Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

For the 43.4 million federal student loan borrowers across the country, fall 2023 ushered in more than back-to-school vibes. The student loan program's COVID-19 payment pause expired—meaning borrowers' payments were due to the government starting in October.

News on repayments, combined with rising education costs and the rising cost of goods in general, has encouraged many parents and grandparents to revisit their college savings strategy. Nate Harris, a wealth planning strategist at First Citizens, notes that recent rule changes may help some savers prepare for the cost. And the rising costs should cause anyone who's interested in saving for a college education to take a broader look at their overall strategies.

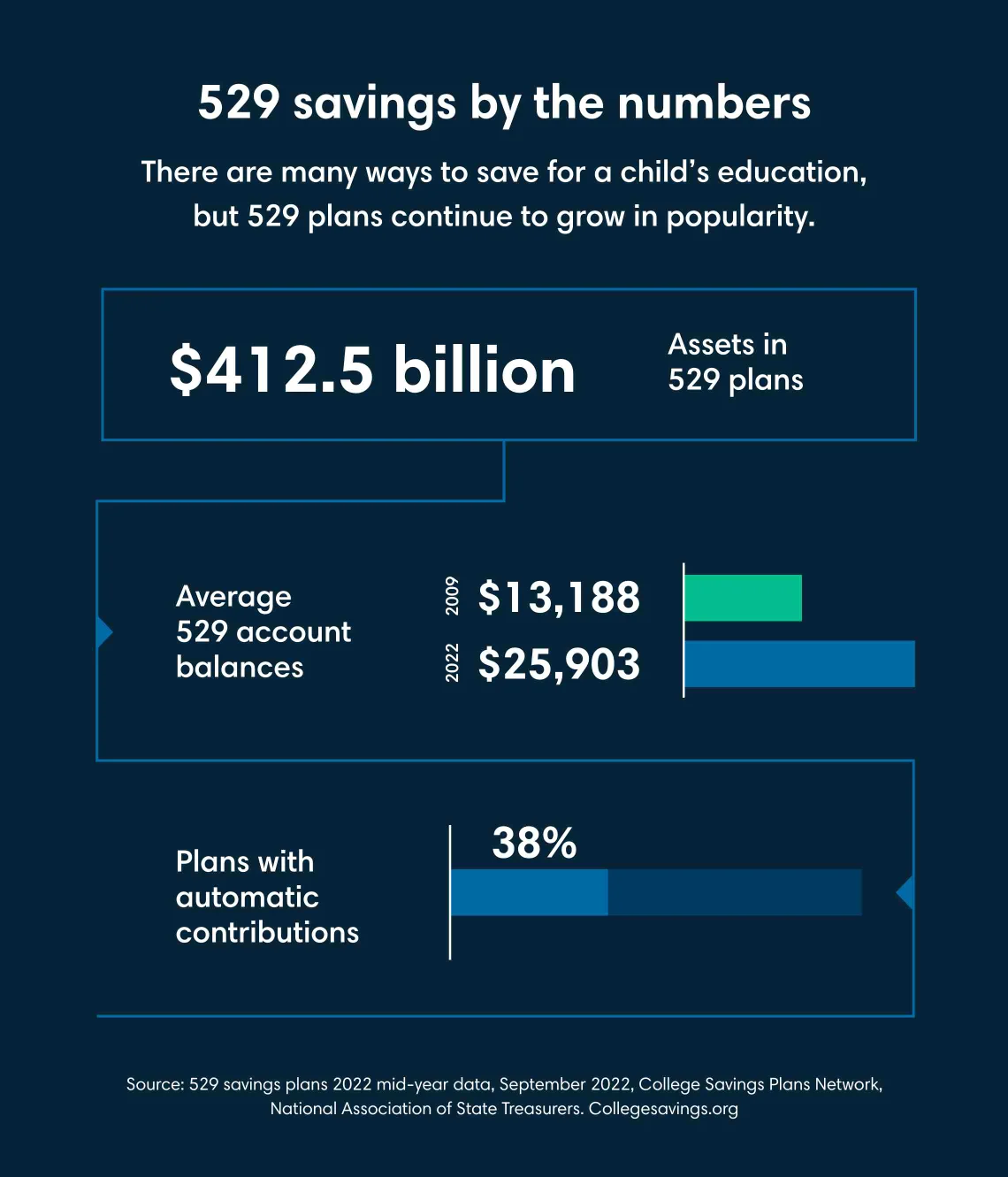

Named for a piece of the tax code, 529 plans were first created in 1996 to encourage saving for future higher-education expenses. In effect, the plans let savers contribute after-tax money, which can be withdrawn free of federal taxes if it's used for education expenses later on. Over the years, federal laws have added new tax benefits and increased flexibility around how the funds can be used.

"Based on conversations with parents, I think there are a lot of misconceptions about taxes and penalties," Harris says.

To ensure parents have up-to-date information as they make decisions on college savings plans, he offers the following facts about 529s, many of which are changes to 529s enacted since their introduction.

Harris likes to clear up these misconceptions because he thinks these 529 plan updates signal the government's commitment to making 529 plans easier to use.

What if parents want to explore other solutions that cover education expenses and minimize student loan debt? There are 529 plan alternatives available.

"While 529s are the only tax-advantaged savings vehicle for college, there are other options that do create flexibility," advises Harris. "And remember that it's not necessarily an all-or-nothing approach."

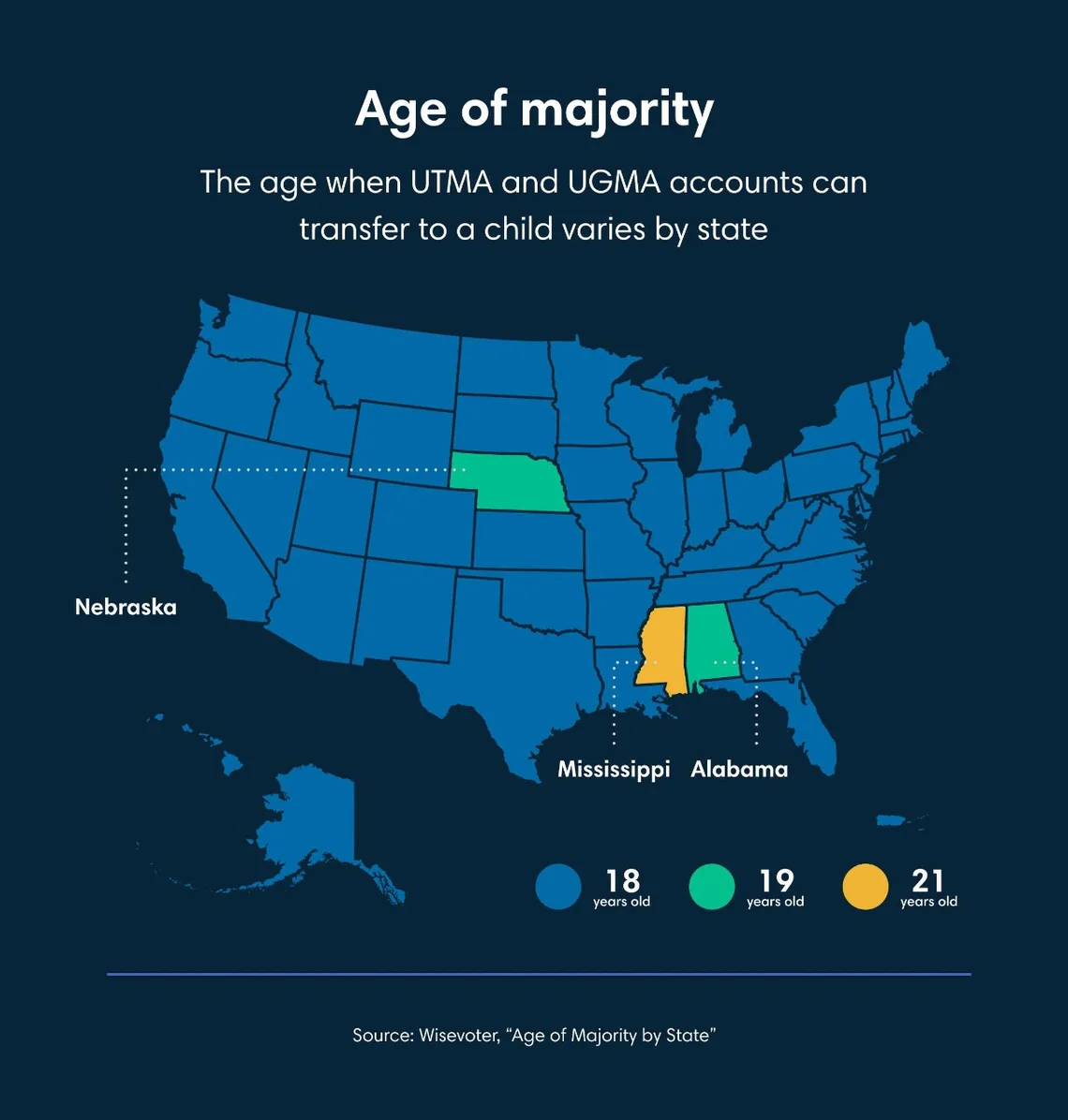

Both Uniform Transfers to Minors Act and Uniform Gifts to Minors Act accounts are controlled by a parent or another relative until the child reaches adulthood.

"Grandparents often love this option because they want to give their grandchildren some fun money, earmarked from Grandma," Harris says. "That way when their grandchildren use the funds, they'll know it's from their grandparent."

Pro: Unlike funds in a 529 plan, the funds in an UGMA or UTMA account can be used without penalty for non-qualified expenses, including clothes for school, health insurance, or application and testing fees.

Con: Because contributions are made with after-tax dollars and earnings can be taxed on withdrawal, regardless of how the money is spent, UGMAs and UTMAs don't have the same tax benefits as 529 plans.

Permanent life insurance—also known as cash-value life insurance—offers a savings component in addition to a death benefit. Parents can use the policy's cash value to pay for college expenses without incurring any taxes.

"You can basically overfund a life insurance policy with this strategy," explains Harris.

Pro: Funds in a permanent life insurance policy grow tax-deferred. Also, these funds can be used for anything—education expenses, the down payment on a home or retirement income decades later.

Con: It takes about 10 years for cash value to accumulate in a policy, so parents have to start early. Permanent life insurance is also expensive; owners should estimate contributing a minimum of $10,000 a year to get an adequate cash value for college costs.

Parents or grandparents may wish to establish an educational trust, in which the money is designated for the beneficiary's education costs.

Pro: Guardians, parents or grandparents concerned about making a large financial gift with unfettered access may prefer this option. The terms of the trust can be extensively customized, preventing funds from being released without certain conditions being met or only for certain expense categories.

Con: There are no tax benefits associated with an education trust.

The universal advice Harris offers to parents about 529 plans or 529 plan alternatives? Start early.

"For all of the best savings options, time is required in order to take advantage of compounding," he says.

As a parent of young children himself, Harris speaks with experience.

"You're trying to balance everything. You have a lot on your mind. But if you can get in the habit of saving, even $100 a month, that can have a big impact."

Plus, he adds, life sometimes offers opportunities to increase your savings without making big budgetary concessions.

"I got a great piece of advice from another advisor: When daycare costs go away, shift that payment to the 529 plan. You're already used to the money coming out as a monthly expense, so you don’t feel it as much."

The bottom line when it comes to funding an education: Save early and often. When it comes to college savings, time is the ultimate extra credit.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.