Retirement Income 101: Learn the Basics

Everyone wants to enjoy their retirement years. But not everyone has the financial planning knowledge to make those dreams a reality. Their retirement income suffers—especially when unexpected economic turns or other unforeseen circumstances get in the way.

Arming yourself with the knowledge of the best time to claim Social Security or a calculation of the potential returns on your IRA or other retirement plan gives you control over your financial future.

To help you get started, we've asked First Citizens Bank Wealth Planning Strategist Doug Semple and Wealth Planner Craig Shively to outline their tips.

Classify your retirement income

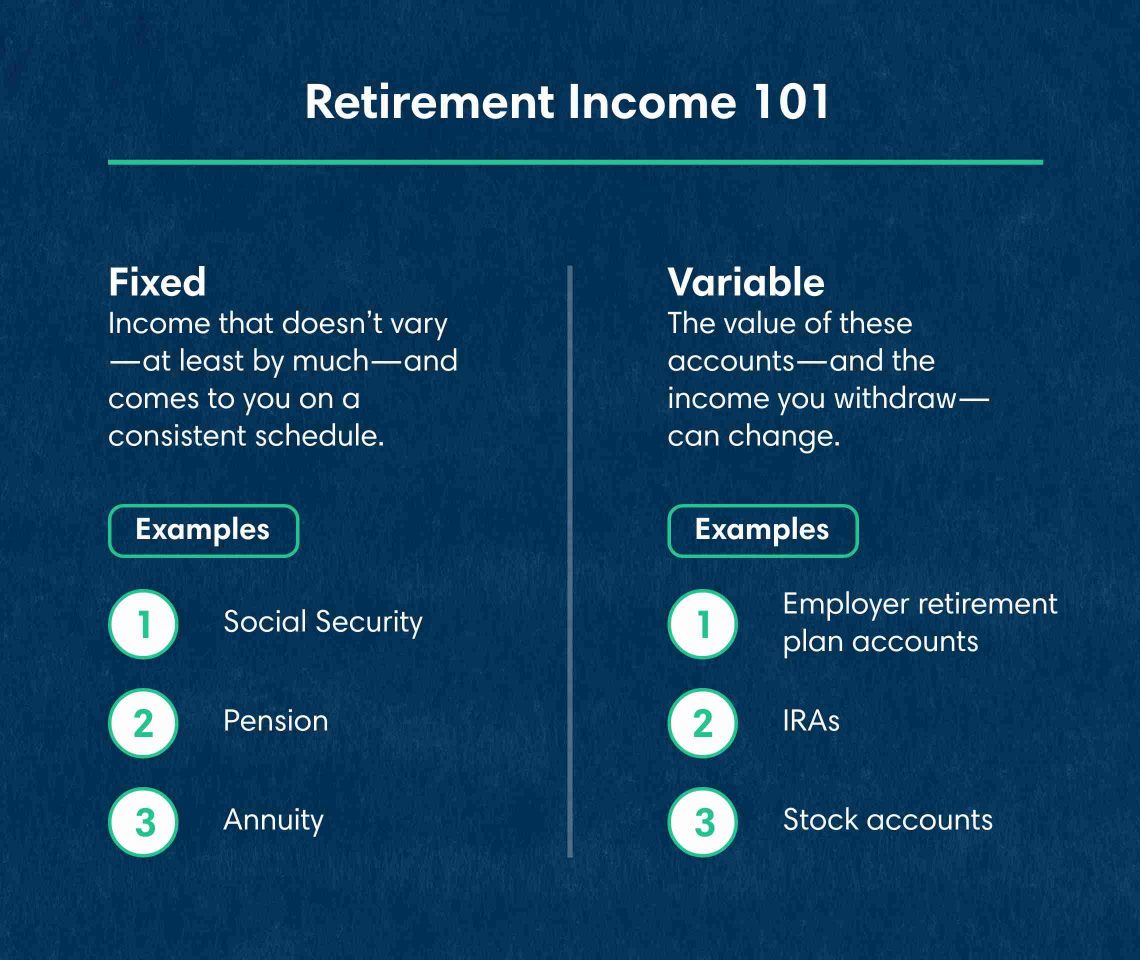

The first lesson in laying a solid foundation for your retirement involves listing all current and expected post-work income and broadly categorizing each. "No matter how many income streams wind up on that list, they're going to fit into one of two categories," Shively says. "It's all either fixed or variable income."

Fixed income includes pensions, Social Security and any annuity streams you're receiving. These are income payments that typically don't change substantially once you start getting them.

Variable income consists of items like investment income, capital gains distributions and dividends. The income you receive from these changes will depend on choices you make, from how your investments are set up to when you take distributions from each account. Classifying your future income into these categories provides the cornerstone for efficiently allocating money in retirement.

"Fixed income has low growth potential and should be used for day-to-day things like groceries, gas and bills," Shively says. If you have debt that hasn't been paid off, these payments should also be covered by your fixed income. However, it's a good idea to eliminate debt—or at least debts with the highest interest rates—before retiring.

"Variable income, which has high growth potential, is for hobbies, passions and vacations," Shively notes. "Using fixed income for day-to-day expenses extends the potential for growth in the assets underlying those variable accounts further into retirement, allowing you to accumulate more in a time when you're not earning."

There are two basic types of retirement income:

- Fixed income: This type of income doesn't vary—at least by much—and comes to you on a consistent schedule. Examples include Social Security, pensions and annuities.

- Variable income: The value of these investments—and the income you withdraw—can change. Examples include employer retirement plan accounts, IRAs and stock accounts.

Maximize your fixed income

How you want to spend your retirement may be unique and can even change over time, but the need to cover day-to-day living expenses won't. This makes crafting strategies for managing fixed-income streams a top priority—and it starts with shifting your thinking around Social Security. Getting more out of Social Security than you put into it is crucial.

"You can't invest your Social Security money, but you can grow it," Semple says. "You've got this 8-year window from 62 to 70 when it's optional for you to turn the income on, and every month you wait the amount you're going to get goes up."

Look for tax efficiencies

An important component of managing your retirement money is engineering tax efficiency into your variable-income streams. To minimize your tax burden, it's ideal to bucket money into three basic accounts with different tax structures—a 401(k) or similar workplace plan, a Roth IRA and a taxable brokerage portfolio. If these are managed correctly, you'll have a better chance of minimizing tax hits than you would if you relied on a single option.

For example, using this multifaceted approach allows retirees to leverage differences between income from pretax 401(k) or traditional IRA contributions and after-tax Roth IRA contributions. "If you're pulling money from a traditional IRA or 401(k) on November 1 and suddenly realize that the next dollar you take out will bump you into a higher tax bracket, maintaining your standard of living until the end of the year will mean taking a tax hit that will not only hurt in the present but also decrease your funds in the long term," Semple says. "But if you have a Roth IRA, you can halt the income from your 401(k) and pull the amount you need for the next 2 months from the Roth IRA, which is not taxed as income when you withdraw it. Then you don't see a reduction in your standard of living and avoid getting pushed into that higher tax bracket."

Many of those leaving the workplace already hold at least one type of retirement plan. While diversifying to include multiple plans might seem like an undertaking, the benefits are typically worth it—and the process is often easier than you might think. A good first step is understanding the differences between a traditional and Roth IRA.

"Discuss with your tax professional whether opening a Roth IRA is right for you," Shively suggests. "If you participate in a 401(k) plan with your employer, consider directing some of your contributions into the Roth account if your employer offers that option."

Consider the impact of life expectancy

Ensuring that your income extends throughout your post-work years is the big-picture objective of retirement income planning. But even with solid strategies for managing and coordinating variable and fixed income, accomplishing this isn't necessarily a straightforward process due to the simple fact that everyone's time horizon is different and unknown.

"You'll hear various rules of thumb in financial planning for dealing with this uncertainty, but none of us come stamped with an expiration date," Shively says. "The surest method for addressing this is to get ahead of the game and have an investment strategy in place as early as possible so that 5 or 10 years out, you're not panicking about being behind."

A reliable and simple technique for aligning retirement income with your life expectancy is to set rules for investing, start early and contribute regularly. Old thumbnail guides such as the Rule of 120—subtract your age from 120 to determine the percentage of your portfolio to put in stocks—can be helpful, but setting more robust goals can increase the effectiveness of your planning.

"Set milestones at 5-year increments that allow you to plan the whole way along in a tax-efficient manner," Semple says. "You'll have more of a fighting chance in retirement if at 20 you invest a certain amount—then double it at 25, triple it at 30 and so on—than you will if you take 120, subtract your age and then suppose this calculation will hold."

Make informed adjustments

Once you've laid the foundations of your retirement income strategy, it's essential to remember that there are factors beyond your control that will dictate how you adjust to changing conditions.

The importance of factoring inflation into retirement planning can't be overstated. "Inflation is the silent killer of retirement plans, and it affects every type of income stream you can have," Semple says. "If inflation is at its historic average of 3%, then after just 10 years your retirement money has lost 1/3 of its purchasing power—even if you still might have another 20 or 30 years to live."

When crafting your retirement income strategy, inflation has more influence on how and when you'll need to make adjustments to maintain the long-term viability of a plan than almost any other factor.

"The state of the markets, inflation, Social Security, tax codes—nobody has any idea what those will look like in 20 or 30 years and how they will affect your plan," Shively says. "The best protection against all this uncertainty is having the fundamentals in order, and then making informed adjustments to your plan to meet any changes that arise as your circumstances change."

Turn retirement savings into income

Watch our video to see how life planning can help you achieve your goals in retirement.