2024 Housing Market Trends: A Guide to What's Expected

High home prices, a record-low shortage of inventory and relatively high mortgage rates almost brought the housing market to a standstill in 2023. In fact, existing home sales plunged to their lowest level in 28 years, according to the National Association of Realtors, or NAR.

But there's opportunity for change on the horizon, with several key indicators showing that home sale activity is picking up while mortgage rates are expected to trend down. These combined factors could change the game for many would-be homebuyers and sellers who've been waiting on the sidelines.

1 The impact of the lock-in effect

To understand where the housing market may be headed, it's important to first review what forces led to this point.

Many homeowners secured historically low mortgage rates during the pandemic. Data from the Federal Housing Finance Agency shows that in the third quarter of 2023, roughly 60% of homeowners had a mortgage rate below 4%, and 22.6% reported an interest rate less than 3%. Many of these homeowners are now reluctant to sell and let go of their low interest rates, creating what economists call a lock-in effect.

To keep a lid on inflation, the Federal Reserve raised its benchmark rate three times in 2023, making it more costly for Americans to borrow money. Fixed mortgage rates—which are tied to the 10-year Treasury yield—also increased, which created another obstacle for homebuyers. As a result, the average 30-year interest rate was 6.61% at the end of 2023—more than double what it was 2 years prior, Freddie Mac data shows.

The combination of low housing inventory and rising mortgage rates means aspiring homebuyers faced an uphill battle last year. However, things may be looking up for both buyers and sellers. Mortgage rates are expected to fall in the coming months—perhaps just not as quickly as many economists predicted.

2 Where the housing market is headed

According to a March 2024 forecast by the Mortgage Bankers Association, the average 30-year mortgage rate is expected to drop to 6.3% in the third quarter of 2024 and 6.1% in the fourth quarter. If mortgage rates do come down, home sales will pick up, says John Millen, a Premier Relationship Banker at First Citizens.

In fact, it's already happening. Sales of existing homes jumped 9.5% in February—the highest monthly uptick in a year, according to the NAR. Total housing inventory also reached 1.07 million units in February, up 5.9% from January.

An uptick in new construction is helping to boost inventory. Sales of new single-family homes hit a seasonally adjusted annual rate of 662,000 in February, a 5.9% increase from a year prior, according to estimates released by the US Census Bureau and the US Department of Housing and Urban Development.

Home value growth is also expected to stabilize this year. CoreLogic's economists are forecasting a 2.6% increase from January 2024 to January 2025—a significant slowdown compared to recent years. At the same time, Realtor.com's 2024 Housing Forecast is predicting a 1.7% decrease.

What does this mean for homeowners?

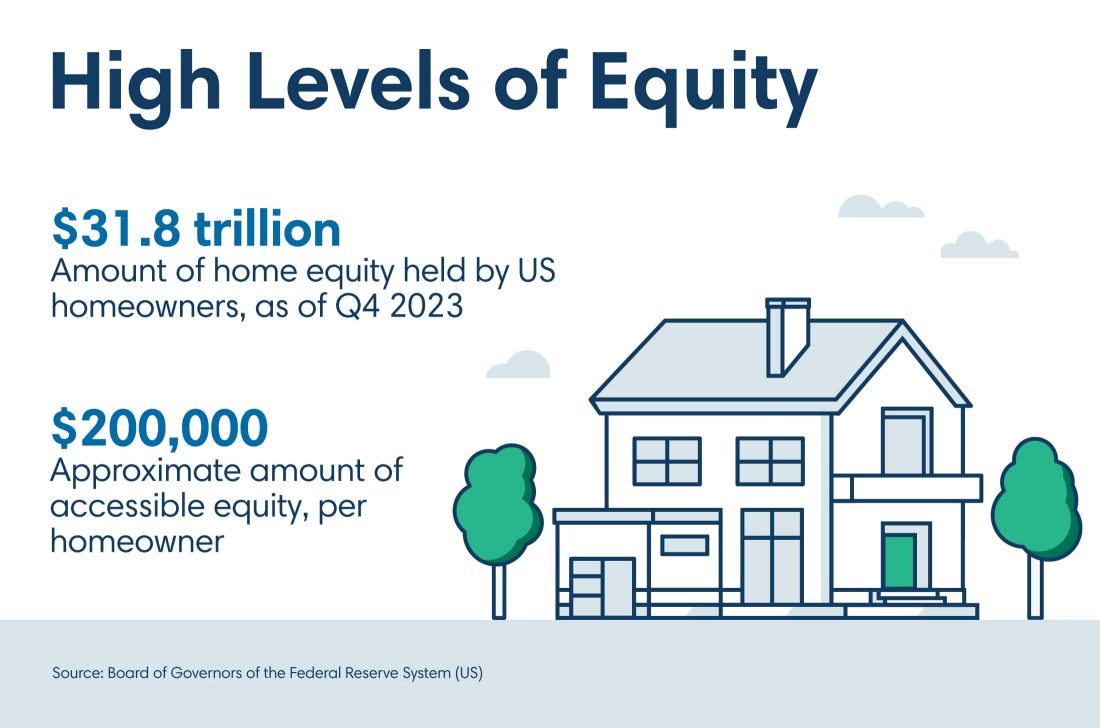

Despite slowing appreciation, many homeowners have gained a significant amount of equity in their homes over the past few years, says Bill Duff, a mortgage banker at First Citizens. The average mortgage holder now has $193,000 of accessible home equity, according to a February 2024 report from data analytics firm ICE Mortgage Technology (PDF)—with equity levels climbing 11% last year alone.

High levels of tappable equity provide homeowners with a few options. They can sell their property and put the profit toward purchasing their next home, or they can use a home equity loan, home equity line of credit or cash-out refinance to fund home improvements, pay off high-interest debt or accomplish a different financial goal.

3 Proposed changes to agent commissions

In early 2024, the NAR announced an agreement to end litigation of a series of claims regarding agent commissions. This landmark deal could potentially transform the housing market in terms of how sales are processed. These lawsuits targeted the long-held practice of the seller paying a single commission—typically 5% to 6% of the home's sale price—which is then split between the listing agent and buyer's agent.

If a federal judge approves the proposed changes in agent commissions, homebuyers would be responsible for paying their own agents' commissions—another expense that will need to be factored into their budget. This could create affordability issues for some people, Millen warns, "particularly for first-time homebuyers who are already struggling to save enough for the down payment and other costs when home prices have risen so sharply in the last 4 to 5 years."

However, sellers may still feel pressure to cover the commission for the buyer's agent. "Sellers unwilling to pay the buyer's agent commission may have real estate agents steering buyers away from those properties, which, ironically, is one of the main reasons sellers brought the lawsuit originally," Millen notes.

Other real estate business models could emerge or become more popular, such as limited-service agents providing a la carte services like listing a home for a flat fee. "Realtors are also discussing dropping from the NAR and forming alternative organizations," Millen says.

Of course, only time will tell. "There will be an adjustment period, probably through year end," Millen says. "I think that 12 to 24 months from now, there will be some clarity, likely with significant changes to how homes are bought and sold."

The bottom line

While it may be tempting to wait for mortgage rates or housing prices to fall, Duff and Millen say prospective homebuyers shouldn't try to time the market. Instead, they recommend working with a loan officer to develop a plan that's tailored to their finances. "Talk to your mortgage banker and see what kind of options are out there," Millen says. "Your mortgage is going to be a critical component of how, when and if you're able to achieve your financial goals."

If you're ready to buy a home but are thinking of waiting until mortgage rates drop, know that mortgage refinancing is always an option. "In general, I would say you start looking at refinancing once you get to half a percent below your current interest rate," Duff says.