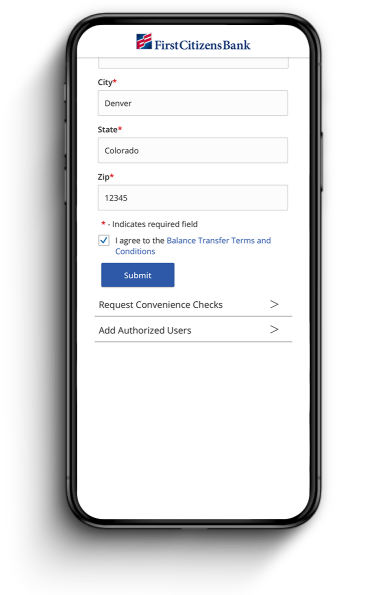

Provide transfer info and accept terms

Log in and go to Manage Cards

Specify your card, select Request Balance Transfer

Provide transfer info and accept terms

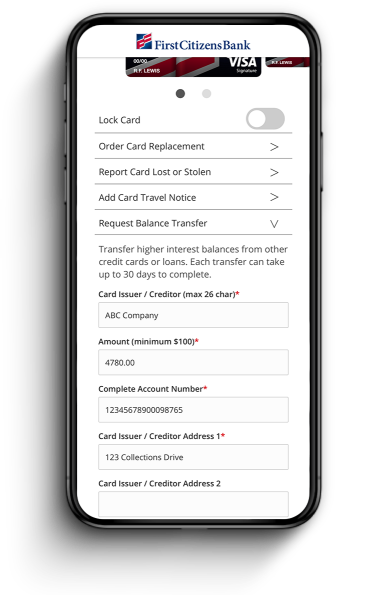

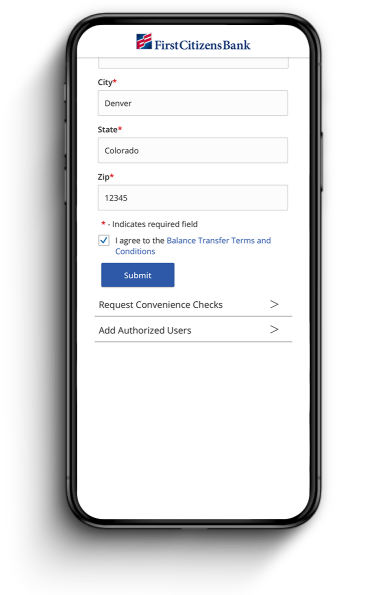

Here's what information you'll need to request a credit card balance transfer.

Whether you're looking to earn rewards or build your credit score, we make it easy to answer a few questions and find the right credit card for you.

A credit card balance transfer is the process of transferring debt from one credit card to another. Usually, people use balance transfers to save money by moving from a high-interest rate card to a low-interest rate card, or to streamline monthly payments. The new credit card may offer other benefits as well, such as a cash back or travel rewards program.

Yes. A balance transfer can be used to pay down balances on any unsecured revolving credit cards and loans, except those with First Citizens or any of our affiliates.

Yes. There is a balance transfer fee of either $5 or 3% of the amount of each transfer, whichever is greater. This fee will post to your credit card account the same time the balance transfer is posted.

Generally, you can expect a balance transfer to take up to 30 days, depending on the postal service and the other institution processing the payment. During this time, continue to make at least the minimum payments on the account balances being transferred.

No. Points or rewards dollars aren't accrued on balance transfers or associated fees.

After the 12th billing cycle, your APR will default to your Purchase APR. You'll be charged interest on purchases unless you pay off the entire new balance, including the transferred balance, by the due date.

These transactions are subject to approval, and we reserve the right to decline based on account status, available credit, credit history and other factors.

You'll need the card issuer's name and address, your full 16-digit card number, and the amount you'd like to transfer.

The 90-day window begins the day your credit card is approved.

No. Your balance transfer doesn't need to post within the 90-day window. However, it must be initiated and submitted during the 90-day window to qualify for the introductory rate.

Normal credit approval applies.

For more information, please see the First Citizens Consumer Credit Card Cardholder Agreement and Disclosure (PDF).

APR (Annual Percentage Rate). The Prime Rate used to determine your APR is the Prime Rate as published in The Wall Street Journal on the last business day of the preceding calendar month. The current Prime Rate as of October 31, 2025, is 7.00% and may vary in the future. The transaction fee for cash advances is $10 or 5% of the amount of the cash advance, whichever is greater. The transaction fee for foreign transactions is 3% (0% for Travel Rewards) of each transaction after conversion to US dollars.

Balance transfer must occur within the first 90 days of account opening to qualify for the 0% APR (annual percentage rate) introductory offer and will be subject to a balance transfer fee of $5 or 3% of the amount of each transfer, whichever is greater. After the 12 billing cycle period, your APR will default to your purchase APR.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Earn more points on travel and get exclusive travel rewards.

Earn more points on special spending categories.

Transform everyday purchases into unlimited cash back.

Get our lowest available rate.

Still not sure? Compare Accounts

Need to make a change?