Are CDs Good for Retirement Income?

For investors seeking stability over high-risk growth, certificates of deposit, or CDs, may be an appealing option. But are CDs good for retirement?

Ultimately, the decision to use CDs as part of your retirement income strategy requires an understanding of not only the benefits and drawbacks of CDs but also how they might fit into the broader context of your financial goals.

What are CDs?

CDs are time-bound savings instruments offered by banks. Like other savings vehicles, they offer stability and security. However, there are a few key differences between CDs and savings accounts. Notably, CDs provide a fixed interest rate over a specified period—one that's often higher than what a traditional savings account may offer.

Learn more about CDs

Explore the difference between savings accounts and CDs.

Benefits of CDs for retirement

Retirement is a significant milestone that ushers in many changes—not just in lifestyle but also in financial strategy. After decades of pursuing growth and wealth accumulation, you'll face a new set of priorities: preserving your nest egg while generating a steady, reliable retirement income.

At any age, CDs may make sense as part of a more conservative portfolio. But in retirement, they may be particularly helpful for supplementing other income sources, such as Social Security, pensions, 401(k) plans or annuities.

There are a few key attributes that may make CDs a good option for retirement income, including their predictable returns.

Stability and consistency

One of the primary reasons many people choose to leverage CDs for retirement income is their fixed interest rate. Unlike stocks, where returns often fluctuate, CDs offer a predictable income stream. This stability is crucial in retirement, when you'll need to rely on your investments to pay for daily living expenses. Plus, CDs kept in a Roth IRA can provide you with tax-free earnings.

Higher interest rates

While CDs typically offer a higher rate of return than most savings accounts, this will fluctuate with the interest rate environment. In a high-interest-rate environment, CDs often become more appealing.

Protection from risk

The fixed returns that CDs offer may be an effective way to shelter capital from market downturns, which may help you preserve your savings in retirement. As a fixed-income investment, CD returns may also help offset portfolio losses during volatile periods.

Low maintenance

Compared to other types of investments, opening a CD is a straightforward process. Interest accrues automatically until maturity, and CDs don't require continuous, hands-on management. This convenience may be appealing to you in retirement, especially if you're seeking stability without labor.

FDIC insurance

CDs issued by banks that are insured by the Federal Deposit Insurance Corporation, or FDIC, are covered for up to $250,000 per depositor, per insured bank, for each account ownership category. This insurance provides a safety net, ensuring that your principal is protected in the unlikely event of a bank failure.

Tips to maximize your CD investments

To make CDs a viable source of income for your retirement, you'll first need to assess your income needs. Determine how much income you'll require from your CD investments to supplement your other sources of retirement income. You'll want to choose CD terms that align with your cash flow requirements. You may choose some shorter-term CDs for immediate income needs and longer-term CDs for stable income for future years.

Drawbacks of CDs for retirement

While CDs present numerous benefits, they do have some drawbacks—especially in the context of your unique needs in retirement.

Liquidity concerns

In exchange for higher interest rates, CDs require you to lock in your capital until the maturity date. You choose the CD's term—from 6 months to 5 years, for example—and you'll pay a penalty for early withdrawals. This may prove to be a significant drawback if you need access to your funds unexpectedly. Implementing a CD ladder is one way to maintain personal liquidity while leveraging CDs.

Potential opportunity cost

While CDs offer predictable returns, this may limit your money's growth potential. Interest rates fluctuate over time, and locking into a long-term CD means you may forfeit the chance to invest at higher yields, should interest rates suddenly increase.

Inflation risk

The fixed interest rate that CDs offer may be a double-edged sword. In times of prolonged high inflation, the real return—that is, the interest rate minus the inflation rate and taxes—can be quite low or even negative, eroding the purchasing power of the income generated.

Ways to use CDs for retirement income

If you're interested in using CDs for retirement income, consider leveraging the following CD investing strategies to maximize the benefits while minimizing the downsides.

CD ladders

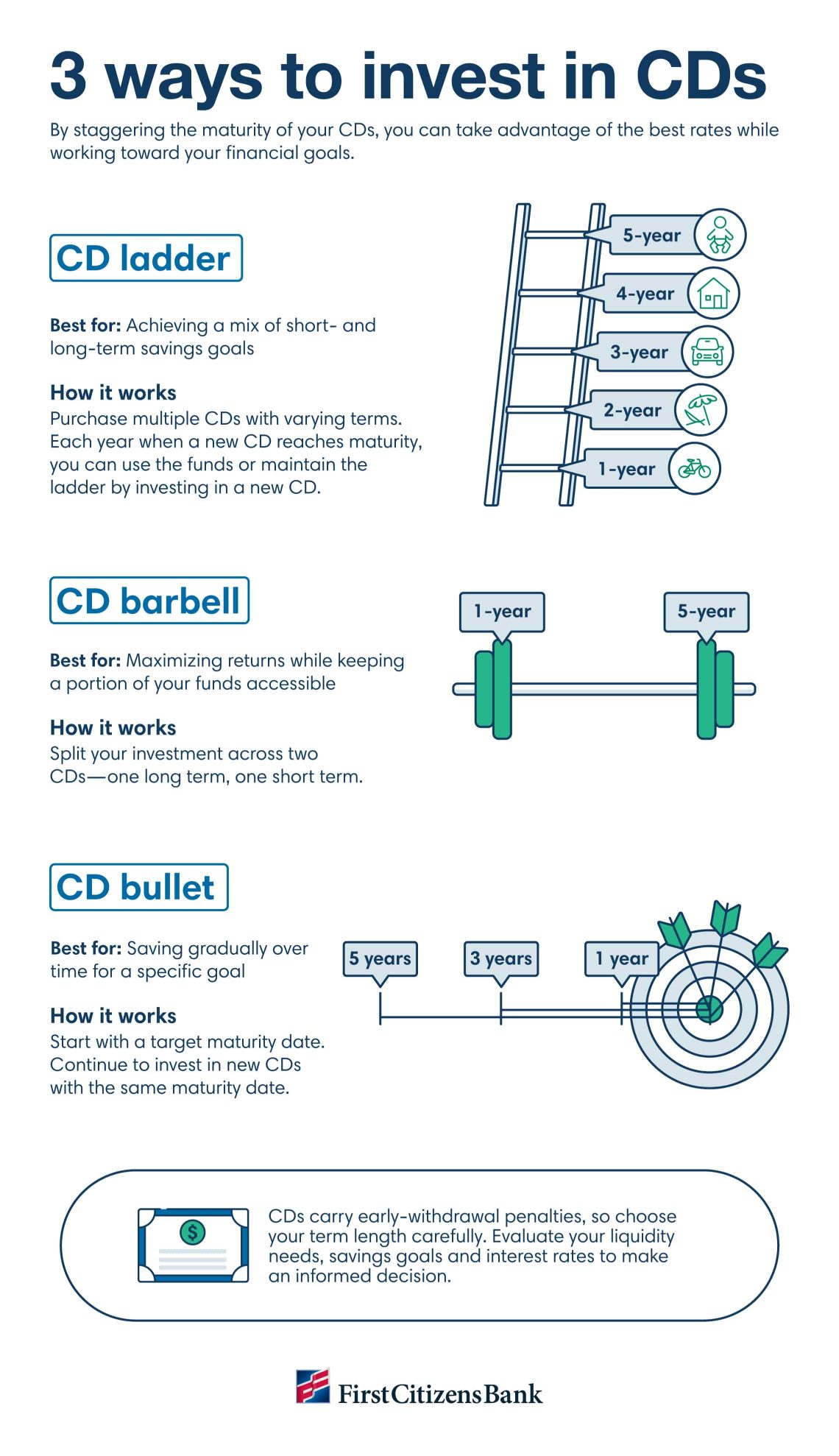

For some, CD ladders may be a useful retirement income strategy. A CD ladder involves buying multiple CDs with varying maturity dates—an approach that allows you to benefit from the higher interest rates of longer-term CDs while providing intermittent, penalty-free access to portions of your money. CD barbells and CD bullets are two other methods you might employ to achieve future goals, like saving for a large family vacation.

Balance CDs with other assets

While CDs offer stability, they're often used as just one part of a diversified portfolio. Assets like stocks, bonds and mutual funds can balance the stable returns of CDs with potentially higher growth. Additionally, maintaining a high-yield savings account can offer more flexibility to access cash when needed.

Keep an eye on inflation

If you choose to leverage CDs for retirement income, you'll need to monitor inflation trends and be prepared to adjust your investment strategies accordingly. Depending on your risk tolerance, this might involve shifting some funds from CDs to assets that traditionally outpace inflation, like stocks or real estate.

Key takeaways

Explore great rates with stable returns

Find a CD account that's right for you, with fixed interest rates and terms ranging from 6 months to 5 years.