Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Ah, that new car smell. Many consider buying a car to make the daily commute easier, chauffeur the kids and pets around town or fulfill the dream of a road trip. But considerable volatility in car prices, during and after the pandemic, has made this process more challenging and sparked continued wariness among potential shoppers.

Car shopping in today's economy requires more research and due diligence than ever before, and buyers should do their homework before they even visit a dealership. Here are some tips for navigating new and used car pricing trends, the expanded push for electric vehicles, the continued impact of microchip shortages and changes in auto loans.

Inflation has hit many household purchases over the last three years, and car prices are no exception. Thanks to the pandemic, used car prices ballooned when fewer vehicle leases were turned over in 2020. That's changing now, and many consumers question whether it makes more sense to buy a new or used car.

The average price of a new car has remained elevated since the pandemic. Many experts believe new car prices will decline slightly in 2024, as global production finally catches up to demand. However, base-model price points for new cars will continue to rise because of an increasing focus on technology and design.

"Even lower-end auto models are going to come with sensors, a backup camera and all these other features that add up," says Daniel Toton, Vice President of Consumer Lending at First Citizens.

In addition to increasing the average cost of a new car, many of these features require microchips, which have been in limited supply since the height of the pandemic.

"We're seeing the used car market start to normalize," says Toton. Used car prices have come down steadily since their peak in 2022, when lower inventories and supply chain disruptions contributed to historically high used car prices.

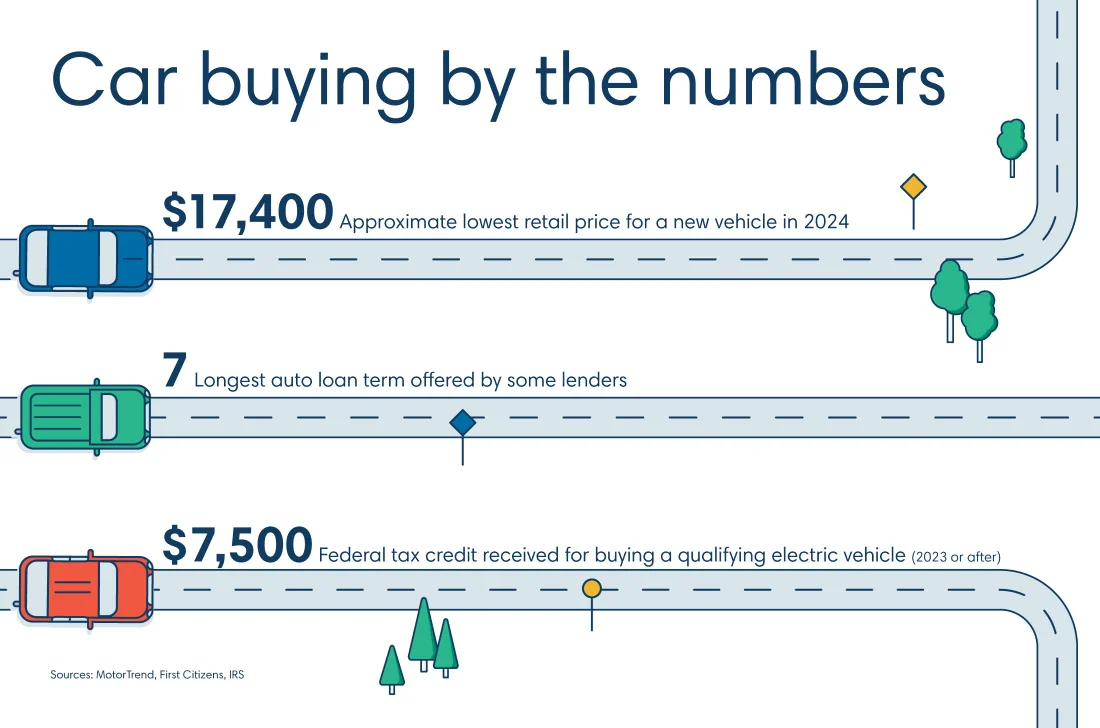

Customers shopping for EVs in the US may see subsidies in the form of a $7,500 federal tax credit if they buy a qualifying EV model. The subsidies are an incentive from US lawmakers to help drivers wean themselves off cars powered by fossil fuels.

But keep in mind that while a tax credit might be persuasive, EVs remain pricier choices overall. The average price tag for an EV sold in 2023 was close to $60,000, according to car shopping guide Edmunds. And even though EVs have upsides—like paying less for gas and having fewer mechanical parts to repair thanks to their battery-driven power trains—they're not necessarily cheaper to own.

"Despite the subsidies, the EV market grapples with technical challenges and high repair costs," says Heim Levi, Managing Director at Auto Almanac. "This underscores the importance of thorough assessment and due diligence when considering an EV purchase."

In recent years, supply chain disruptions famously drove down new car inventory, and these shortages contributed to higher prices for both new and used cars. While inventory levels continue to stabilize, semiconductor chip shortages are still playing a role in keeping dealer supply relatively low in 2024.

While this issue tends to be more disruptive for high-tech options like EVs, even the base gasoline-powered models offered by automakers are fitted with computers, sensors and gadgets galore—all of which rely on microchips. Meanwhile, car manufacturers are decreasing the number of models they roll out to operate more efficiently, leading to fewer budget options as well. According to Motor Trend, you may find it difficult to find a new car in the 2024 auto market for less than $17,000.

As car prices have gone up, financing a car purchase through an auto loan makes sense to even more buyers. In fact, higher prices are pushing some buyers to finance with longer loan terms.

"One of the trends we're seeing is customers taking out an auto loan for longer and longer terms," says Toton. "It's not totally unheard of to hear of someone getting an auto loan for seven years."

Stimulus efforts in the early stages of the pandemic—ranging from checks for US citizens to loan forbearance—resulted in historic lows for late household debt payments, including auto loans. Lately, the story looks very different. The rate of auto loans transitioning to delinquency increased about 17% from the end of 2022 to the end of 2023, according to data from the Federal Reserve Bank of New York, so it's important to budget appropriately and not commit to loan payments that are out of reach. You can estimate your potential payment with an auto loan calculator.

Lenders are reacting to this rise in delinquency by raising credit standards. Promotions offered at dealerships may be one option, but buyers with good credit may opt to shop around for favorable auto loan rates. Check with your bank to see what promotions they may be able to offer, but be prepared to consider the trade-off between lower rates and longer terms.

Shopping for a car in 2024 is quite different from years past, raising new questions for buyers to consider. Two decades ago, the average age of vehicles in the US was less than 10 years, according to S&P Global Mobility. Now, the average age is 12.5 years, the highest it's ever been. Extended auto loan terms are also more common. Both trends may lead to persistently lower turnover in the used-car market.

Ultimately, you may have to do a little more scouting and research to see what's available in your price range before you head to a dealership or used car lot. Trends for used car prices and new car inventories, available EV subsidies, and shopping around for the best loan are all things to consider before you hit the road in this economy.

Save more when you finance your vehicle with a new auto loan.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.