Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

The balancing act between interest rates and inflation has dominated economic trends through the first half of 2024, and there's no sign of that ending in the foreseeable future.

Will the Federal Reserve cut rates in time and by enough to avert a recession? Or will an overly aggressive drop in rates reignite inflation, leading to pressure to raise rates again later?

For anyone who's investing for the long term, there's one solid path for navigating volatile times—form a comprehensive financial plan that works for you, preferably with a trusted advisor, and stick to it. That's the best way to keep your money working and take advantage of shifting market conditions while avoiding the risks of shifting the wrong assets for the wrong reasons at the wrong time.

"We're staying very strategic," says Penn Nugent, Director of Personal Portfolio Strategy with First Citizens Wealth Management Services. "We want people to remain invested."

In 2022 and early 2023, the specter of double-digit inflation spurred a series of aggressive rate hikes by the US Federal Reserve. By the summer of 2023, the federal funds rate hit 5.33%—a level Americans hadn't seen in more than 2 decades—and stayed there.

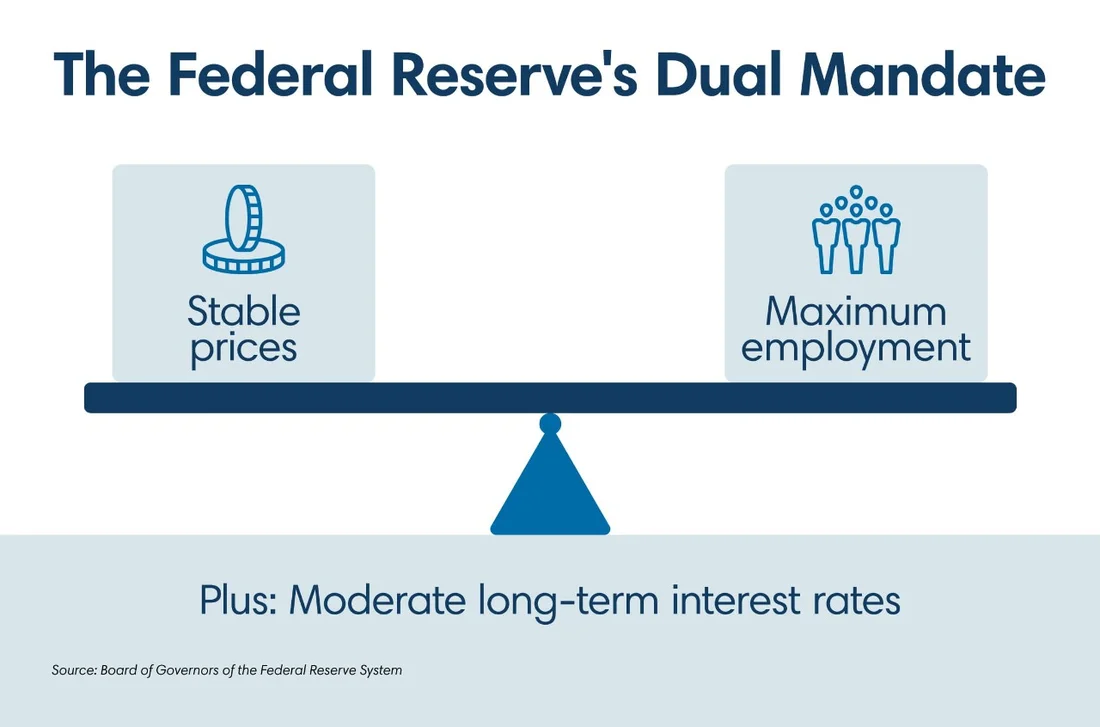

The Fed's aim was—and still is—tackling inflation that drives up the prices of everyday goods. Food prices, for example, rose nearly 20% from 2021 to 2023. And the US Consumer Price Index, or CPI, which aggregates prices of a basket of consumer goods, increased 3.3% year over year in May, per the US Bureau of Labor Statistics. These rates are above the Fed's target of 2% annual inflation. Inflation has cooled since then to a little less than 3%.

Meanwhile, investment markets hit a volatile patch in early August 2024 when weak employment numbers fueled fears that the Fed's cautious approach to reducing interest rates might lead to a recession.

While investors are now betting that the Fed will reduce its target rate at least once in 2024, there's no guarantee that any reductions will occur or how large they might be. What's certain, Nugent notes, is that the rock-bottom interest rates of a decade ago are gone.

"One of the things our clients need to remember is that this won't end back where rates are going to be at zero," Nugent says. "People should take a moment and reexamine their financial plan, especially if it was created in the last few years because it was developed in a time that wasn't a normal environment."

Barring a sudden downturn in economic activity, the Fed is likely to move relatively slowly to lower interest rates from their high levels, says Blake Taylor, Market and Economic Research Analyst with First Citizens Wealth. This means it may only make gradual moves to adjust rates as it watches data closely for signals on where the economy and inflation may be headed.

"The Federal Reserve moves rapidly in times of crisis or when it is clearly behind the curve," Taylor notes. "Otherwise, interest rate changes tend to occur slowly and steadily."

Because rates are unlikely to return to zero, planners and long-range investors are finding some opportunities in the new normal that haven't existed in more than a decade, Nugent says, in the form of higher yields for fixed-income investments such as bonds or FDIC-insured savings vehicles.

"It's great to have an aspect of a portfolio that's actually generating yield in what we think of as a safer part of someone's portfolio," he says. "That aspect makes it easier to accomplish financial goals."

While some asset classes may react quickly to the changing rate environment, housing may rebound more slowly.

The rapid rise in rates through 2023 nearly froze residential housing markets throughout the country as current homeowners stuck with their low-rate mortgages, fearful of selling and venturing into an expensive rate environment to buy a new home. Meanwhile, home prices remained stubbornly high, buoyed by the low supply of houses available for sale.

There are signs that the logjam may be loosening, says Zach Kelly, a North Carolina-based Premier Relationship Banker with First Citizens.

Some homeowners are choosing to get on with their lives and move despite current mortgage rates, particularly when they realize their current homes have risen substantially in value over the past few years.

"It's enabling them to potentially pull more equity out of their property on the front end if they're doing some sort of bridge loan to get from house A to house B," he says. "I think people are tired of sitting on the sidelines hoping for the rates to drop."

High equity positions are also driving some homeowners to consider staying in place—but they're not necessarily standing still.

"Instead of going out and trying to find something new, homeowners may opt to make their current houses work," Kelly says. "They're sitting there saying, 'Hey, I have a ton of equity—I'm just going to do the addition or add a pool or build the dream kitchen here.'"

Mortgage rates have shown signs of breaking in recent weeks. Federal mortgage agency Freddie Mac's weekly survey of 30-year fixed-rate conventional mortgages dropped to 6.47% in early August—a 15-month low.

On the home improvement front, meanwhile, The Home Depot reported a 3.6% drop in year-over-year sales in the second quarter of 2024 in stores that were open for more than a year. CEO Ted Decker blamed the drop largely on high interest rates but remained confident in the fundamentals surrounding home improvement.

There's no guarantee that mortgage rates will continue to drop. Residential mortgage rates tend to follow the rise and fall of economically sensitive 10-year Treasury yields more closely rather than moves in the Fed's short-term rates. But if the Fed puts downward pressure on interest rates in an attempt to avoid a recession, there will eventually be downward pressure on mortgage rates as well.

The changing playing field makes it doubly important that all savers and investors have a long-range plan, Nugent underscores—a plan that can help you take advantage of changing scenarios, while avoiding panic when panic is unwarranted.

"In a world where change is the only constant, being flexible and adaptable isn't just smart," he says. "It's essential for navigating whatever comes next."

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.