Tractor & Trailer Financing

Get your fleet on the road with affordable financing

Custom tractor and trailer financing solutions

Acquire the vehicles your business needs and maintain your cash flow with tractor and trailer financing through First Citizens. We offer both capital leases and terminal rental adjustment clause, or TRAC, tax leases for both tractors and trailers, with custom tailored terms to meet your tax and accounting needs.D

Financing solutions are ideal for small and mid-sized companies with fleets of 10 to 100 units, as well as for distributors and manufacturers.

Tractor & Trailer Financing Solutions

Select the right financing for your business

Try a capital lease/$1 purchase option

Frequently used to acquire an asset for your practice or business, this option allows your business to depreciate the cost of the equipment and expense the interest portion of the payment.

Benefit from a TRAC lease

If you operate a fleet from 10 to 100 units, you can reduce your monthly payments with a TRAC lease. Get up to 100% financing for leases with a guaranteed residual purchase option.

Take advantage of term loans

We offer loan financing up to 100% for new and used vehicles. Typical terms are up to 5 years and can be structured to suit your needs.

Get started easily

Choose the tractor or trailer you want to finance, then select the dealer and negotiate pricing. Once credit approval is received, we'll prepare the closing documents and pay the dealer for your purchase.

Reap the benefits

Up to 100% financing is available with the first and last payments required at closing, along with an administrative fee. Lower lease payments are obtained due in part to vehicle residual values. Our competitive lease rates are frequently lower than commercial finance rates.

Get your fleet moving with tractor and trailer financing

Is it better for you to purchase or lease equipment?

Manage your business on the go

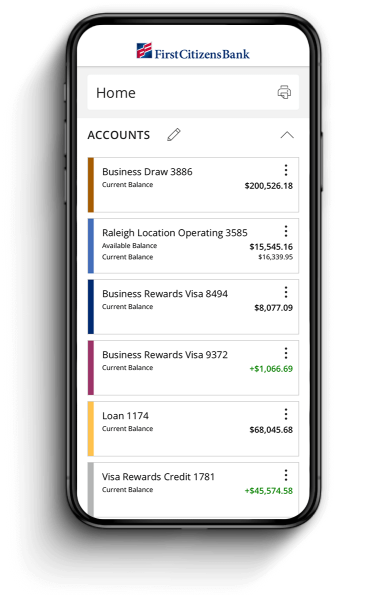

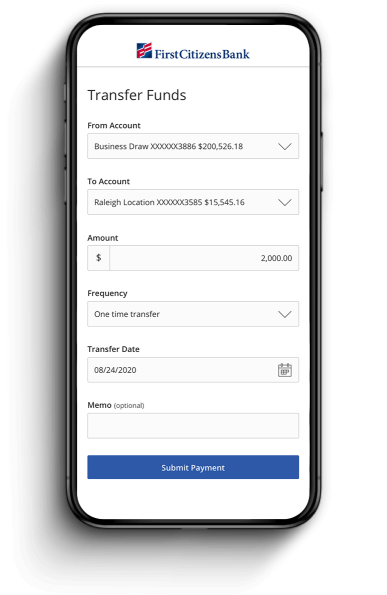

Manage your accounts from anywhere

Send & transfer money with ACH and wires

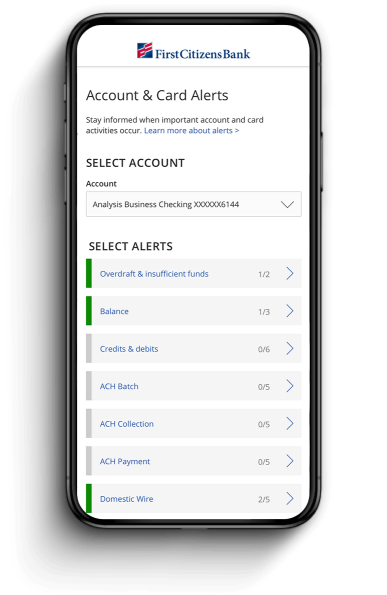

Receive account and security alerts