OneWest Bank Personal Banking Customers

Learn more about your personal banking transition

Quickly find what you need below

Your Transition to Digital Banking ↓

New Opportunities in Personal Banking ↓

Your transition timeline

Here's a look back at the key dates for your transition.

Welcome package

We mailed a First Citizens welcome package that included all the key things you needed to know and do.

New debit card

If you had a OneWest Bank debit card, we sent you a First Citizens Visa® Debit Card. We also sent you a new PIN in a separate mailing.

OneWest Bank access ended

You could start using your First Citizens Visa Debit Card beginning July 15. Your OneWest Bank debit card stopped working at this time, and access to OneWest Bank ended.

Conversion weekend

OneWest Bank branches closed over the weekend as we transitioned your service to First Citizens. During this time, online and mobile banking were temporarily unavailable.

Transition completed

Your accounts became First Citizens accounts. Online and mobile access became available the morning of July 18.

You can begin to use your new network of more than 550 branches in 19 states.

Get the details about your transition to Digital Banking

Bank from anywhere with your mobile devices

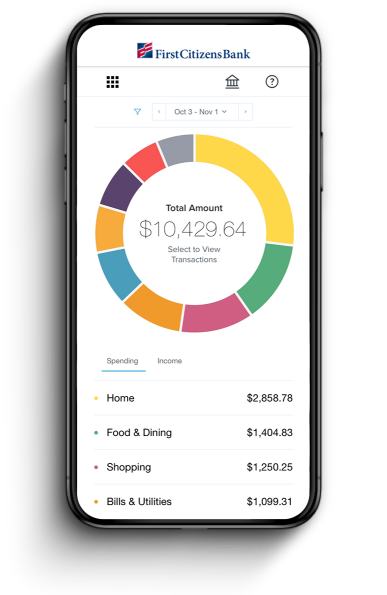

Track your spending habits

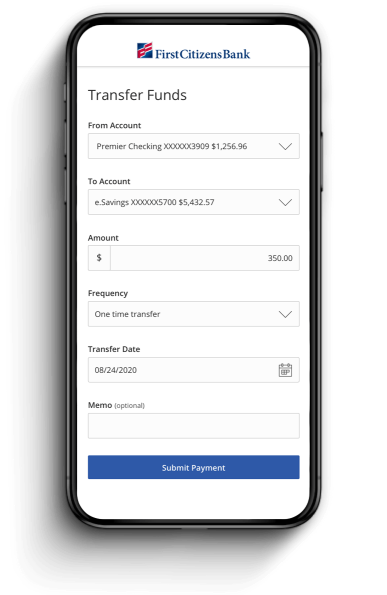

Seamlessly move your money

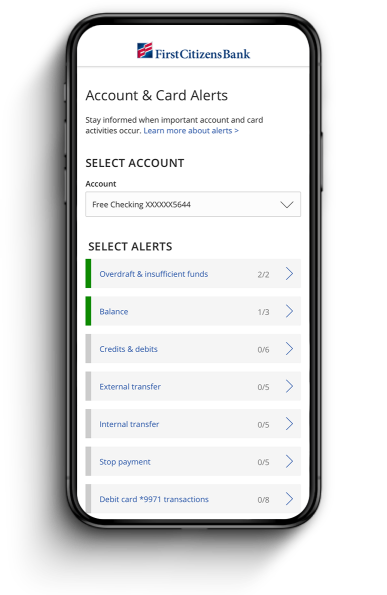

Set alerts for transactions

New opportunities in personal banking

First Citizens can make your banking better—and provide new ways to help you reach major life goals.