Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

December FOMC meeting commentary: Available now

This month, the Fed lowered interest rates by another 0.25%. Read highlights and key takeaways from the Making Sense team.

As a parent, you want to give your children every opportunity to succeed—including helping them pay for their education expenses using a 529 college savings plan. But it's an ambitious goal—and one that few parents can actually meet.

Of the families surveyed in 2021 by loan administrator Sallie Mae, 53% said they relied on students' savings and income to cover college costs (PDF). College is expensive, and at some point you'll likely need to look for alternatives to a 529 plan contribution. Here are some tips for managing the situation should it arise.

There will be times when saving for your kids' education must take a back seat to other financial priorities—and that's perfectly normal.

"You have to do what's right for your long-term financial longevity and your current circumstances," says Craig Shively, an investment advisor at First Citizens Investor Services. "There are other sources of funding and ways to make college more affordable."

If you find yourself in this situation, Shively recommends using a saving for college calculator to help you determine whether it's the right goal to prioritize at this point in your life.

As you calculate these costs, determine whether one or more of the following scenarios applies to you. If they do, it might be time to pause your kids' college savings plan.

If competing financial priorities have forced you to cut back on the amount you're contributing to your savings, you may want to devote any discretionary income now to a 401(k) or IRA rather than a 529 account. This is especially true if you're saving more aggressively for retirement, cutting debt or building an emergency fund.

"Not only is inflation eroding our purchasing power, but we're also living longer," Shively explains. "Because our retirement savings don't stretch as far as in the past, it's critical to get a plan in place and stick to it."

A financial professional can help you develop a plan based around your goals and current circumstances. They can work with you to determine how much you should increase retirement contributions, suggest whether your portfolio needs rebalancing and provide other strategies to optimize your savings.

Your peak earning years may come with additional financial responsibilities that include caring for aging parents. If you or your spouse have to reduce your work hours to provide caregiving or help your parents financially—either through the cost of home modifications, home healthcare or assisted living—it can significantly reduce your discretionary income. This can significantly impact how much you have left to put toward your kids' college education.

If you're in this situation, contact your parents' local Area Agency on Aging to discover resources available to help cover the cost of their care. And remember, it's fine to put college savings on hold when you need to step in and care for them.

It's not uncommon for extended family to help send a young relative to college. This can help ease the pressure on you to push your own savings toward a college plan.

Grandparents in particular can open 529 savings plans for their grandchildren and contribute up to $16,000 per year without incurring any gift taxes.

"They can also front-load a 529 plan, contributing up to 5 years for a total of $80,000 tax-free," Shively says. "As an added advantage, a 529 account held by someone other than the parents doesn't factor into the income used to determine federal student aid."

Relatives can also set up savings accounts dedicated to your kids' college or pay for college directly. Paying the college tuition bill directly is not considered a gift, but it can potentially reduce any financial aid your child may have otherwise received.

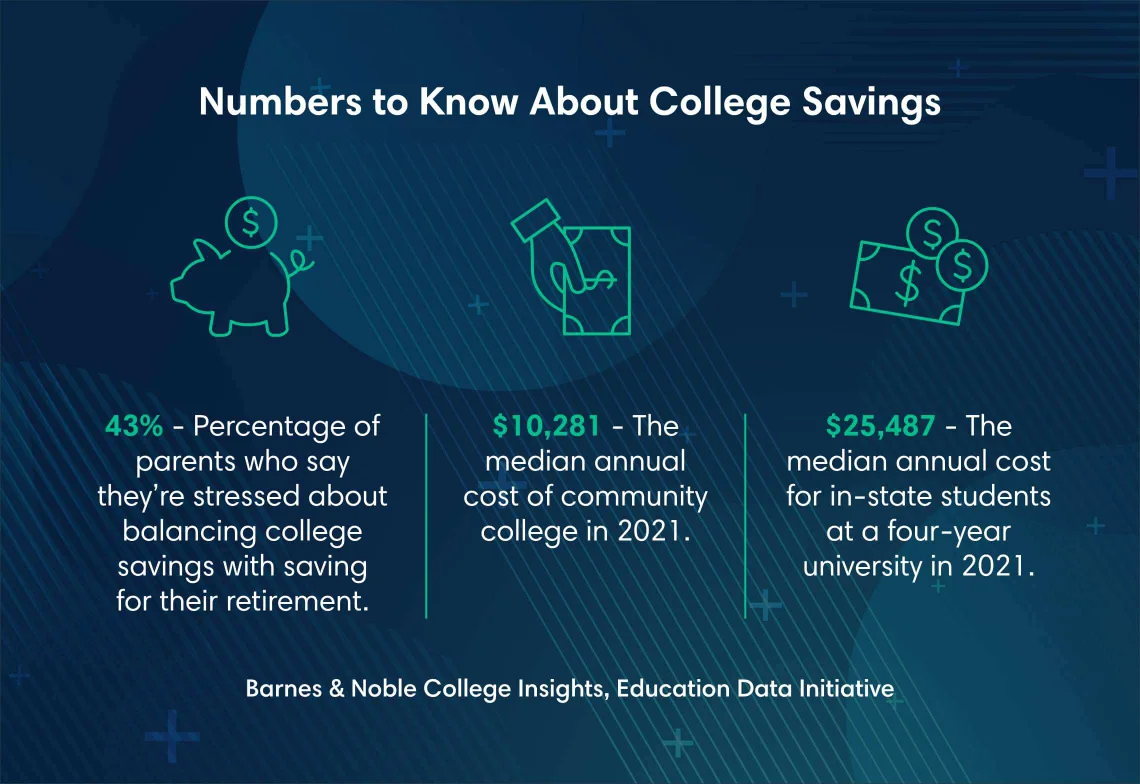

Source: Barnes & Noble College Insights, Education Data Initiative

Another way to ease the stress of financially assisting your child is to lower the cost altogether. Consider the following ways to reduce the cost of tuition.

Even if you think your child won't qualify, it's worth filing the Free Application for Federal Student Aid, or FAFSA, form. According to the 2021 Sallie Mae survey, 70% of middle-income and 66% of high-income families submitted the FAFSA form. Of those who received aid, 29% applied for more aid, while 52% received higher grant amounts and 47% received higher scholarship amounts.

The median annual cost of community college in 2021 was $10,281, according to the Education Data Initiative. Compare this to an average of $25,487 for in-state students at a four-year university. Even better, at least 17 states offer free community college. After completing prerequisites at a community college, students can finish their education at a four-year university.

Many organizations offer scholarships and grants based on merit or financial need, or for particular groups of people. Check with your target college's financial aid office or use the US Department of Labor's scholarship search tool to find a match.

Not all kids are ready for—or interested in—college when they're 18. Depending on their interests, they may do well at a vocational school. Vocational and technical colleges generally offer shorter programs than community colleges and give students skills they can apply right away. Many roles they train for command strong salaries, and it doesn't preclude your child from earning a four-year degree later.

Rest assured, even high-income earners often have a difficult time paying for their kids' college expenses. If competing priorities make it difficult to contribute to a college savings plan, let yourself off the hook. Your kids have a plethora of ways to fund their educational future.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.