Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

Once your retirement is financially secure and you've completed your basic estate planning, dedicating some thought to the impact you want to have on your family, your community and the causes you believe in can help you develop a legacy for generations to come.

With a legacy plan in place, you have an opportunity to make a difference that can be sustained long after you've passed away.

Consider Dolly Parton, a singer admired around the world. She created the Dollywood Foundation's Imagination Library to help children learn to read. As a tribute to her father, who never learned to read or write, she launched the project in her home state of Tennessee. Since its founding, the organization has donated more than 200 million books to children around the world. “Before he passed away, my daddy told me the Imagination Library was probably the most important thing I had ever done,” she has said.

Whether you choose to benefit successive generations of your family, your local community or causes that are important to you, there are strategies you can use to help amplify your bequest or preserve it for the long term.

For beneficiaries, legacy planning can close the wealth gap and help them get started earlier on the path to financial independence. For example, the National Association of Realtors reports that 7% of first-time home buyers used inheritance to finance their home purchase in 2023—a record high. Buying a home allows individuals to begin building equity and perhaps even upgrade to a larger home in the future.

Looking at financial stability metrics, a 2024 Northwestern Mutual planning and progress study revealed the importance of inheritance for future beneficiaries. When asked how critical their expected inheritance was to their long-term financial security or retirement, more than half of survey respondents answered that their inheritance was either critical or highly critical to their financial well-being.

As you develop your legacy plan, there are several straightforward tactics you can employ to help you achieve your goals. The items below can help you become more informed and organized as you dig into the planning stages.

In most cases, wealth preservation strategies are more effective with help from professionals—including a financial advisor, an estate attorney and potentially a tax professional. Once you assemble your team, these early steps can help you build a comprehensive legacy plan together.

For starters, everyone should have a current will, power of attorney and healthcare proxy documents. Make sure your loved ones know where these documents can be found and who should be contacted in case of an emergency or loss. Having a basic estate plan and making it easily accessible will reduce stress for your heirs and may help avoid or at least streamline the probate process.

You should also confirm that the beneficiaries named on your retirement accounts and insurance policies are up to date because your assets will automatically transfer to them outside of probate.

Once your basic estate planning is complete, you can move on to legacy planning, which is a loftier undertaking. This is a more personal assessment of your financial generosity and what you want it to do.

At this stage, it's helpful to give some thought to who or what you want to benefit with your assets. You've done well in your life, achieved goals and accumulated wealth. You're now in a position to do something with this wealth that can make an impact. What are the critical things you want to affect?

Be sure to consider your values, morals and ethics, as well as your cultural and religious priorities. This may be a conversation you have with family members or a process you go through alone.

For some, it's successive generations of their family. Creating trusts, such as dynasty trusts, or similar structures that hold protected assets for many generations—and sometimes indefinitely—can offer your family incalculable benefits.

You may also want to help specific organizations. Pledges, endowments and other gifts are ways to help them with their mission. Your gifts could be limited in their use or used for any general expenses of the organization.

Like Dolly Parton, you may be interested in a particular purpose, such as children's issues, other humanitarian concerns, welfare of animals or a more global concern like climate change.

As you determine your vision, documenting the journey is vital. The values and priorities that helped you solidify your vision aren't things that will be written in a will. If you effectively build your legacy, it can last for generations. The recipients of your wealth will want to know where the benefits they're receiving come from. Who were you? What drove you? What where your values and inner strengths, and how can they emulate them?

Documenting your vision can include writings, stories, videos and photographs. We recommend what's called an ethical will. While it's not a legally enforceable document, it's a letter that can include your motivations, family story, experiences, wishes, hopes, life lessons and themes. Basically, it's wisdom and advice that can help guide the recipients of your legacy.

If your legacy is comprised of family members, they can hear stories about you and prior generations. This is especially important if your gift will last for many generations.

Most people only know family history or stories going back three generations. A dynasty trust could last far longer. By accompanying the trust with an ethical will, you offer guidance to your beneficiaries regarding the purpose of the wealth so they can be motivated by it rather than potentially corrupted by it.

Once you identify the items you want to focus on, you can decide if you'd like to begin helping during your life or if you want all of the bequests to occur at your passing. If you begin making gifts during your life, or inter vivos, you may benefit from feeling the rewards of seeing the recipients of your gifts while you're alive.

If you plan to create an endowment or scholarship or to partner with an organization to construct a new building or add a department within a college, you can see how they manage the gift and if they're progressing and utilizing the money as you wish. This gives you the flexibility to adjust and make changes to your legacy.

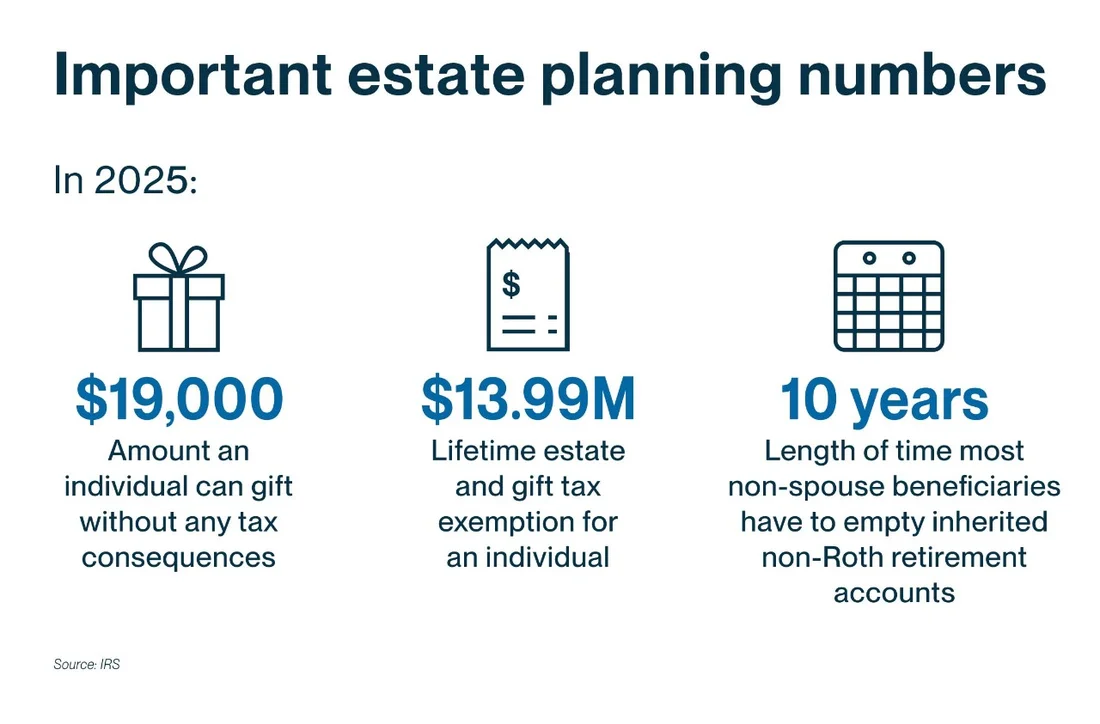

This decision doesn't have to be an all-or-nothing proposition. Most people do a combination of some gifting during life, with the bulk of the gift or inheritance taking place after their passing. If you plan to gift inter vivos, it's helpful to be aware of the gifting rules.

A dynasty trust is useful in legacy planning because of its longevity. In certain jurisdictions, the rule against perpetuities has either been repealed or extended, allowing trusts sited in that locale to carry on for many generations instead of the traditional three. With this potential, if your vision is to protect and benefit your family with a well-structured and funded dynasty trust, you could provide a benefit for an indefinite number of generations to come.

Trusts can provide additional utility when you're legacy planning, especially if you're concerned that your heirs may spend inheritance funds on things that may conflict with your personal values. You can minimize this risk by setting up rules around when and how heirs can access money left to them in a trust.

Adding limits and incentives to a trust are effective ways to integrate your wishes into your legacy plans. For example, incorporating time and spending limits can help safeguard your beneficiaries from becoming overly dependent on their inheritance throughout their lives.

You can provide incentives to trust payouts for certain behaviors like graduating, marrying or starting a business. These stipulations can help motivate your beneficiaries to achieve certain life milestones. The trust can also serve as a family bank. Rather than receiving funds outright, beneficiaries can apply for a loan, which they must ultimately pay back. But such loans can be obtained at lower interest rates and in a private context, keeping money within the family but still encouraging behaviors like buying a home, founding a company or obtaining a degree.

Legacy trusts, which are more likely to be set up for a general class of beneficiaries rather than for an individual, have an independent trustee and the added benefit of protecting assets from future creditors or ex-spouses who have a claim against the trust's beneficiary.

Trusts can also help if you want your legacy planning to include charitable giving. A charitable remainder trust, or CRT, essentially works like an annuity that helps a charity of your choice. You put assets into the CRT, which gives you or your noncharitable beneficiaries an income stream for a set period or until you pass away. When you die or the term ends, your designated charity receives the remainder in the trust.

If the charities you've listed no longer exist or are no longer tax-exempt at the time of your passing, we recommend—in addition to listing the specific charities—including a provision in the CRT specifying the charitable mission you wanted to support, such as childhood illness research or unhoused assistance, so your trustee can find a suitable replacement.

If you want to leave more to your heirs or charity than you think your estate will support, a life insurance policy may help bridge the gap. Charities don't need to have an insurable interest to be a beneficiary of your policy. Alternatively, assigning life insurance as the asset to pass to charity may help prevent family disputes over other assets with sentimental or other reasons that make them difficult to relinquish.

The life insurance benefit after you pass away can bolster your gift. Life insurance can also be a supplement to the CRT to help replace the asset funding it so family members don't feel a loss when the trust terminates and the asset or its value passes to the charity. Supplementing a CRT with life insurance is called a CRT with a wealth replacement trust.

As your financial situation and goals—and those of your heirs—evolve, you may need to adjust your legacy plan. You may find that the enjoyment you feel from planning your life's legacy makes these review conversations rewarding for you and your heirs, and you may even begin to look forward to them each year.

Creating a legacy plan can help empower the people and causes closest to you. It can give more meaning to your life and leave you feeling empowered. Once your own retirement plans are solidly in place, sharing your wealth and values with future generations begins with a few practical strategies.

With the help of a capable financial team, developing a comprehensive legacy plan gives you the opportunity to make an impact that can last longer than that of a traditional estate plan.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.