Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Providing for the health and security of your children is a top concern as a parent. If your child has a special need, your focus on their well-being may become even more pronounced.

Addressing everyday financial considerations like healthcare, education and insurance often requires significant adjustments and individualized planning—because raising children is expensive. While the average cost of raising a child to the age of 17 can cost anywhere between $176,000 and $407,000, Autism Speaks calculates the lifetime cost of a child with an intellectual disability at around $2.3 million.

First Citizens Wealth Planning Strategist Doug Semple highlights common concerns and offers his professional and personal insights into caring for a child with special considerations.

From the moment you're aware that your child has an impairment, your focus likely shifts toward understanding their medical needs and getting them the best possible care. This certainly was the case for Semple when his daughter was diagnosed with a disability at age 7.

"Before we could even begin treatment, we had to take her to specialist after specialist just to get an accurate diagnosis," he says. "Right away, it showed me that this process doesn't hinge on a single isolated variable. It's not just covering the costs of medical treatment. There's an entire ecosystem of factors influencing financial planning for families with special needs."

To help manage these considerations, Semple advises taking the following key steps to improve your response to overlapping financial and emotional concerns.

The beginning is budgeting—and budgeting kicks off with a diagnosis. This should be your financial planning starting point, and it applies not only to the classification of the disability but also the age at which it's first identified.

"Financially, your planning decisions are much more clear-cut if you're young parents with a child diagnosed from birth than if you're a couple in midlife dealing with a teenager disabled by an automobile accident that alters decades of financial planning overnight," Semple says. "The entire ecosystem of financial considerations you'll need to navigate to secure care starts with these two factors."

It's important to have a realistic notion of just how much energy and tenacity you'll need for every facet of planning—and the sooner you can gather a lot of both, the better.

"Emotional and intellectual resilience are crucial—something that I only appreciate after caring for a child with disabilities," Semple says. Whether it's working with medical providers or government agencies, the foundation of this resilience is continual and requires precise recordkeeping, scheduling and budgeting.

Semple recommends breaking budgeting documentation into overarching categories. This is your basis for creating a strong, adaptable framework that can help plan for the lifetime expenses of a child with disabilities.

And you don't have to do this alone. You can assemble a team of formal and informal advisors focused on your family's and your child's needs to increase the quality of their care and help you gauge and manage your entire plan.

Semple and his family quickly learned why they need to keep any and all medical care records. Providers change practices, retire or go out of network from your insurance, so keep every item from every appointment. "From a comprehensive planning perspective, the number one skill for any parent with a disabled child is producing and maintaining an intact treatment history that enables them to construct an ongoing, forward medical record," he says.

A spreadsheet of every doctor's appointment, prescription and test may help ensure changes to your child's medical team don't lead to interruptions in treatment. Meticulous recordkeeping is also crucial from a budgeting perspective—especially if you're dealing with health insurance claims or require government benefits in the form of Supplemental Security Income, or SSI, Social Security Disability Insurance, or SSDI, or Medicaid.

"I can tell you from experience that when you're applying for benefits or making claims, the Social Security Administration and insurance companies will want to know about every doctor and doctor's appointment your child's ever had," Semple notes.

His daughter's diagnosis was not only a personal watershed moment but also a professional one. It brought a new focus to the guidance he gave to other families with a child with a disability, especially ones where the diagnosis came during the child's school-age years.

"Your lifetime financial plan will need to adjust to account for immediate necessities like treatment, the scope of your health insurance plan, the possibility of hitting that plan's annual or lifetime maximums and putting together an emergency fund," he says. "Then there are other case-by-case, near-term issues like potentially needing specialized education, home care and government assistance programs such as SSI and Medicaid—and financially, each of these factors creates a cascade effect."

Let's say you were putting a specified amount of money into your 401(k) before your child's diagnosis. Within the first year of treatment, however, you've seen your out-of-pocket medical costs triple, and you need to determine if you should reduce your retirement contribution to cover the cost or pull from somewhere else.

Decisions like these can be tricky and may cause budgetary ripple effects. To avoid this, you can consult with a financial professional to help advise on a course of action that fits your particular circumstances to help build a strong, responsive budget. Semple notes that many planners who work with client families under these circumstances also often have chartered special needs planning qualifications, as well as personal experience raising their own children with disabilities.

If your child needs government assistance in the form of SSI, SSDI or Medicaid, a disability lawyer can be invaluable to help navigate the paperwork required to qualify and answer questions related to things like financial powers of attorney and semi-independent children over 18.

"From personal experience, I can tell you that qualifying for something like Social Security disability can be difficult," Semple says. "The process includes an assessment of your child's care needs, but it's also an examination of your personal finances—because to combat fraud, the entire process is heavily bureaucratic by design. A lawyer really helps with that."

Some disability lawyers don't charge upfront fees. They're only paid if they land your claim—and then they're compensated only out of the back pay owed, and there's a cap on the total percentage they can make.

"It tends to be affordable, and as the parent of a disabled child going through this process, the fact is some tiny detail like a lost savings bond can gum everything up," Semple says. "If it does, you'll be thankful you have a lawyer trained in this specialty to help get your case back on track."

In adulthood, your child may still require financial support from you, such as insurance, housing or help managing their government benefits and employment income. This means not only a lifelong link between your personal finances and theirs but also a more-intricate-than-average navigation of the financial landscape.

The amount of money your child receives—and the manner in which they receive it from you or any other source—can easily exceed the asset restrictions that dictate eligibility for government benefits like SSI, SSDI and Medicaid.

"For example, if your child uses Medicaid and has over $2,000 of assets in their name, you're putting them at risk of losing that benefit," Semple says. "So the issue, especially with something like a semi-independent adult child, is how can I make assets available for them in their name without jeopardizing access?"

There are two main resources for families in this situation.

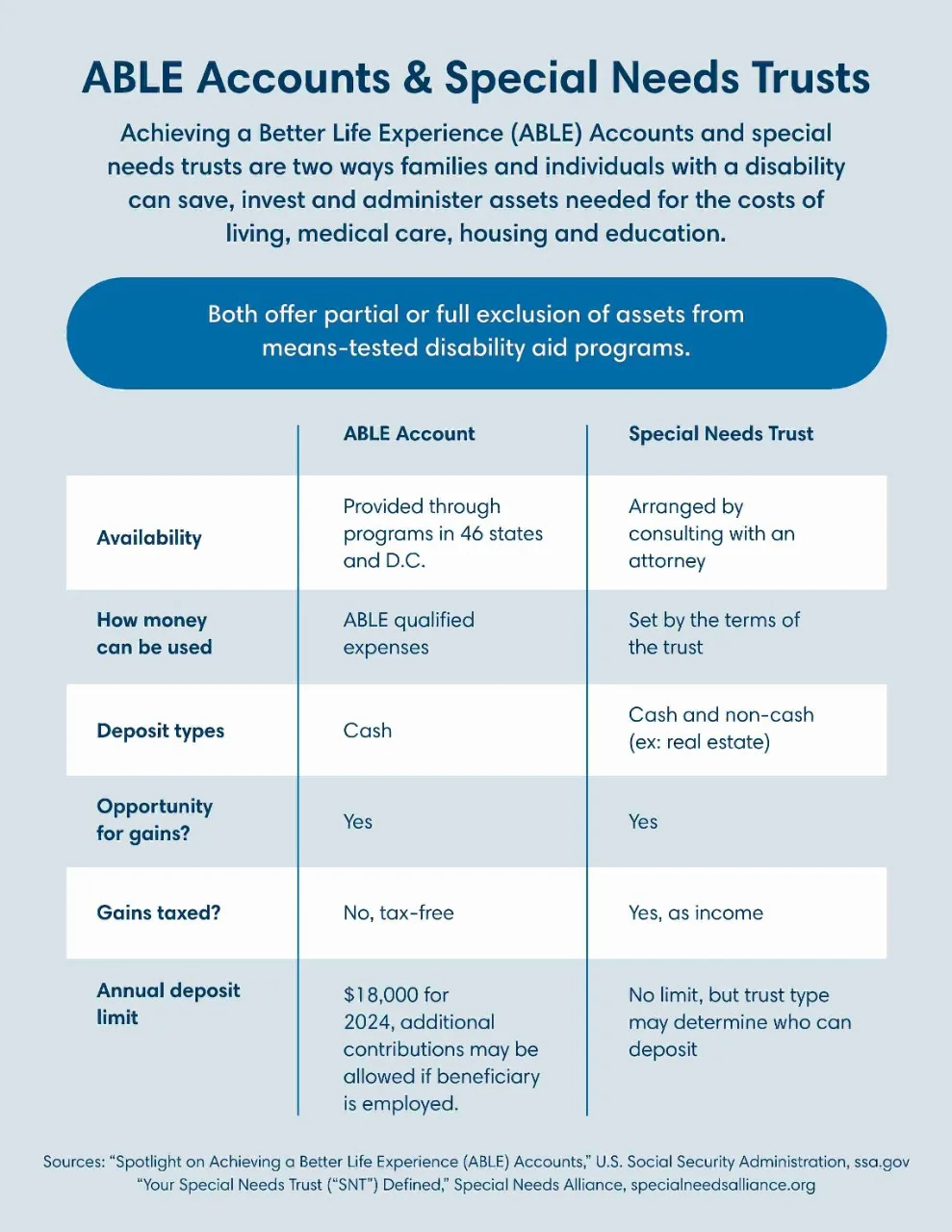

Achieving a Better Life Experience, or ABLE, accounts are tax-advantaged accounts that let families and individuals save and invest funds for qualified expenses without the risk of having their access to government benefits like SSI, SSDI or Medicaid revoked or reduced. Qualified expenses include housing, job training and assistive technology. Funds grow tax-free in the accounts, which are offered by 46 states and Washington, DC, and the amount that can be deposited per year equals the IRS gift-tax exemption.

"The conditions vary by state, but as of 2024 you, your family or your child can deposit up to $18,000 annually to be used for qualified expenses without losing benefits," Semple says. "This allows you to far exceed that $2,000 threshold." The total account balance cap is $100,000, or more if the individual is employed and meets other criteria.

Like ABLE accounts, special needs trusts are used to exclude resources from the asset totals that government programs set—and thus keep benefits eligibility for the beneficiary of the trust. Unlike ABLE accounts, these trusts don't have a maximum balance limit and can hold non-cash assets like stock and real estate. They can also persist after the parents' lifetimes and receive assets from a life insurance policy or other inherited assets. Families can set other conditions around the use of the funds based on the beneficiary's needs and the family's values. Control is never in the hands of the person with a disability or special needs.

"The key word here is control," Semple says. "Your child won't be in danger of not qualifying for something like Medicaid because, as a beneficiary of the trust, they neither control nor own the assets in it. So when you're talking about resources for parents with a child with special needs, a properly structured special needs trust is worth gold."

You'll need an attorney to recommend the type of trust to use and then to structure it. Semple also advises getting their guidance on selecting a trustee. "Choosing a loved and respected family member over an institutional trustee like First Citizens might seem like a perfect fit," he says. "But having that family member as the gatekeeper of the money could potentially change the nature of family relationships."

With these fundamental tips in hand, you and your advisors can build a strong financial plan for your child. After it's created, you'll just need to make sure to keep it current. The strongest plan is one that evolves to meet both your child's healthcare needs and your financial parameters.

"The base plan you've put together may have certain spending amounts attached to wellness benchmarks you expect your child to hit by 18 or 25, but their need for care may turn out to be longer," Semple says. "That's why it's crucial to keep good records, communicate with your team, know your resources and talk with people who've been through this so you have a 360-degree view that covers every aspect of the process and helps evolve your plan."

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.