Guide to personal liquidity

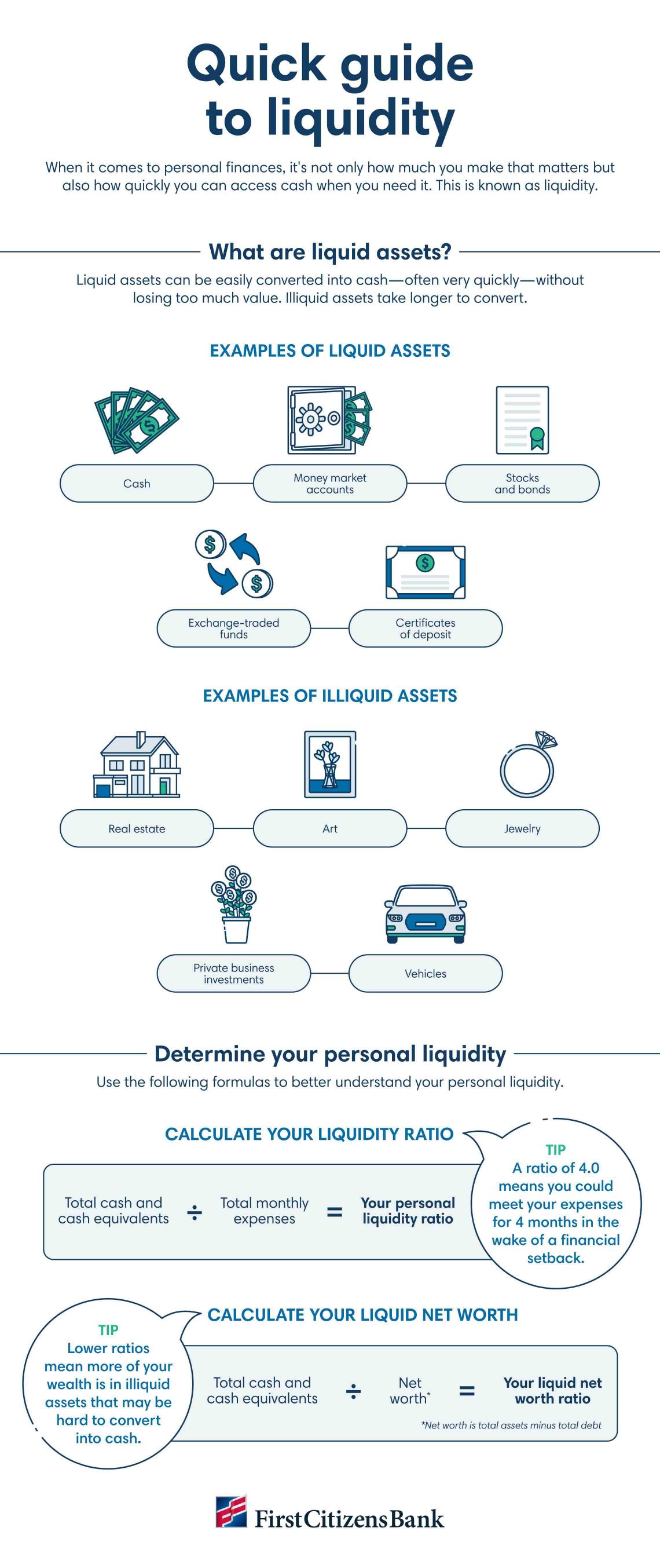

When it comes to personal finances, it's not only how much you make that matters, but also how quickly you can access cash when you need it. This is known as personal liquidity. The higher your liquidity, the better equipped you'll be to meet your financial obligations. However, too much liquidity can cause you to miss out on growth opportunities.

As you evaluate your personal finances and create a financial plan, your personal liquidity can be a helpful metric to consider. Learn more about how to assess your personal liquidity and how to find the right balance between illiquid and liquid assets.

What is liquidity?

In business and personal finance, liquidity is defined as the amount of available cash, as well as how quickly an asset could be sold and converted into cash.

For an asset to be considered liquid, a market with ample buyers must exist so the asset can quickly be converted into cash without incurring financial penalties. Illiquid assets are those that require significant time or effort to convert into cash. This may be because the selling process is lengthy, such as with real estate, or because the market of potential buyers is quite small, such as with rare collectibles. Some investments, such as restricted shares, are also considered illiquid because they specify how and when the asset can be sold.

Why is liquidity important?

As you begin to amass personal wealth, you may start investing your money in the stock market or contributing to a retirement fund. You may also invest in items like collectibles, art or jewelry. All these items contribute to your individual net worth.

However, problems may arise if too much money is tied up in illiquid assets, or assets that can't be easily converted into cash. In such a situation, you may have trouble covering everyday expenses or fixed financial obligations should any sort of personal financial setback occur.

On the flip side, high liquidity may come at an opportunity cost. Keeping too much of your money in a traditional checking or savings account may cause you to miss out on potentially higher returns.

The trick is to maintain liquidity while pursuing growth by balancing your investments in liquid and illiquid assets.

What are liquid assets?

Cash is a cut-and-dried example of a liquid asset. For almost any other type of asset, however, determining what is or isn't a liquid asset can involve a bit of nuance. Some factors to consider include the speed, ease and loss of value involved in converting the asset into cash. Here are some common types of liquid assets.

Checking and savings accounts

Withdrawing funds from a personal bank account is quick and easy and doesn't require you to jump through any hoops. And because such accounts are FDIC-insured, you know your money will be there when you need it. While these kinds of accounts offer stability and accessibility, many interest-bearing savings accounts produce minimal returns compared with other financial vehicles.

Money market accounts

Money market accounts generally pay higher interest rates than other savings accounts, and accessing your cash is simple. Depending on the financial institution, however, there may be a limit on how many transactions or withdrawals you can make per month. Likewise, you may have to maintain a minimum daily balance to avoid a maintenance fee.

Stocks

While stocks have the potential to earn a higher interest rate compared to other vehicles, they also carry higher risk and have lower accessibility. Most stocks are routinely bought and sold over exchanges, so in many cases, converting them into cash tends to be relatively swift and straightforward. However, stocks are subject to market volatility, and if you need to sell when the market is down, you may incur a loss.

Mutual funds

Mutual funds are professionally managed investment accounts that pool money from many people to buy a diversified collection of stocks, bonds and other securities. Investors can sell their shares of the mutual fund at any time. However, accessing these funds may take some time. After selling, it can take a few days for the cash to appear in your account.

Money market funds

Not to be confused with money market accounts, money market funds focus on short-term, debt-based financial instruments. While they offer lower risk and higher liquidity, most offer modest interest rates. Unlike bank accounts, these funds aren't FDIC-insured.

Certificates of deposit

Banks issue certificates of deposit, or CDs, for a set period of time. Because your money is locked up for a period, these accounts may offer higher interest rates than traditional savings accounts. Withdrawing funds early often means paying a penalty, but there are several CD investing strategies you can employ to balance accessibility with growth.

Bonds

Known for their predictable, stable income, bonds tend to offer high liquidity compared with other fixed-deposit investments. Be aware that some bonds are easier to trade on the secondary market than others, and off-loading a bond before it matures could mean taking a financial hit.

Assessing your financial liquidity

Figuring out how much of your money to keep liquid is a deeply personal calculation impacted by everything from your personal cash flow to your psychology around risk and safety. Still, calculating your liquidity ratio can be a helpful way to understand your current liquidity—and determine which financial moves to make going forward.

How to calculate liquidity ratio

To calculate your liquidity ratio, divide your cash or cash equivalents by the sum of your monthly expenses. The resulting number is your liquidity ratio, which estimates how many months you could meet your expenses by drawing only on your cash reserves.

For example, let's say you have $8,000 in liquid assets. If your monthly expenses total $2,000, your liquidity ratio is 4.0.

This number can give you a rough sense that you'd be able to meet your expenses for four months in the wake of a financial setback, such as a job loss. While many financial planners urge individuals to have at least 3 to 6 months of liquidity, everyone's situation is unique.

How to calculate liquid net worth

Another metric that can shed light on your personal financial health is your ratio of liquid assets to net worth.

To calculate this ratio, you'll want to divide your cash and cash equivalents by your net worth. If the resulting percentage is lower than 15%, it could mean that much of your wealth is locked into illiquid assets that may be hard to convert into cash. The risk of such illiquidity is more common during retirement when people may find that their income has dwindled considerably but that they're sitting on high-value property.