Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

December FOMC meeting commentary: Available now

This month, the Fed lowered interest rates by another 0.25%. Read highlights and key takeaways from the Making Sense team.

Buying and owning a home has become increasingly expensive, leaving many people looking for relief. The average sales price for an existing home has risen more than 30% since the beginning of 2020. Property taxes, insurance, maintenance fees and utilities have also increased during this period, so longtime homeowners may even be feeling the squeeze.

Despite the increased costs, homeownership is still a good goal and one of the primary ways Americans build equity toward retirement or navigate credit and lending strategies. Here are nine popular tax credits and deductions that may offer some relief and help you maximize your savings.

If you have a mortgage, the mortgage interest deduction will allow you to deduct the amount you pay in mortgage interest—to a limit. You can only deduct the interest paid on up to $750,000 of your mortgage debt for your primary or secondary home. If you're married and filing separately, the limit drops to $375,000.

If you purchased your home before December 16, 2017, and closed before April 1, 2018, the limit is more generous. You can deduct the interest you paid during the year on the first $1 million of the mortgage—or $500,000 for married couples who file separately.

As mortgage rates have crept higher over the last several years, the mortgage interest deduction has become even more valuable for those who claim this popular tax deduction for homeowners.

If you want to make improvements or additions to your home, two popular sources of funding are home equity loans and home equity lines of credit, or HELOCs. In general, homeowners who obtain a home equity loan or HELOC may deduct the interest they pay on those loans, subject to certain dollar limits.

However, there's a caveat to keep in mind. Under the current tax law in effect through 2025, the funds must be used to buy, build or substantially improve your residence. For example, if you used a portion of a loan to pay for home improvements and spent the rest on furniture, you'd only be eligible to deduct the interest you paid on funds used for the improvements.

The IRS defines discount points as charges paid—or treated as paid—by a borrower in order to obtain a home mortgage. Alternative names are loan origination fees, maximum loan charges and loan discounts.

The upfront advantage of negotiating discount points ahead of closing your mortgage deal is that you can reduce the interest rate you'll be paying. Typically, one discount point costs a fee equivalent to 1% of the total mortgage amount, and the lender will often reduce the mortgage interest rate payable by 0.25% in exchange for that fee. There are no official limits on the negotiation. Loan and lender types and the current mortgage rate can all have an impact. Discount points can also be set at more or less than 1% of the loan amount and reduce the interest payable by different amounts as well.

Mortgage points are considered as prepaid mortgage interest. During the life of the mortgage, there are situations where you can deduct the amount paid for points from taxes—if you itemize taxes. Keep in mind that the similarly labeled loan origination points can't be deducted. These points are fees charged by mortgage lenders that contribute to their costs for providing the loan. Only the discount points paid to reduce the interest rate are deductible.

You can choose to deduct the full number of points you've paid for in the same year you paid for them if you satisfy the criteria established by the IRS. The most important one is that your mortgage can't exceed $750,000.

You could also choose to deduct them equally over the life of the mortgage. If you choose this option, there are still necessary criteria to meet. For example, your loan period can't be more than 30 years, and either the initial principal amount of your loan was $250,000 or less or the number of points isn't more than four if your loan period is 15 years or less—or six if your loan period is more than 15 years.

There are many rules around deduction of points, including the status of your property as your main home and the specific purpose of the loan. If you're unsure, it's a good idea to seek professional advice to understand how this could impact your unique situation.

Although property tax rates vary depending on the location of your home, you can apply the state and local tax, or SALT, deduction when you file your federal taxes.

The maximum SALT deduction is $10,000 for single filers or married couples filing jointly and $5,000 for married people filing separately. This cap applies to the total amount of state and local taxes you can deduct, which includes property taxes and either state income taxes or sales taxes.

If you recently sold a home, a capital gains exclusion for primary residences may lower your tax bill.

First, some background on how capital gains work. If you sell a home that has appreciated in value, the money you earn on the sale is called a capital gain—and may be treated as taxable income.

This is where the exception for primary residences comes into play. The IRS allows homeowners to exclude up to $250,000—or $500,000 for married couples filing jointly—of the capital gain. To qualify, you must own and use your home as your primary residence for 2 years of the previous 5 years before the sale.

If you made alterations or improvements to your home to accommodate a medical need, you may be able to deduct the costs associated with these renovations.

Some examples of medically necessary home improvements include:

These home improvements must be for the purpose of medical care for you, your spouse or a dependent. Review the list of IRS-approved capital expenses to determine if your renovations qualify for this tax deduction.

If you're self-employed and have a dedicated home office, you may be eligible for the home office deduction. To qualify, you must be a small business owner, freelancer or independent contractor. Remote workers employed by a business are excluded from this deduction. You must use that particular portion of your house exclusively for business purposes.

If you do qualify, you can deduct a percentage of your home office expenses. This may be difficult to calculate, so the IRS also allows filers to use a simplified option. With this method, you just deduct $5 per square foot of dedicated office space—up to a limit of 300 square feet, or $1,500.

If you made clean energy updates to your home, you may qualify for two home energy tax credits—the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit.

The Energy Efficient Home Improvement Credit applies to renovations like new insulation, windows and heat pumps. This credit can apply to 30% of qualified expenses, up to $3,200. Individual improvements must also meet energy efficiency standards, and some are subject to specific credit limits.

If you added a renewable energy source to your home—such as solar, wind, geothermal, fuel cells or battery storage technology—you may qualify for the Residential Clean Energy Credit. This tax credit applies to 30% of eligible expenses for updates made between 2022 and 2032.

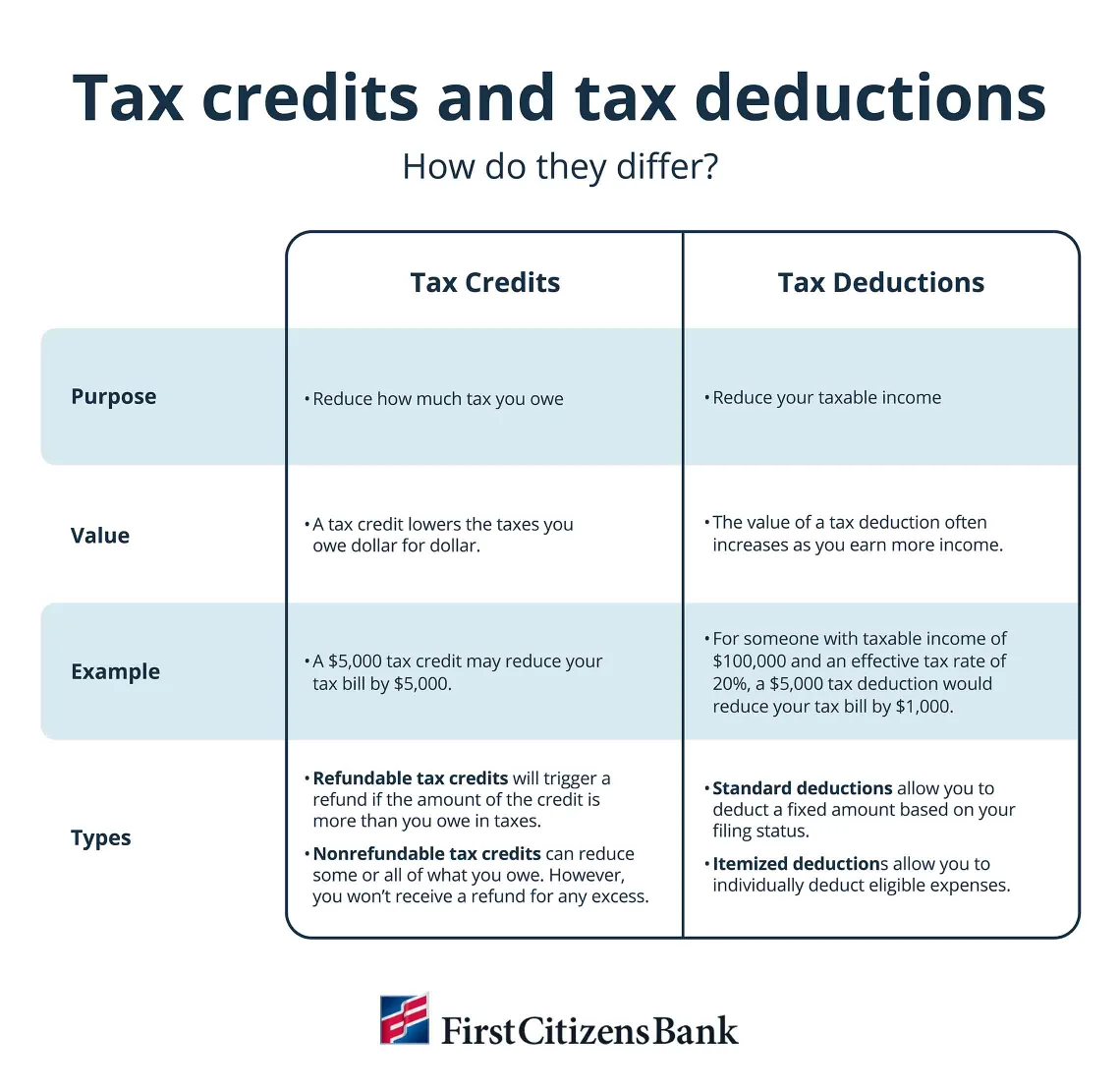

Unlike tax deductions, which reduce your taxable income, tax credits provide a dollar-for-dollar decrease to the amount of tax you owe. As a result, tax credits typically offer greater relief than tax deductions of the same amount.

Tax Credits

Tax Deductions

Depending on where you live, your state or local jurisdiction may offer additional tax credits and deductions. For example, 30 states and the District of Columbia allow taxpayers to itemize deductions on their returns. Of those, all allow homeowners to deduct mortgage interest, and most allow them to deduct property taxes—subject to some limits.

If you own rural land, it's also worth checking to see if it qualifies for a state exemption. Each state applies a lower valuation to land that's agriculturally productive. These current-use or present-use valuations don't reduce the actual rate of tax on the land, but they do significantly reduce how the land is valued.

For example, the property taxes paid are much lower than they would be on land held for residential development. These reductions can be as high as 90% in some states. This would likely be taxed on its full market value based on its highest and best use. These valuations tend to be specific to individual states—and even individual counties.

Because state laws vary, check with your state tax office for any relevant tax breaks. An accountant with experience in your local tax laws can also help you make sure you're claiming every available deduction.

Unfortunately, the tax credit for first-time homebuyers is no longer available. The popular tax credit provided first-time homebuyers with a refundable credit equal to 10% of the purchase price of the home—up to $8,000 for married taxpayers who filed jointly. This credit was created in 2008, but it was phased out in 2010.

If you're preparing to buy your first home, talk to your mortgage banker. There are several federal and state homebuying assistance resources, such as vouchers, grants and down payment assistance programs available. Your mortgage banker can help you determine your eligibility and show you where to apply.

While the costs of owning a home have increased in recent years, there are many opportunities to save money by lowering your taxes. It's important to note that additional tax breaks may be available that aren't covered here. Also, the tax code is always subject to changes that may eliminate, alter or add new deductions and credits.

For these reasons, it's a good idea to consult with a tax specialist who can provide personalized advice. They can help ensure you're claiming every credit and deduction available to you.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.