How to Pay Less Taxes

You have more control over your taxes than you may imagine. If you're thinking about your upcoming tax liabilities, the good news is that there may be ways to reduce the amount you owe.

Everyone's situation is different, but there are strategies that can help you pay fewer taxes. Even better, many of these tax breaks are available to everyday taxpayers.

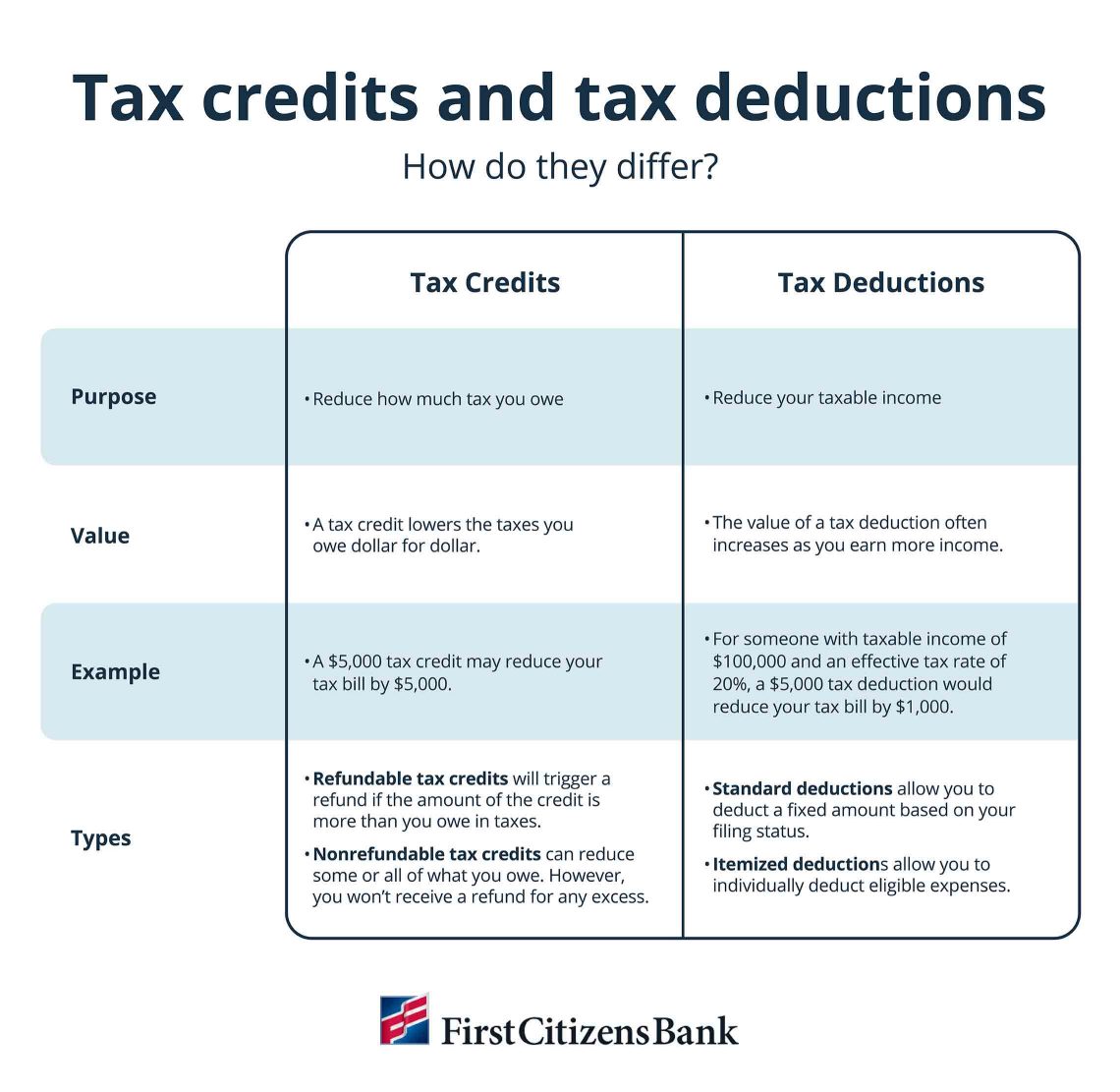

Understanding tax credits and deductions

Tax credits and tax deductions are two important tools you can use to help lower your tax liability. While both may reduce the amount of tax you pay, they operate in different ways.

How tax credits work

Tax credits lower your liability dollar for dollar. For example, if you have a $5,000 tax credit, it will reduce your tax due by $5,000—regardless of your taxable income or tax bracket. Some credits are even refundable, which means you'll get money back if you owe less tax than the credit amount.

How tax deductions work

In contrast, tax deductions reduce the amount of your income that's subject to taxes. How much you actually save depends on your tax bracket. For example, let's say you made $100,000 of taxable income last year and qualify for a $5,000 tax deduction. That means you'll only be taxed on $95,000 of income. If your effective tax rate is 20%, your $5,000 deduction will save you $1,000 in taxes—that's $5,000 times 20%.

Standard versus itemized tax deductions

When it comes to maximizing tax breaks, there's another important consideration—you'll need to decide whether to take the standard tax deduction or itemize your deductions. In most cases, you can choose between them, based on which saves you the most money. However, you can't take both.

What's the standard tax deduction?

The standard deduction reduces your taxable income by a specific dollar amount, depending on your filing status. For example, for the 2025 tax year, the standard deduction is $15,000 for single taxpayers and $30,000 for married taxpayers filing jointly. Note that if you're 65 or older, or legally blind, you'll qualify for additional amounts on top of the standard amount.

What are itemized tax deductions?

Itemized deductions differ by person and are made up of any eligible expenses you incurred during the tax year, such as medical expenses or charitable donations. To claim itemized deductions on your return, you'll simply list them on Schedule A and subtract the sum from your taxable income. Just make sure to keep documentation of these expenses. The IRS advises individual taxpayers to keep tax records for a minimum of 3 years.

Using tax credits to pay less tax

There are many potential tax credits available, but here are a few examples of top ones to consider. You can claim these credits on your federal tax return whether you take the standard deduction or choose to itemize your deductions.

Tax credits for families

Raising children comes with its financial challenges. Recognizing these strains, the government codified several tax breaks to help parents manage the costs.

- Child Tax Credit: You may be able to claim this tax break if a dependent child is under age 17, receives more than half their financial support from you, lives with you at least 6 months during the year and meets US citizenship requirements. According to current tax law, you may claim up to $2,000 per qualifying child, depending on your income.

- Family tax credit: If your dependents don't meet the criteria for the Child Tax Credit, you may still be eligible for a $500 family tax credit. However, you must be able to claim your children as dependents on your tax return and meet the income requirements.

- Child and Dependent Care Credit: You may be eligible to claim this credit if you paid someone to care for your child or other qualifying person so you could work or look for work. Your credit amount will be based on your income and qualifying expenses, although you must subtract any employer-based dependent care benefits from your expenses.

- Adoption Credit: Depending on your income, this credit can help offset up to $17,280 in qualified expenses incurred during the adoption process. Qualified expenses may include a home study, travel expenses, adoption fees and court costs. Note that adopting a spouse's child doesn't qualify you to claim this credit.

Education tax credits

With the cost of higher education rising, two tax credits exist to help offset some of those expenses.

- American Opportunity Tax Credit: This credit is intended to reduce the cost of an undergraduate education. It may be applied against qualified expenses for an eligible student during the first 4 years of higher education. Eligible taxpayers can claim up to $2,500 per student per year, and up to $1,000 of this credit is refundable.

- Lifetime Learning Credit: Another education-related credit, the Lifetime Learning Credit may help pay for an undergraduate or graduate degree, as well as vocational or career training. There's no limit on the number of years you can claim this credit. Eligible taxpayers can deduct up to $2,000 per year.

Energy tax credits

Signed into law in 2022, the Inflation Reduction Act is a multiyear investment in the country's economy. As part of this legislation, eligible taxpayers may claim several targeted energy tax credits for energy-efficient home and transportation upgrades.

- Energy Efficient Home Improvement Credit: You may qualify for this credit if you made certain energy-efficient improvements to your existing primary residence. The Energy Efficient Home Improvement Credit applies to renovations like new insulation, new windows and heat pumps. The IRS imposes specific limits for some home improvements, but in general you can claim 30% of qualified expenses, up to $3,200.

- Residential Clean Energy Credit: Adding a renewable energy source to your home—such as solar, wind or battery storage technology—may make you eligible for this credit, which also applies to 30% of eligible expenses.

- Clean Vehicle Credit: Depending on your income, you may be able to claim a credit of up to $7,500 against the purchase of a new electric or fuel cell vehicle. The car must be for your personal use primarily within the US, and it must meet several specifications to qualify for the credit.

Reduce taxable income with tax deductions

Depending on your circumstances, you could gain from a variety of beneficial tax deductions. These deductions could reduce your taxable income, which would lower your tax liability.

Deductions for all taxpayers

There are a handful of tax deductions you may be able to claim whether you choose the standard deduction or decide to itemize your tax deductions.

- Contributions to a traditional IRA: You may be eligible to deduct contributions to a traditional IRA if you meet certain income requirements and you and your spouse aren't covered by a retirement plan at work.

- Business use of your car: If a car is used entirely for business purposes, the full cost of its ownership and operation is deductible, subject to some limits. If the car's usage is a combination of both business and personal, the deduction can be calculated by using the standard mileage rate or a percentage of actual expenses.

- Penalties on early withdrawals: Penalties paid as forfeited interest or principal on funds withdrawn early from a certificate of deposit or similar deferred-interest account are deductible.

- Student loan interest: You may be able to deduct the lesser of $2,500 or the amount of interest paid on a qualifying student loan during the tax year, subject to some income limitations.

- Teacher expenses: Eligible educators may be able to deduct up to $300 of nonreimbursable expenses for classroom materials such as books and computers.

- Moving expenses for active-duty military: Active-duty members of the military are eligible to deduct unreimbursed moving expenses due to a permanent change of station.

Deductions for itemizers

Some of the most well-known and generous tax deductions are only available to taxpayers who itemize their deductions.

- Homeowner tax breaks: If you're a homeowner, you may be able to deduct the interest you pay for a home mortgage or home equity loan, subject to limitations. Deductions are also available for medically necessary home improvements and mortgage discount points. Home office deductions are more complex—allowable only if you own a business and are using that space exclusively for business purposes.

- State and local taxes: Property tax payments and other local taxes can reduce your federal taxes as part of the deduction for state and local taxes, or SALT. This deduction is currently capped at $10,000, or $5,000 for married people filing separately.

- Charitable donations: In general, itemizers may deduct cash or property contributions to qualified charitable organizations—subject to rules and type of donated asset. You can use the IRS search tool to verify a charity's eligibility.

- Medical expenses: Qualified nonreimbursable medical and dental expenses you paid for yourself, your spouse and your dependents during the year are deductible if they exceeded 7.5% of your adjusted gross income.

Other ways to lower your taxes

Along with tax credits and deductions, here are some other ways you might be able to lower your tax liability through effective tax planning.

- Use tax-advantaged benefits through your job, such as flexible spending accounts and dependent care accounts, if available.

- Contribute to a health savings account, or HSA, if you're eligible.

- If you pay taxes on income earned as an independent contractor, you may be eligible for some of the tax deductions available to freelancers.

- Aim for long-term capital gains. If you hold a security for less than a year, any realized capital gain from the sale of that asset is taxed as ordinary income. If you hold it for a year or longer, that’s considered a long-term capital gain, and those realized gains are taxed at a lower rate.

- Deduct realized capital losses. Tax-loss harvesting involves selling investments that have decreased in value to offset the taxes on gains secured from other investments. Some restrictions apply.

The bottom line

Taking the time to explore all the tax breaks that may be available to you can lead to significant savings. While these strategies may help you pay fewer taxes, it's important to remember that the laws and regulations change regularly. Additionally, there may be other federal and state tax breaks you qualify for.

Consult with a tax specialist to get personalized, up-to-date advice and make sure you're engaging in strategic tax planning to claim every credit and deduction possible.