Selecting and Paying For a Senior Care Community

Retirement planning often focuses on the financial aspects, ensuring you have enough money to support your desired lifestyle after you stop working.

But it's also important to consider what assistance you or your loved ones might need to maintain health and wellness in retirement. Research is essential in order to find the retirement option with the right level of senior care and support.

Options are multiplying

Average life expectancy in the US has been on an upward trend since 1950. In fact, according to US Census Bureau projections, the number of Americans age 65 and over could rise an additional 47% over the next few decades—reaching 82 million by 2050, or 23% of the population.

It's estimated that 7 out of 10 people will require assisted living care during their lifetimes, making it likely that you or a loved one will need some level of extended care later in life.

Fortunately, some major shifts in senior-oriented housing—and assisted-living communities in particular—have occurred over the past few decades.

There's been a dramatic shift in options that are available as it relates to assisted-living settings, says David Schless, president and CEO of the American Seniors Housing Association, or ASHA. In the 1980s, your options might have been limited to a nursing home or living with a loved one, he says. Now, there are many more facilities to choose from, offering different levels of care at varying price points.

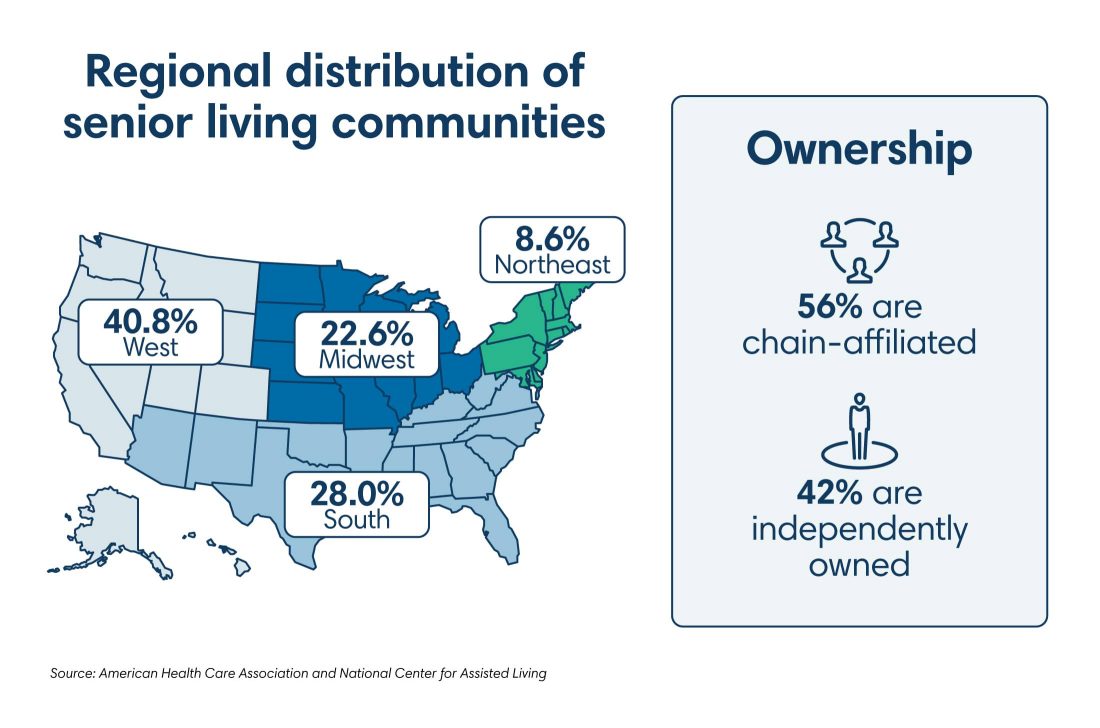

According to data compiled by the American Health Care Association and the National Center for Assisted Living, there are about 30,600 assisted living communities in the US, collectively housing more than 800,000 residents. More than half of these residents are 85 or older, and 70% are women.

Research opportunities

Whether you have an immediate need for assisted-living care or anticipate that it may be required soon, you'll need to do some research to find the right community. This involves finding the appropriate level of support and assistance, and looking for a facility within your or your loved one's budget.

"It's good to begin your senior living research at any time," Schless says. "There's a great benefit to starting early and not waiting until you're in the throes of a crisis."

Senior housing can cover a range of options. There are active-adult neighborhoods—also known as 55+ communities—geared toward people looking to socialize with others their age. These communities often offer various services and amenities, including outdoor maintenance, fitness facilities and social experiences.

Other types of communities offer increasing levels of assisted living for seniors.

- Independent living: These residences—which may be villas, townhomes or apartments—are intended for older adults who mostly live independently but might require or want help with things such as meals, housekeeping or transportation. Higher levels of care might also be available within the same community.

- Assisted living: These communities generally consist of senior-friendly apartments that offer help with general tasks like housekeeping, laundry and grocery shopping, as well as more personal daily activities like bathing, dressing and taking medications.

- Memory care: This living arrangement is for someone living with Alzheimer's disease or another form of dementia. Memory-care communities are secure residential settings with around-the-clock care, a specially trained staff, innovative technologies and interventions, and memory programming and therapies.

- Skilled nursing: Also known as nursing homes, these are the types of facilities many people think of when discussing assisted-living options. They're equipped to handle more serious or long-term medical conditions and frequently offer rehabilitation services like physical, occupational and speech therapies.

- Continuing care: Also known as a life plan community, this option offers residents a continuum of care—from independent living through skilled nursing—in one convenient campus setting. If a resident's needs change, they can shift to a different type of care without moving facilities.

There are some distinctions to be mindful of with these types of communities. Skilled-nursing care provides temporary around-the-clock medical assistance for an injury or illness and requires a medical referral, while nursing homes are residential communities for people who need an ongoing higher level of care than assisted living. Some nursing homes also offer short-term, skilled-nursing care. Residents in skilled-nursing facilities tend to have shorter stays, which average 20 to 38 days.

There are also in-home, assisted-living options you might want to consider. Home health care services—sometimes required after a hospital stay—are a mix of skilled-nursing care and rehabilitation therapies. In addition, hospice care for managing non-curative, life-limiting illnesses frequently takes place at home.

Paying for care

Communal living can offer overall health and wellness benefits, but it can be expensive. The national median rate for assisted-living services is $4,500 per month or $54,000 per year.

The actual rate you'll pay varies by state, community type and level of care needed. Still, depending on your situation, finding a way to pay for an assisted living community will require some planning.

Here are some financing options to consider.

- Private sources of income: Start by looking at your or your loved one's sources of income—such as retirement plans, Social Security, and savings and investments. If you own a home, perhaps you can sell it and use the proceeds to pay for some or all of the costs of assisted living. However, this approach may be complicated if one spouse plans to stay in the home.

- Private insurance: If you have a long-term care insurance policy, it may cover some expenses for assistance with daily activities—although not all policies will cover home-based care. In addition, your private health insurance might pay for some of the medical care needed. Private insurance policies vary widely, so you'll need to check the terms of your specific coverage to see which expenses are eligible.

- Government-sponsored insurance: Medicare and Medicaid might also defray some of the costs. Medicare, for example, may pay for some medically necessary care in a skilled-nursing facility or rehabilitation program. Depending on your income and assets, Medicaid also may pay for some long-term care costs, including daily care services.

- Government assistance: Your state or local government might offer grants or other programs for eligible seniors, but benefits vary from location to location. Veterans and their spouses can explore two programs—the US Department of Veterans Affairs' Aid and Attendance benefits and Housebound allowance—to see if they qualify for benefits to supplement the cost of care in a senior living community.

Starting the process

Several online resources are available—like ASHA's consumer-oriented Where You Live Matters program—to help you research types of communities. When it comes to planning for the financial commitment, your advisor can help you decide which strategies best align with your senior living goals.

Finding and financing an assisted-living community can be a difficult and lengthy process. But with careful planning and consideration, you or your loved one may reap the benefits associated with senior communal living.