Real-Time Payments

Improve cash flow by receiving payments instantly

Get Real-Time Payments

We understand every business has unique needs and may want to streamline their payment services. That's why we offer Real-Time Payments, or RTP®, which allows businesses to conveniently receive payments and access funds immediately.

Real-time payments benefits

Fast, secure payments

Process Real-Time Payments 24/7/365

Receive same-day payments for goods and services rendered.

Send payments securely

Make payments from accounts at other banks to your First Citizens account for cash concentration and daily reconcilement.

Opt out easily

You can opt out of RTP at any time by contacting the Business Engagement Center. We'll process your request within 3 business days. All RTP payments will be rejected without further notification.

Manage your business on the go

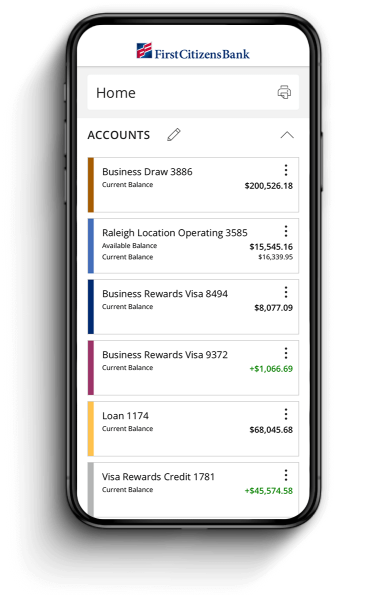

Manage your accounts from anywhere

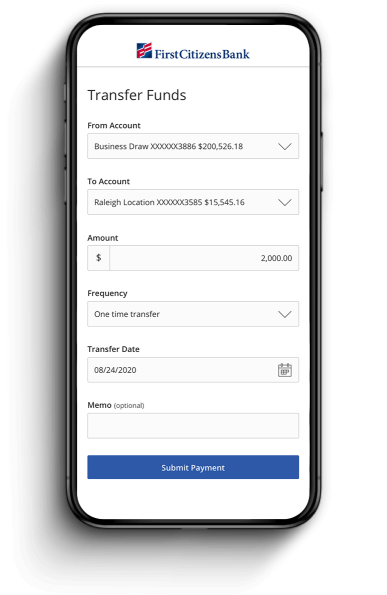

Send & transfer money with ACH and wires

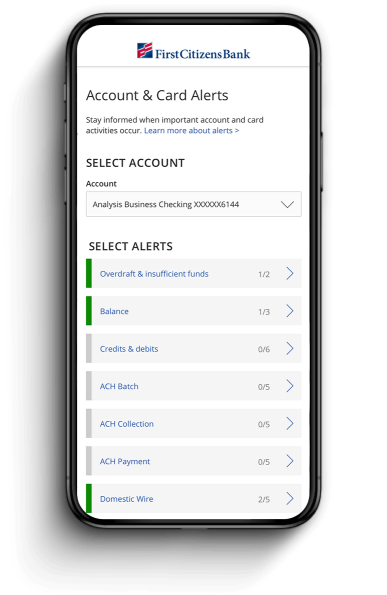

Receive account and security alerts