Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Think about an exciting event in your future—a wedding, big vacation or child's college graduation. It's fun to plan for these, and you'll likely have contingencies in place in case something goes awry—like if it rains at your wedding or you miss a connecting flight.

This same contingency mindset should apply to financial planning, says Brandie Fintchre, Senior Wealth Training and Development Consultant with First Citizens Investor Services. Here, she discusses four ways to reframe how we think about financial planning.

Financial planning can have a reputation for being overly complicated and expensive—but it doesn't have to be.

"People should be intentional and proactive with their money to achieve long-term goals and protect wealth while still being realistic about the what-if scenarios that might come into play," Fintchre says.

"Financial planning is about intentionally aligning your resources with your goals and values to create peace of mind," she adds. "It's also about enhancing your lifestyle over time, regardless of your income level."

All it takes to start crafting a financial plan is an overall understanding of your finances. This means identifying your income and expenses, cash flow and a strategy for saving a little each month.

Some also believe financial planning is reserved for the ultra-rich or those with heirs. But whether you're single or married, inheriting wealth or accumulating it to pass on, you should develop a financial plan that aligns with and supports the life you want to live.

"Financial planning should always center on a conversation about your values," Fintchre notes.

Another common misconception is that solid financial plans revolve solely around funding retirement. But financial planning is much broader than that.

"It encompasses all of your life goals," Fintchre says. "That can include retirement—but also goals along the way that are on different timelines and require different resources."

If you're struggling with how to focus your efforts, don't worry about the numbers for now. "First, understand how you relate to money today and what you want to accomplish," she says. After that, you can align financial targets to the different life milestones you're hoping to achieve—whether that's saving for a first house, paying for education expenses or upgrading or renovating your home.

Finally, think about your timelines when making a financial plan. "It's good to list short-term, mid-term and long-term goals," Fintchre says. This way, an advisor can help you achieve a short-term goal, like saving and planning for a down payment, while not losing sight of what you want to achieve in the long term.

"We want to make sure we're prioritizing now—but not at the expense of longer-term targets," she explains. "We want to protect your wealth while also growing it for the future."

Avoid the temptation to set it and forget it. "Financial planning should be an engagement that happens routinely. It's not just one or two meetings and you're done," Fintchre advises. "Economic circumstances change, and life circumstances change."

The economic environment won't be the same in 10, 5 or even 3 years—and your life goals could change significantly. A financial plan helps you stay adaptable and agile while remaining focused on what's most important.

Fintchre acknowledges that saving and planning for the unexpected is a lot less fun to think about—and a result, she sees fewer people accounting for unwanted scenarios in their plans.

"People tend to shy away from the conversations that have to do with disability, job loss, healthcare challenges or a loved one passing away," she says. "But the foundational goal of financial planning is to protect us from things that are unexpected."

Just as you'd prepare for the possibility of getting a flat tire when taking a long car journey, a financial plan helps ensure you can overcome—or find an alternate route around—obstacles in your path.

It's also important to regularly return to your plan for things you can better anticipate. If you start earning more money over your career, double-check that you're avoiding lifestyle creep—when your expenses grow at the same rate as your income, making it harder to save for the future.

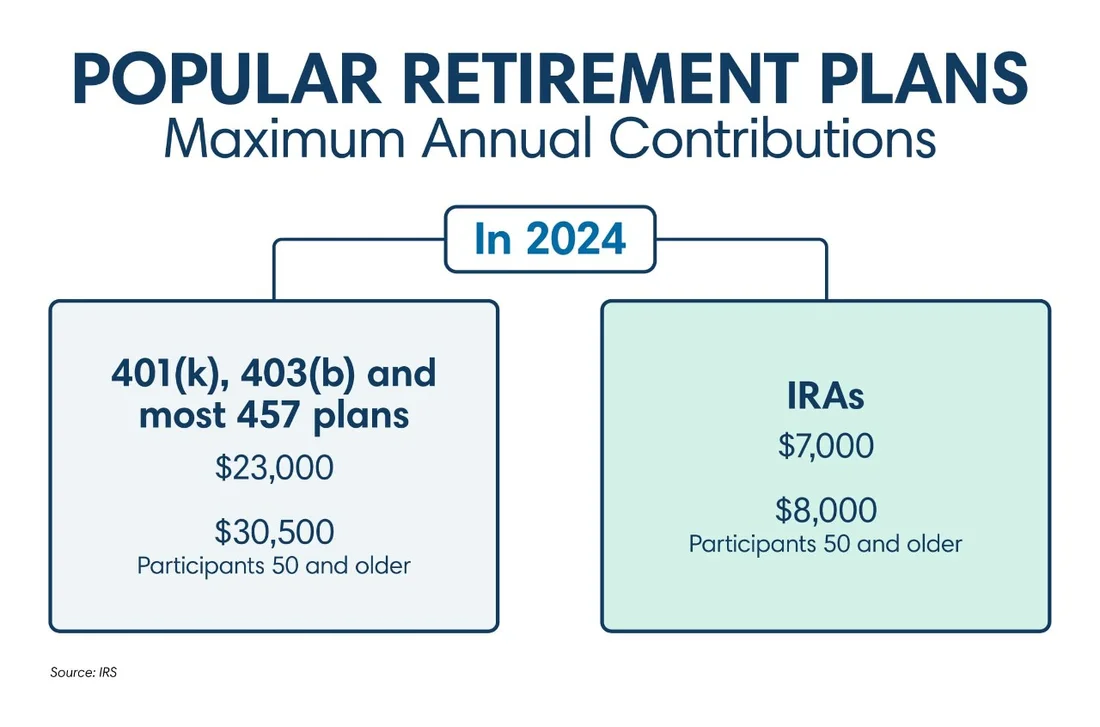

Put away extra money when you can—especially those over age 50, Fintchre advises. In 2024, people 50 or older can make an annual 401(k) catch-up contribution of $7,500, while the traditional or Roth IRA catch-up amount is $1,000, according to the IRS.

You may also want to start saving and planning for long-term care and other medical needs before your physical health becomes an issue.

"An advisor can help you maintain some discipline to keep your end goals in mind," Fintchre says. "Your future self will thank you."

Many people turn to financial advisors simply to help grow their assets, but there are other key benefits to partnering with one. Above all else, they can provide some helpful objectivity.

Take market-based decisions as an example. "Even individuals who say they have an aggressive risk tolerance may want to reduce their exposure to additional declines in the market rather than stay the course based on their initial thoughts around risk," Fintchre explains. "An advisor can help keep you focused on the long term so that a short-term emotion doesn't derail the achievement of long-term goals."

Financial advisors should also be looking to protect your wealth just as much as they want to help you increase it. "A reputable advisor will help you grow your wealth by understanding your goals and your timelines, and then they'll help you protect that wealth as it grows," she says. "They'll also understand your family dynamics and help you, when the time comes, to transfer that wealth and create a legacy."

This process sometimes involves gathering a team of advisors who work holistically on your plan—saving you the trouble of reallocating assets, rebalancing your portfolio or even selecting the right insurance policy.

"A whole team of experts you can trust to look out for your best interests can pull a comprehensive plan together," Fintchre says. "That way, you can focus simply on enjoying your life."

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.