Where Should I Save My Next Dollar?

Whether you're building an emergency fund, saving for something special or planning for retirement, there's no one-size-fits-all answer for the best way to save cash. It all depends on your current financial situation and future goals.

Not all types of savings accounts offer the same benefits, and you may have different options to maximize your interest earnings.

If it makes more sense for you to chip away at debt, for instance, you'll want to consider your interest rates and overall balances when choosing where to make extra payments. Be sure to calculate the effect of an extra payment as well.

Most common ways of savings

Here are a few savings options to consider when you want to make the most of some extra cash.

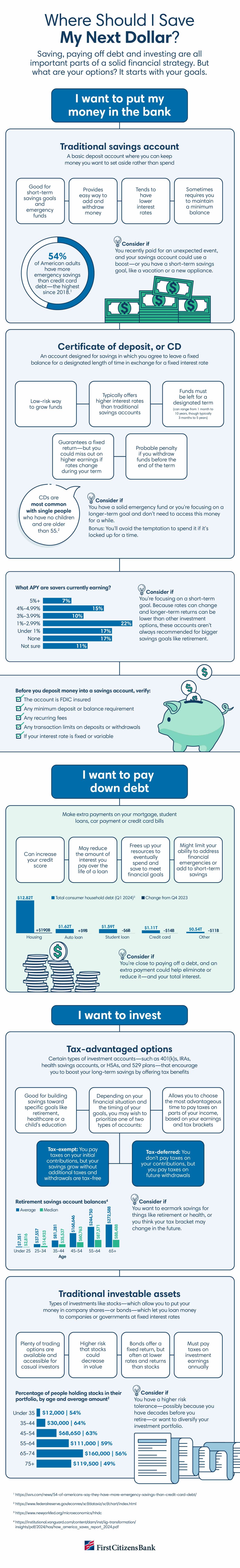

Saving, paying off debt and investing are all important parts of a solid financial strategy. But what are your options? It starts with your goals.

I want to put my money in the bank

Traditional savings account

A basic deposit account where you can keep money you want to set aside rather than spend

- Good for short-term savings goals and emergency funds

- Provides easy way to add and withdraw money

- Tends to have lower interest rates

- Sometimes requires you to maintain a minimum balance

54% of American adults have more emergency savings than credit card debt—the highest since 2018.1

Consider if: You recently paid for an unexpected event, and your savings account could use a boost—or you have a short-term savings goal, like a vacation or a new appliance.

Certificate of deposit, or CD

An account designed for savings in which you agree to leave a fixed balance for a designated length of time in exchange for a fixed interest rate

- Low-risk way to grow funds

- Typically offers higher interest rates than traditional savings accounts

- Funds must be left for a designated term (can range from 1 month to 10 years, though typically 3 months to 5 years)

- Guarantees a fixed return—but you could miss out on higher earnings if rates change during your term

- Probable penalty if you withdraw funds before the end of the term

CDs are most common with single people who have no children and are older than 55.2

Consider if: You have a solid emergency fund or you're focusing on a longer-term goal and don't need to access this money for a while.

Bonus: You'll avoid the temptation to spend it if it's locked up for a time.

What APY are savers currently earning?

- 5%+: 7%

- 4%-4.99%: 15%

- 3%-3.99%: 10%

- 1%-2.99%: 22%

- Under 1%: 17%

- None: 17%

- Not sure: 11%

Consider if: You're focusing on a short-term goal. Because rates can change and longer-term returns can be lower than other investment options, these accounts aren’t always recommended for bigger savings goals like retirement.

Before you deposit money into a savings account, verify:

- The account is FDIC insured

- Any minimum deposit or balance requirement

- Any recurring fees

- Any transaction limits on deposits or withdrawals

- If your interest rate is fixed or variable

I want to pay down debt

Make extra payments on your mortgage, student loans, car payment or credit card bills

- Can increase your credit score

- May reduce the amount of interest you pay over the life of a loan

- Frees up your resources to eventually spend and save to meet financial goals

- Might limit your ability to address financial emergencies or add to short-term savings

Total consumer household debt (Q1 2024)3

- Housing: $12.82T

- Auto loan: $1.62T

- Student loan: $1.59T

- Credit card: $1.11T

- Other: $0.54T

Change from Q4 2023

- Housing: +$190B

- Auto loan: +$9B

- Student loan: -$6B

- Credit card: -$14B

- Other: -$11B

Consider if: You're close to paying off a debt, and an extra payment could help eliminate or reduce it—and your total interest.

I want to invest

Tax-advantaged options

Certain types of investment accounts—such as 401(k)s, IRAs, health savings accounts, or HSAs, and 529 plans—that encourage you to boost your long-term savings by offering tax benefits

- Good for building savings toward specific goals like retirement, healthcare or a child's education

- Depending on your financial situation and the timing of your goals, you may wish to prioritize one of two types of accounts:

- Tax-exempt: You pay taxes on your initial contributions, but your savings grow without additional taxes and withdrawals are tax-free

- Tax-deferred: You don't pay taxes on your contributions, but you pay taxes on future withdrawals

- Allows you to choose the most advantageous time to pay taxes on parts of your income, based on your earnings and tax brackets

Retirement savings account balances4

- Age: Under 25

- Average: $7,351

- Median: $2,816

- Age: 25-34

- Average: $37,557

- Median: $14,933

- Age: 35-44

- Average: $81,281

- Median: $35,537

- Age: 45-54

- Average: $168,646

- Median: $60,763

- Age: 55-64

- Average: $244,750

- Median: $87,571

- Age: 65+

- Average: $272,588

- Median: $88,488

Consider if: You want to earmark savings for things like retirement or health, or you think your tax bracket may change in the future.

Traditional investable assets

Types of investments like stocks—which allow you to put your money in company shares—or bonds—which let you loan money to companies or governments at fixed interest rates

- Plenty of trading options are available and accessible for casual investors

- Higher risk that stocks could decrease in value

- Bonds offer a fixed return, but often at lower rates and returns than stocks

- Must pay taxes on investment earnings annually

Percentage of people holding stocks in their portfolio, by age and average amount2

- Under 35: $12,000, 54%

- 35-44: $30,000, 64%

- 45-54: $68,650, 63%

- 55-64: $111,000, 59%

- 65-74: $160,000, 56%

- 75+: $119,500, 49%

Consider if: You have a higher risk tolerance—possibly because you have decades before you retire—or want to diversify your investment portfolio.

Sources:

1 54% of Americans Say They Have More Emergency Savings Than Credit Card Debt

2 Board of Governors of the Federal Reserve System: Survey of Consumer Finances, 1989-2022

3 Center for Microeconomic Data: Household Debt and Credit Report, Q2 2024

Insights

A few financial insights for your life

Be Aware: Health Savings Account Rules Change Over Time

How Interest Rate Changes Can Affect Economic Trends

College Savings: The Rules are Changing

The information provided should not be considered as tax or legal advice. Please consult with your tax advisor.

Your investments in securities and insurance products and services are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands and Services Offered: First Citizens Wealth™ (FCW) is a marketing brand of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares are the entities through which FCW products are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. ("FCIS"), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. and SVB Wealth LLC, all SEC registered investment advisors. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions or to all investors. Insurance products and services are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products and services are offered by First-Citizens Bank & Trust Company, Member FDIC, and an Equal Housing Lender, and SVB, a division of First-Citizens Bank & Trust Company. icon: sys-ehl

For more information about FCIS, FCAM or SVBW and its investment professionals, visit FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941