Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

2026 Market Outlook video: Available now

The Making Sense team reflects on 2025 and discusses key headwinds and tailwinds for 2026.

Looking to add another checking account? Our checking accounts put you in control with convenient spending options and secure online banking.

Apply for a credit card that works for you, whether you're looking to build your credit, earn exclusive travel rewards or enjoy unlimited cash back.

Get the funds you need to achieve your dreams. From auto to home loans, our bankers can help you meet your goals.

Find the right mortgage for your home—whether you're buying, building or renovating.

Get peace of mind for the things that matter most, and protect yourself from the unexpected with an affordable insurance policy.

Save for a rainy day or sunny vacation with competitive interest rates and affordable minimum opening deposits.

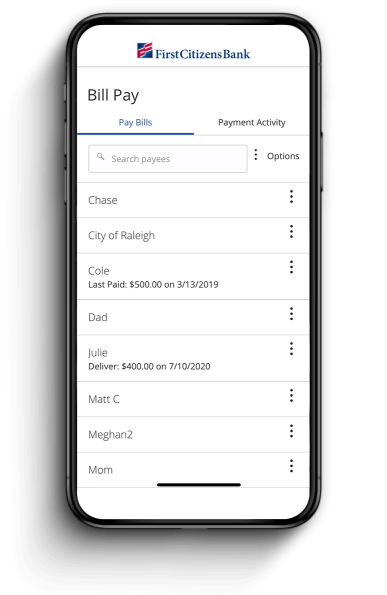

Pay your bills from any device

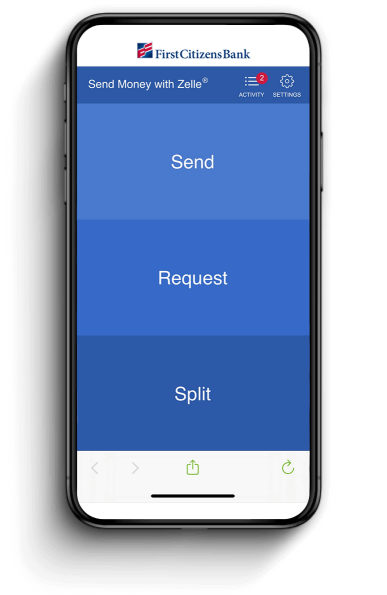

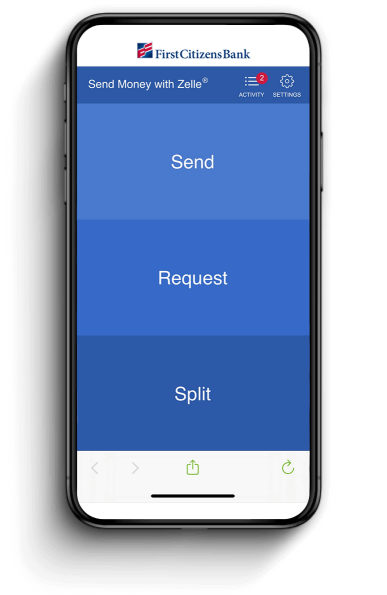

Send money with Zelle®

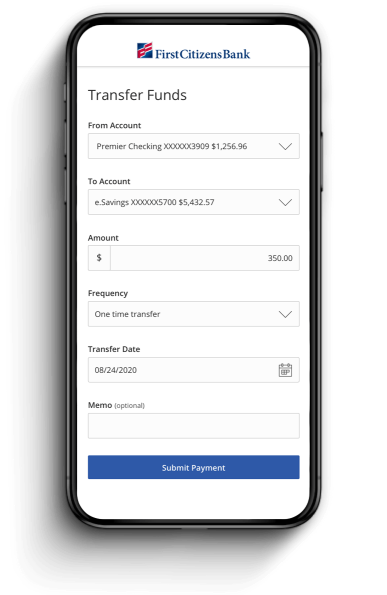

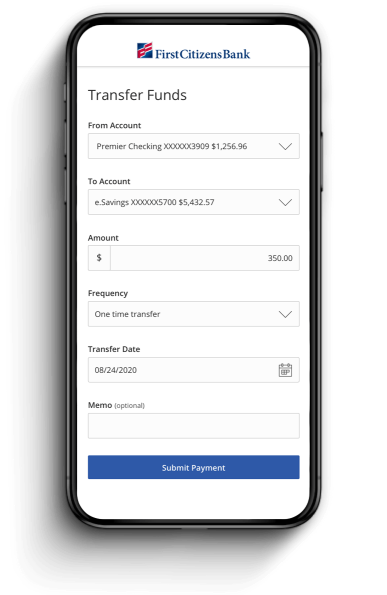

Transfer funds to other accounts

Pay your bills from any device

Send money with Zelle®

Transfer funds to other accounts

If you and your family have $250,000 or less in all of your deposit accounts at the same insured bank or savings association, you don't need to worry about your insurance coverage—your deposits are fully insured. A depositor can have more than $250,000 at one insured bank or savings association and still be fully insured provided the accounts meet certain requirements. In addition, federal law provides for insurance coverage of up to $250,000 for certain retirement accounts.

Yes. You can access your First Citizens credit card information online through Digital Banking. You can view your current account status and review 6 months' worth of transaction history. You can also access account information and view recent transactions in Mobile Banking.

Customers with Digital Banking access can switch to email delivery and go paperless for all credit card statements. To enroll, log in to Digital Banking.

Yes. You can access your personal accounts through Digital Banking, including the mobile and tablet apps, if they are tied to your Digital Banking profile.

You can transfer from any of your checking, savings, equity line or money market accounts.

You can transfer money between your First Citizens checking accounts, savings accounts or money market accounts—including accounts at other financial institutions.

You can also transfer to another First Citizens banking customer using our Pay Bank Customer feature, or our Transfer to Another Customer feature.

Account openings and credit are subject to bank approval.

For complete list of account details and fees, see our Personal Account Disclosures.

Normal credit approval applies.

For more information, please see the First Citizens Consumer Credit Card Cardholder Agreement and Disclosure (PDF).

Not applicable in all states.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Insurance products are not insured by the FDIC or any federal government agency and are not a deposit or other obligation of, or guaranteed by, any bank or bank affiliate.

Insurance products offered in California are offered by First Citizens Bank & Trust Co., CA Agency License #OH380006.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

Congratulations! You've taken an important step in the loan process by reaching out to our experienced team of loan advisors. Complete the form below, and a member of our loans team will contact you within 2 business days.

Fields denoted with an asterisk (*) are required.

If you prefer to speak with someone directly, please give us a call or visit a branch.

Earn more points on travel and get exclusive travel rewards.

Earn more points on special spending categories.

Transform everyday purchases into unlimited cash back.

Get our lowest available rate.

Still not sure? Compare Accounts

Need to make a change?

Make life easy with our simplest personal checking account.

Get the upgrade with the personal checking account that pays you interest.

Sign up for the VIP experience—an interest-bearing personal checking account with the best features.

Still not sure? Compare Accounts

Need to make a change?

A member of our team will contact you within 2 business days upon completion of this form.

Fields denoted with an asterisk (*) are required.

If you prefer to speak with someone directly, please give us a call.