Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

Q4 Quarterly Market Review: Available now

The Making Sense team reviews changes in the market during Q4 2025.

The end of the year is a popular time for charitable giving, especially for those who may qualify for a tax deduction based on their donation habits. According to Nonprofits Source, almost 1/3 of charitable donations take place in December. But any time is a good time to consider how to be more systematic and purposeful to maximize year-end giving.

When it comes to donating, it's not just about how much you give. Making strategic choices about how you donate can help you make the most of your contributions and boost your tax savings, says Hank Dunbar, Manager of Charitable and Philanthropic Services at First Citizens Bank. Here, he shares some strategies that can help you take your giving to the next level.

Many people give cash gifts to a variety of charities, often in response to direct requests from organizations or when something moves them in the moment. For example, more than 40% of charitable givers donate after a natural disaster. While these gifts are undeniably appreciated, Dunbar advises developing a strategy for a more profound impact.

Start by considering which causes you care most about. Is it access to education, animal welfare or perhaps the arts? Identify charities that focus on your priorities by talking to friends you trust and doing research on sites like GuideStar and Charity Navigator, Dunbar suggests. Then think about the long-term impact you want to make instead of simply what you can do now.

Choose one or two charities that align with your values, and consider what you want to achieve. Decide how you want your donations to be used, how much you want to contribute and how often you want to give.

For example, if you're already donating to your alma mater every year, you could talk to the university's development office about creating an endowment. At some colleges, you can endow a named scholarship for about $25,000, Dunbar says. To hit this number, you could give $5,000 a year for 5 years, Dunbar says—and make a lasting difference.

Loop in your financial advisor and tax planner to help you identify tax-saving strategies and ensure that your philanthropic goals fit in with your overall financial plan. They can help you find a level of giving you're comfortable with that can help you pursue your charitable giving goals while still allowing you to manage monthly expenses and prepare for other goals like retirement.

According to Dunbar, donating securities that have grown in value instead of cash is a tax-smart strategy because you avoid capital gains taxes on the asset—and you can still deduct its full fair market value. You can donate appreciated stocks, bonds, mutual fund shares or even assets that aren't publicly traded, like restricted stocks.

"I once spoke to a church group of fairly astute men and women—several had investment backgrounds—and suggested that they give appreciated property rather than cash to their church, and their jaws dropped," Dunbar says. "People just don't often think that way."

You can also donate real property, artwork, jewelry, a private business interest or any other high-priced item to charity and deduct its fair market value. If you inherit an item you can't use or don't want, passing it along to a nonprofit can be another deduction opportunity.

A donor advised fund is an investment vehicle that gives you more flexibility with your charitable contributions, Dunbar says. When you donate assets—cash, securities or anything else—to a donor advised fund, you're eligible for a potential tax deduction in the same year. However, you don't have to decide right away how to distribute your gift. "You remain an advisor over how the money is distributed into the future," he explains.

You can name your fund to reflect your mission or in memory of someone, and then you can designate your children and grandchildren as successor advisors. You can also determine a set amount to give every year or donate larger amounts when a nonprofit is truly in need.

Donor advised funds have lower startup costs and administrative expenses—as well as more favorable tax treatment—than private foundations, Dunbar says. They also don't require the creation of a corporation, trust document, board of directors or a separate tax return.

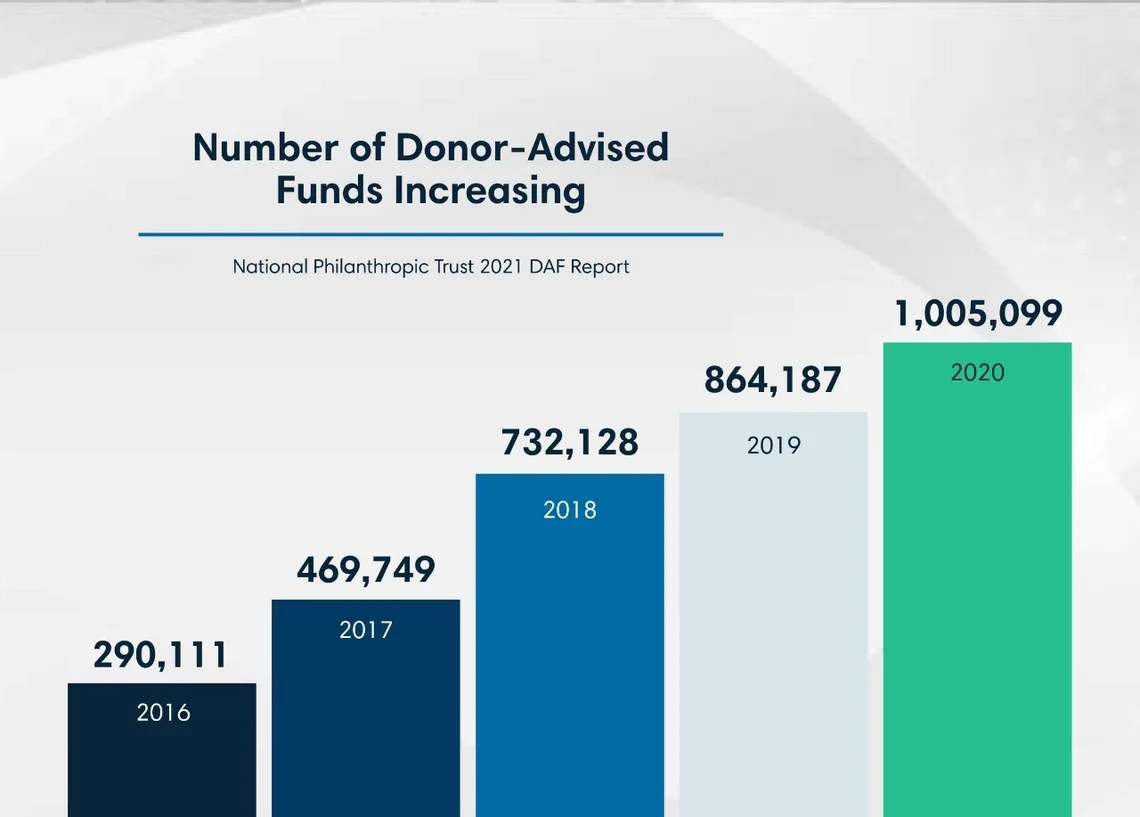

The number of donor advised funds is increasing, according to the National Philanthropic Trust 2021 DAF Report.

Tax reform changes in 2018 increased the standard deduction and capped some itemized deductions, making it more challenging for taxpayers to get tax benefits from their charitable contributions. Special laws were put in place during the COVID-19 pandemic to encourage charitable giving, though, so make sure to check with a tax professional if you have questions about your donations and their impact on your income taxes.

Even if you may not regularly qualify for itemizing your deductions on your taxes, don't forget that one-time influxes of wealth may change your giving habits. Let's say you receive an inheritance and want to use it to help fund your future charitable giving. If you have the available funds, a strategy called bundling—or bunching—can help you maximize your donations and their impact, Dunbar says.

Here's how it works: If you're planning to give away $5,000 a year for the next 5 years, you'd instead condense those donations and give $25,000 the first year. This may allow you to itemize and get a tax deduction that year, and then take the standard deduction in the following years. According to Dunbar, making your bundled gift to a donor advised fund can be especially strategic because you get the tax benefit but can still spread out your donations over time.

Regardless of how you decide to give, the most important aspect is to find a cause or causes you're passionate about and that you believe will help others. It's a great opportunity to get family members involved in the selection process and discuss what's important to you. Talk to your financial advisor or bank professional to discuss options for your charitable giving strategy and understand how they impact any other goals you're pursuing.

The information provided should not be considered as tax or legal advice. Please consult with your tax advisor.

Your investments in securities and insurance products and services are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands and Services Offered: First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares are the entities through which FCW products are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. ("FCIS"), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. and SVB Wealth LLC, all SEC registered investment advisors. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions or to all investors. Insurance products and services are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products and services are offered by First-Citizens Bank & Trust Company, Member FDIC and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

For more information about FCIS, FCAM or SVBW and its investment professionals, visit FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.