Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

For most of us, the term FDIC coverage is nothing new. It's been around since the Great Depression, when the federal government established the Federal Deposit Insurance Corporation to insure a portion of bank savings against loss.

While many consumers today don't give it much thought, FDIC insurance limits are becoming more important as interest rates continue to rise and consumers look more toward bank-based saving options. Zach Kelly and Brandon Johnson, Premier Relationship Bankers with First Citizens Bank, shed light on these limits and what they mean for consumers—especially those with large deposit portfolios.

When something is FDIC insured, it means you're protected against any losses of your insured deposits, up to certain limits, if a bank ceases operations. Many types of bank deposits are insured by the FDIC, including checking accounts, savings accounts, money market deposit accounts and certificates of deposit, or CDs.

However, there's an important qualification regarding the amount in an account. According to the FDIC, deposits are insured up to $250,000 per depositor, per FDIC-insured bank, per ownership category. So for those with less than $250,000 deposited in an FDIC-insured institution, the insurance is automatically assigned to their accounts.

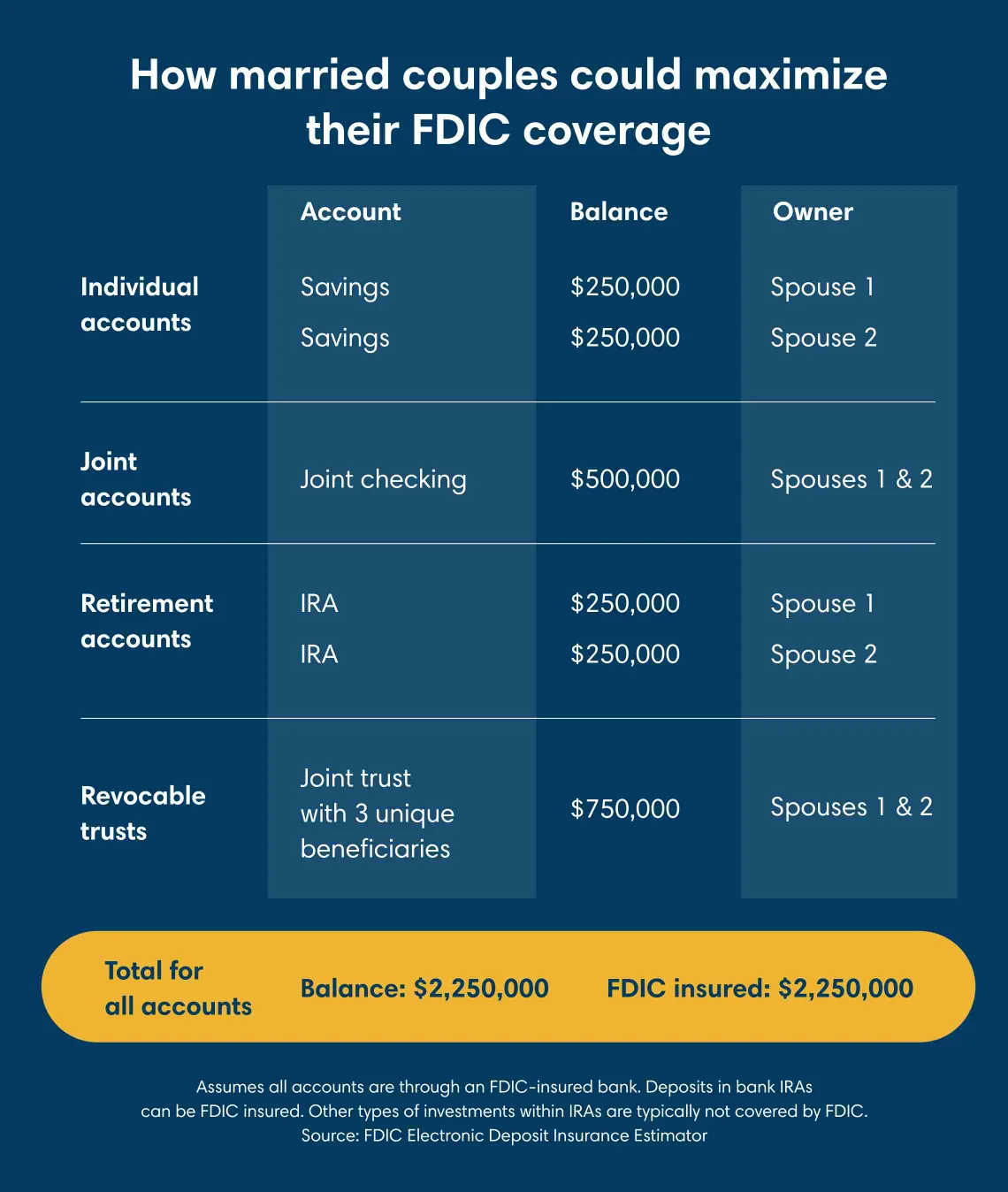

The rules get a little more complex when you have more than $250,000 deposited in an FDIC-insured bank, but there are ways to stay protected—including using account titles to maximize coverage, Kelly and Johnson note. Because the $250,000 coverage limit refers to individual accounts and depositors, each account that's titled differently can qualify for its own $250,000 coverage limit, and each depositor can qualify separately for $250,000 or more in coverage as long as their accounts are structured properly.

Johnson often uses an example of a married couple to explain the nuances of account titling. "Let's say a married woman wants to confirm that her and her husband's deposits with First Citizens are FDIC insured," he says. Their $375,000 is spread across a checking account, a savings account and a money market deposit account.

"If she has $250,000 in a savings account titled with her name, it's FDIC insured," Johnson adds. "If she wants to insure more in a savings account, she could open a new account with her husband's name on it, or she could open a new account and add a different beneficiary. If she added a joint owner to her savings account, FDIC insurance would cover up to $500,000."

He says this strategy can also be used when individuals have unexpected increases in available deposits. "Let's say her husband's mother passes away, and they have a windfall of cash that leads to $750,000 or more in their accounts," he says. "If we move funds into just one person's name or add a beneficiary, we can easily bolster that FDIC insurance number higher."

While simply adding beneficiaries to individual retirement accounts, or IRAs, doesn't increase their FDIC insurance coverage, one option Johnson and Kelly discuss with clients is establishing a revocable trust account. With this option, owners can insure up to $750,000 if they name three unique beneficiaries.

When titling and structuring your accounts, remember that the FDIC doesn't cover certain account types. Unprotected financial products include cryptocurrency, mutual funds, annuities, life insurance policies, exchange traded funds, or ETFs, stocks and bonds. Savings-based traditional or Roth retirement accounts like CD IRAs are FDIC insured, while investment-based IRAs typically aren't covered.

"Some customers have funds in checking accounts and savings accounts, and they also have a wealth relationship," Johnson says. "Different rules may apply to the wealth choices in their portfolio. For example, stock market investments aren't covered by FDIC insurance."

Kelly often refers to the FDIC's Electronic Deposit Insurance Estimator with clients to demonstrate the full scope of how he may be able to help bolster their coverage. "When people see it presented like that, they feel a lot more confident than just reading a blanketed sign that we're an FDIC-insured bank," he says.

In addition to helping customers ensure their accounts are titled in accordance with their financial goals, Johnson and Kelly help ensure that the mix of accounts is the best choice for meeting their goals.

"When we sit down with our clients, we try to be inquisitive and understand their short-term and long-term plans for different accounts," Kelly says. "This way, we can provide guidance and options for how accounts are titled."

Right now, he says many customers' go-to account for fully liquid savings is a money market account.

"There's never been a time in my career where we've had this many conversations about moving funds into a money market savings account," he says. "But because of higher interest rates, it makes sense for a lot of people."

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.