Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

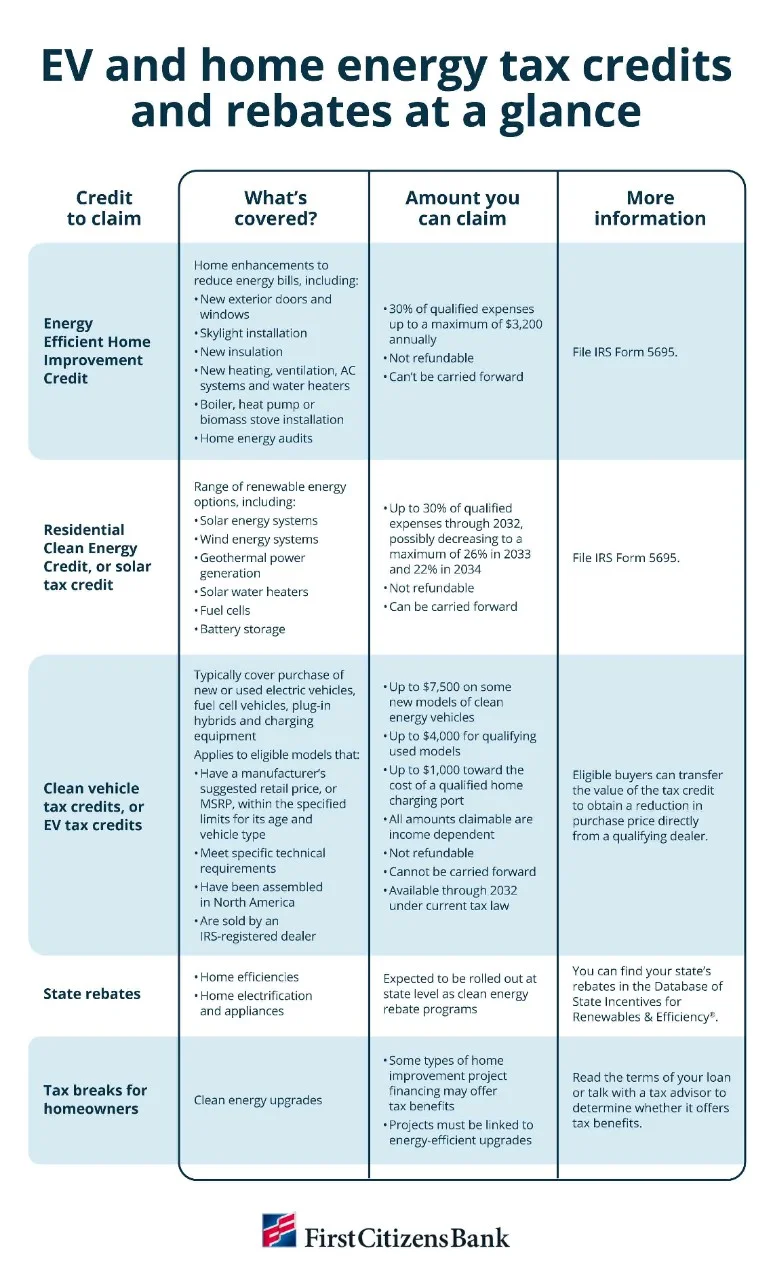

Energy-efficient home improvements and clean energy vehicles can significantly reduce your monthly expenses, but the upfront costs can be steep. The Inflation Reduction Act of 2022, or IRA, introduced three major energy tax credits designed to make these upgrades more affordable.

The IRA includes residential energy credits designed to offset the cost of projects such as installing solar panels, energy-efficient appliances and improved home insulation. Likewise, the electric vehicle, or EV, tax credit can also help improve the affordability of electric and hybrid cars. Here's a breakdown of what's covered by the IRA tax credits and how to claim them.

Upgrading your home with energy-efficient features not only helps reduce your environmental impact but can also qualify you for valuable tax savings.

The Energy Efficient Home Improvement Credit covers a variety of updates to increase home value while reducing your energy bill. These include:

The products you install must meet specific criteria to qualify for the credit. For instance, insulation materials must adhere to the International Energy Conservation Code.

Homeowners who upgrade an existing primary residence can claim 30% of qualified expenses up to a maximum of $3,200 each year. However, the credit is subject to specific dollar limits for different types of improvements. There's no lifetime cap for this tax break.

To claim the Energy Efficient Home Improvement Credit, complete IRS Form 5695 and attach it to your federal tax return. Keep your receipts for qualifying expenses. Under current tax law, you can claim the energy tax credit through the 2032 tax year.

This home energy tax credit is nonrefundable, meaning it won't increase your tax refund. You also can't carry over any unused credit to a future tax year.

If you invest in renewable energy for your home, you may qualify for the Residential Clean Energy Credit. While often referred to as the solar tax credit, it actually applies to a range of renewable energy options, including:

To claim the Residential Clean Energy Credit, your upgrades must meet or exceed stated guidelines. For example, geothermal heat pumps must meet Energy Star® requirements in effect at the time of purchase, and a home backup power battery storage solution must have a capacity of 3 kilowatt hours or greater.

Under current tax law, you can claim up to 30% of qualified expenses through 2032. However, that amount may decrease to a maximum of 26% in 2033 and 22% in 2034. There are no annual or lifetime caps, except for specific limits on some fuel cell technologies.

Homeowners or renters who install renewable energy systems in their primary residence are eligible for the Residential Clean Energy Credit. Upgrades to a second home may qualify if you live there at least part-time and don't rent the home to others.

To claim this credit, complete IRS Form 5695 and attach it to your tax return. Make sure to keep related receipts. The credit must be claimed in the same tax year your upgrade was put into service. This tax credit is nonrefundable. However, you can carry any unused credit to a future tax year.

If you're thinking about buying an alternative fuel vehicle, you may be eligible for a tax credit. Clean vehicle tax credits—also referred to as EV tax credits—typically cover the purchase of new or used electric vehicles, fuel cell vehicles, plug-in hybrids and charging equipment.

The clean vehicle tax credit can only be applied to an eligible model that:

The US Department of Energy offers a complete list of guidelines and eligibility criteria, including income requirements.

Depending on your income, you may qualify for a credit of up to $7,500 on some models of new clean energy vehicles and up to $4,000 for qualifying used models. Additionally, you could receive a credit of up to $1,000 toward the cost of a qualified home charging port. Under current tax law, this credit is available through 2032.

As of 2024, eligible consumers have the option to transfer the value of the tax credit to dealers that meet certain requirements. That means you'll get a reduction in the vehicle's purchase price instead of having to claim the credit on your tax return. Be sure to request a copy of the submitted time-of-sale report, as well as confirmation that the report was accepted.

Note that clean vehicle tax credits are nonrefundable, and you can't carry over excess credit to the following tax year.

Beyond the tax credits covered in this article, there might be other clean energy rebates and tax breaks you may be eligible for.

The clean energy tax credits described above are available at the federal level. However, many state rebate programs are expected to roll out over the coming years. You can track your state's progress and check with local energy departments to see what clean energy rebate programs may be available in your area.

Be sure to research other tax breaks for homeowners. If you're making energy-efficient upgrades to your home, certain types of financing for home improvement projects may offer tax benefits. For example, interest paid on a home equity loan may be tax-deductible if the funds are used to upgrade your home. These tax breaks can help make the cost of clean energy upgrades more manageable.

The president recently put a 90-day hold on the distribution of IRA funds that include energy tax credits. How will that affect those who have recently made, or plan to make, clean energy updates?

Anyone who purchased a qualifying EV or installed a qualifying energy-efficient appliance or solar panels during 2024 should still receive the relevant credit or rebate after filing their 2024 taxes. Anyone planning a clean energy upgrade in 2025 can realistically expect a policy change to take until 2026 to come into effect.

This means, for example, that a solar panel installation made this year has a reasonable prospect of qualifying for credit when 2025 taxes are filed. But the situation is subject to change, and it will be worth monitoring developments closely.

Not only do these energy tax credits help reduce your taxable income, but they also can minimize the cost of purchasing an EV or creating a more energy-efficient home.

However, because tax laws are subject to change, be aware that these IRA tax credits may not be available in the long term. If you're thinking of claiming any of these energy tax credits, it's a good idea to consult with a tax specialist. They can help you determine your eligibility and ensure you're taking advantage of all the tax credits and deductions available to you.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.