Money Market Account

The savings account that helps you earn more, faster

Higher savings are within reach with a money market account

Earn more when you save more with our money market savings account. It's a convenient way to build your savings and reach your goals quicker.

Higher interest rates

Earn anywhere from 0.05% to 0.15% APYDD based on your balance.

Easy access

Get unlimited withdrawals and transfers in person or at First Citizens ATMs.

Banking when you want it

Enjoy free Digital Banking,D bill pay and 24/7 mobile deposits.

Money Market Account Benefits & Pricing

Higher rates and easy access

Earn more

Earn up to 0.15% APYDD depending on your money market account balance.

Forget the fees

Maintain a $1,000 daily balance to avoid a $10 maintenance fee.D

Get started online

Open your money market account online with a minimum deposit of $500.

Get alerts

Securely keep track of your account activity with text and email alerts.

Spot spending trends

Use the Manage My Money trends tool to visualize your spending habits.

Manage wealth

See the full picture by tracking all your accounts, even from other financial institutions.

Instantly move your money wherever you need it

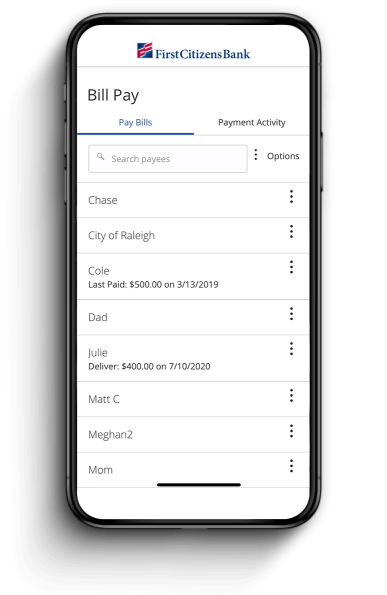

Pay your bills from any device

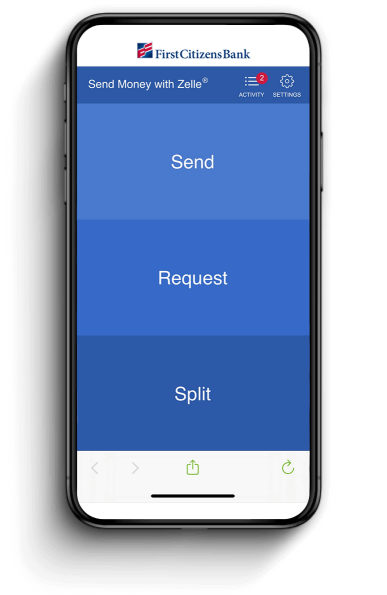

Send money with Zelle®

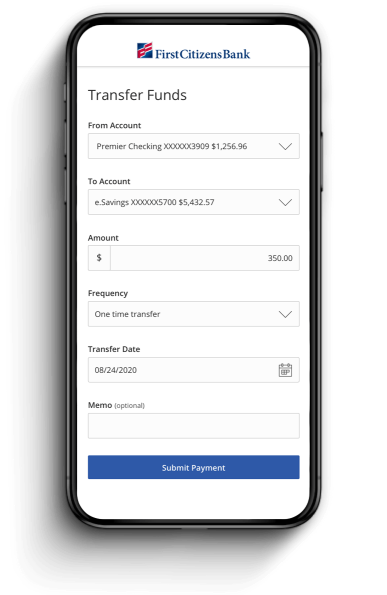

Transfer funds to other accounts

Money Market Account Interest Rates

Balance tiers

Money Market Balance |

APYDD |

|---|---|

$0 to $999 |

0.05% |

$1,000 to $9,999 |

0.05% |

$10,000 to $24,999 |

0.05% |

$25,000 to $49,999 |

0.07% |

$50,000 to $99,999 |

0.07% |

$100,000 to $499,999 |

0.10% |

$500,000+ |

0.15% |

Interest rates for money market savings accounts may vary depending on your area. Contact your local branch for details.

How to get started

It's easy to open a money market account online in just three steps.

Tell us about yourself

To start your application, we'll ask for your personal details such as name, address, email address and Social Security number.

Make your first deposit

Make an initial deposit of $500 or more with your credit or debit card or by transferring funds from an existing First Citizens checking or savings account.

Enroll in Digital Banking

Get online access to your money market account right away when you enroll in Digital Banking.