Rewards Credit Card

Earn more points every day with the Rewards credit card

Earn points on everyday essentials

Now here's the points rewards credit card you'll always want in your wallet. With a First Citizens Rewards credit card, you'll earn more points on regular everyday purchases.

Earn rewards everywhere

Get even more credit card points on groceries, gas and streaming services.D

Enjoy more protection

Credit card benefits make purchasing safer, quicker and more convenient.

Get an introductory offer

Consolidate debt with 0% intro APRD on balance transfers for the first 12 months.D

Visit your local branch to apply

A competitive rate, a variety of rewards

Choose your credit card rewards from a range of redemption options, including cash backD, gift cards and merchandise.

Rewards Card Information

Card details and transaction fees

Balance transfers

0% introductory APRD for first 12 monthsD on balance transfers, then variable purchase rate of 17.24% to 26.24% based on creditworthiness applies.

Maximize your rewards

Automatically earn more points every day when you use your card for gas, groceries, drugstores and streaming services.

No annual fee

Enjoy all this point reward credit card has to offer with $0 annual fee.

Tap your card to pay

Make quick and secure purchases with contactless payments.

Get alerts

Track your accounts and transactions with text and email alerts.

Pay your bills

Automate your bill payments with Digital Banking for extra peace of mind.

Credit card rewards calculator

Choose how you want to earn credit card points

Use this credit card rewards calculator to pick the best First Citizens card for you. See how quickly your points rewards add up, just for making everyday purchases.

Find the features you want with our card comparison table

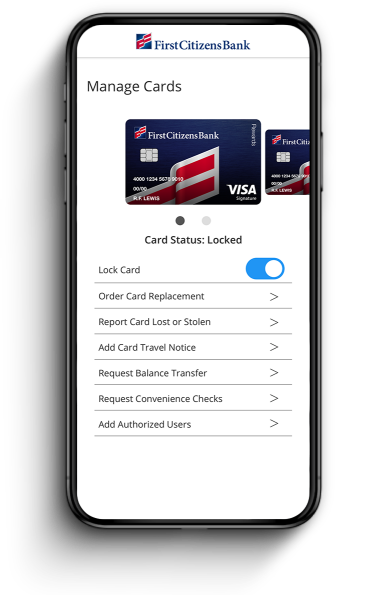

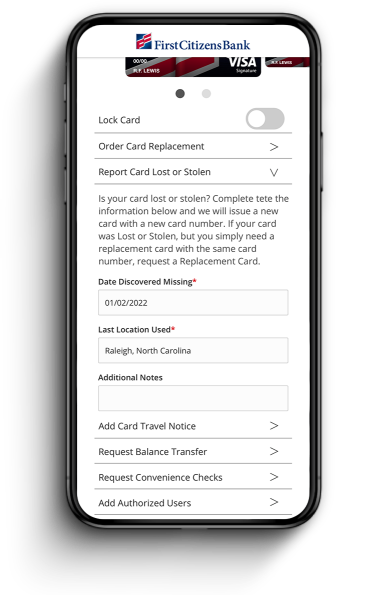

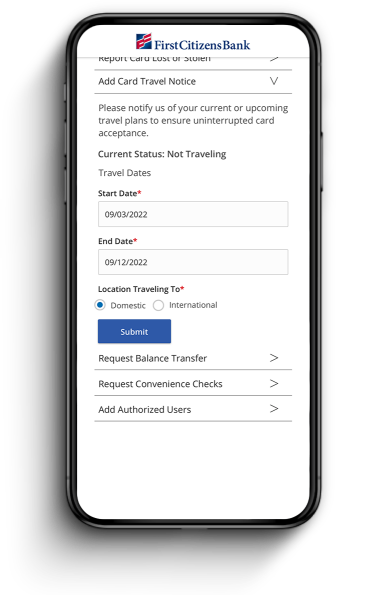

Access any of our card services from your phone

Temporarily lock your card

Report a lost or stolen card

Notify us if you're traveling