Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

December FOMC meeting commentary: Available now

This month, the Fed lowered interest rates by another 0.25%. Read highlights and key takeaways from the Making Sense team.

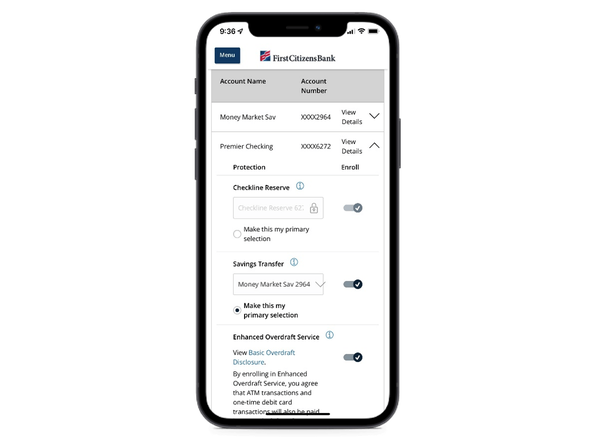

You've got options for how to handle overdrafts. Plan ahead today and enjoy peace of mind.

For more coverage, you can layer overdraft protection options on top of our overdraft service. Learn more about all these options below.

Free to enroll

Enrolling for additional coverage beyond our Basic Overdraft Service is free. Pay only when an overdraft is covered.

Convenient

Easily track and review overdraft transactions in Digital Banking.

Flexible

Choose the right level of protection to meet your needs and layer your coverage.

Basic Overdraft Service is provided automatically when you open a checking account, so there's no need to enroll.

Extends the coverage provided by Basic Overdraft Service to include ATM and one-time debit card transactions.

Link your savings account to your checking account for overdraft protection. If your checking account has insufficient funds, money is automatically transferred from your savings.

Apply for a revolving line of credit and access funds when you need them most—for any kind of expense—just by writing a check.D Speak to a First Citizens branch associate to establish your Checkline Reserve account.

You can control your overdraft options in just a few steps.

Knowledge is power, especially when it comes to your finances. Here are more tools and resources you can use to track and manage your spending.

Account Alerts

Get text and email alerts about transactions, deposits and low balances.

Digital Banking

Manage your accounts, transfer money and make payments with online banking.

Mobile Banking

Download our secure mobile app for digital banking and check deposits on the go.

Direct Deposit

Enjoy same-day access to your funds with recurring automatic deposits.

An overdraft occurs when the bank pays an item withdrawn from a bank account that doesn't have enough in its available balance to cover the transaction.

Overdraft protection refers to arrangements that help a customer avoid overdrafts. In contrast, overdraft service enables overdrafts to occur. At First Citizens, there are two overdraft protection options:

Usually, there's a $10 fee on a day when funds are transferred from savings or a Checkline Reserve account to cover one or more items for which there were insufficient funds.

When we say Basic Overdraft Service, we're referring to the default overdraft preferences set up when you opened your checking account with First Citizens.

Under our Basic Overdraft Service, at our discretion, we may authorize and pay overdrafts for checks, automatic bill payments or other transactions made using your checking account number. When such an overdraft is authorized, it may result in the assessment of a $10 overdraft fee (up to a maximum of four overdraft fees per day). You can change your overdraft preferences and elect not to permit overdrafts by notifying us.

When you open a checking account, you're also asked if you would like to opt in to Basic Overdraft Service with ATM/Debit Card Coverage. This enhanced service adds coverage for ATM cash withdrawals and one-time debit card transactions. We don't authorize or pay overdrafts for these types of transactions unless you opt in to this service. If we don't authorize or pay an overdraft, your transaction will be declined. You can change your overdraft preferences for these types of transactions at any time.

Yes. In fact, layering overdraft protection on top of Basic Overdraft Service with ATM and Debit Card Coverage has a number of benefits. Not only are you more protected against balance instability and the surprise of declined transactions, but you also set the order of priority for how transfers from savings and Checkline Reserve will occur. For example, you can prioritize your overdraft protection to draw from savings first, then Checkline Reserve.

Regardless of how you prioritize your protection, your Basic Overdraft Service or Basic Overdraft Service with ATM and Debit Card Coverage will always be last. In other words, we'll first try to help you avoid an overdraft by transferring funds as available. If the necessary funds aren't available in savings or in your line of credit, then First Citizens will exercise its discretion regarding whether to permit an overdraft or decline the transaction.

If you don't enroll in this enhanced service, we won't be able to authorize one-time debit card transactions or ATM cash withdrawals unless your account has sufficient funds to cover the amount of the transaction. If your account doesn't have sufficient funds, these transactions will be declined at the point of purchase.

Yes. Your decision to enroll in Basic Overdraft Service with ATM and Debit Card Coverage can be changed at any time. Keep in mind that any previous overdraft fees you've incurred won't be waived or reimbursed as a result of such a change.

Overdraft protection and service is set on an account-by-account basis. This means you decide how you'd like overdrafts to be handled for each account you have. If you want overdraft protection on more than one bank account, then you must enroll each one.

Account openings and credit are subject to bank approval.

Overdraft Protection Transfer fees do not apply to Prestige, Premier Executive or Sure Advantage checking accounts.

Account may also be subject to accrual of interest and a minimum monthly payment must be made if the line is used.

With the exception of the Sure Advantage and Together Card products (which are ineligible for overdraft service), if the available funds in your account are insufficient to pay an item when presented, First Citizens Bank will make a decision on whether to pay the item or return it unpaid. When we pay an item for which there are insufficient funds, it results in an overdraft. The following overdraft fee structure applies to eligible Consumer accounts: First Citizens Bank will charge you $10 each time we pay an item resulting in an overdraft, up to our limit of four (4) overdraft charges per business day. We will not charge you for overdrafts caused by transactions of $5.00 or less, nor for items returned unpaid. You are obligated to repay overdrafts immediately. Consumers have the option to decline overdraft service. First Citizens Bank also offers overdraft protection programs. Please see our Deposit Account Agreement (PDF) for additional details.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.