Your Guide to Professionally Managed Investment Vehicles

Thomas O'Keefe

Managing Director | Capital Management Group

Before the creation of the first open-end mutual fund in 1924, private citizens looking to invest excess capital were limited to directly purchasing stocks and bonds through an exchange. At the time, this presented many challenges, including access, cost, time, lack of information and inability to properly diversify.

Just 5 years later, the stock market crash of 1929 wiped out many of the existing mutual funds but led to foundational legislation—including the creation of the Securities and Exchange Commission, or SEC, and the Investment Company Act of 1940—which would lay the groundwork for future registered investment companies.

Funds enter the scene

From this point forward, fund creation and investment exploded. Mutual fund assets under management jumped from $2 billion in 1950 to $17 billion in 1960. These new funds offered diversified, professionally managed portfolios of stocks and bonds that investors could easily access at a reasonable price.

Today, investment vehicles like open-end mutual funds have grown to more than $22 trillion. The dramatic rise in popularity was fueled by the creation of the traditional IRA and the corporate 401(k) plan in the 1970s and 1980s. Also during this period, the first retail index funds, money market funds and exchange-traded funds, or ETFs, were created.

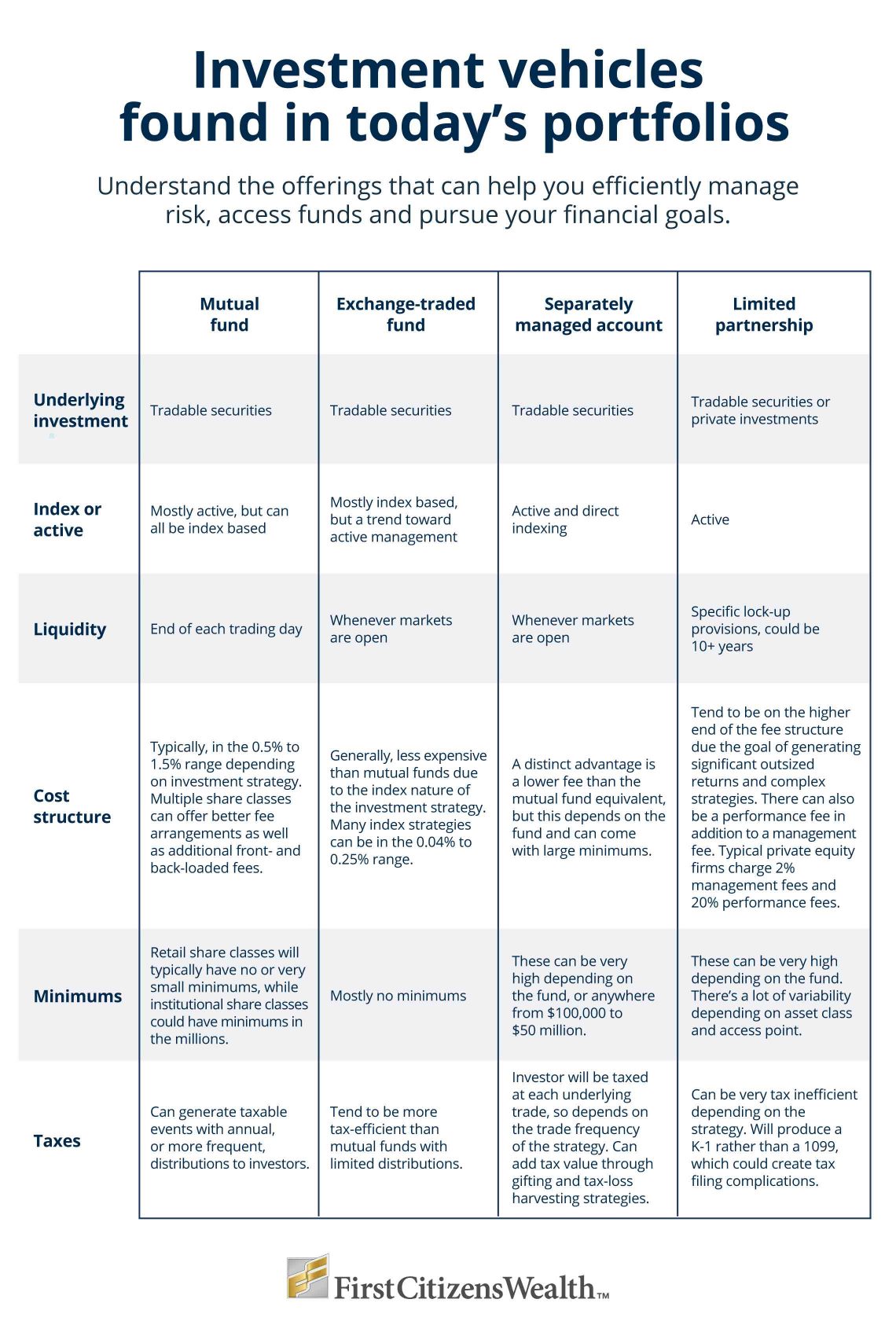

Choosing investment options that meet your needs

For today's investor, it can be challenging to navigate the ever-growing landscape of offerings and industry jargon. Many, if not all, of these vehicles have a place in a well-diversified portfolio, but it's important to have a basic understanding of the vehicles themselves to help you build your portfolio with your investment team. Here are four common investment vehicles and some advantages and disadvantages of each option.

Mutual funds

Mutual funds can either be open-end or closed-end. Open-ended mutual funds dominate the market, so it's important to know how they work.

Mutual funds are investment vehicles that pool money from many investors to invest in a diversified portfolio of assets, such as stocks and bonds. A professional investment manager administers the portfolio to its specific investment philosophy. They're bought and sold at the end of each trading day at the net asset value price, which is calculated after the market closes.

Mutual funds are by far the largest segment of the investment market today and a great way to thoughtfully invest capital. However, it's important to have a keen understanding of the specific fund investment manager and their strategy. Mutual fund pricing is divided into different share classes with a range of fees, expenses and minimum investment requirements, so it's crucial to understand which mutual fund share class you have access to.

Over the past few decades, it has been much harder for active mutual fund managers to outperform the market. With the proliferation of low-cost, index-based ETFs, there has been a distinct shift away from actively managed mutual funds into index ETFs.

Exchange-traded funds

ETFs are a type of investment fund that trades on a stock exchange, similar to individual stocks. ETFs can hold a collection of tradable assets like stocks, bonds or commodities. Their price fluctuates throughout the day as investors buy and sell shares, much like the underlying securities.

Similar to mutual funds, ETFs are administered by a professional investment manager for a fee. The manager will invest the fund's assets based on a specific investment mandate. ETFs gained popularity for their ability to track a designated market index for a low fee and their improved tax efficiency. Another key benefit of ETFs is the ability to trade throughout the day, instead of only at market close. More recently, there has been an increase in ETFs that are actively managed, shifting this business away from mutual funds.

Separately managed accounts

While mutual funds and ETFs are pooled vehicles where an investor buys shares of the vehicle that owns a collection of assets, a separately managed account, or SMA, allows the investor to own the actual underlying assets in their own brokerage account. The investment manager is given trading authority of the account to administer based on the account's investment mandate.

SMAs are often only available to institutional and high-net-worth investors at very high minimums, but their costs can sometimes be lower than their mutual fund counterparts. Other benefits include client customization, gifting of appreciated securities and transition management. Bond funds can be particularly attractive for clients looking to achieve a specific exposure or outcome.

An increasingly popular alternative to the index ETF is direct indexing. This is where a manager buys the securities that directly comprise an index. The manager is essentially building a portfolio of securities that replicates the benchmark in a more flexible vehicle. This approach also provides a foundation for tax-loss harvesting.

Limited partnerships

A limited partnership investment structure is often used for hedge funds and other private investments like venture capital and real estate. The general partner manages the fund investments and raises capital from limited partners to pool toward those investments.

These vehicles are regulated differently from traditional mutual funds and ETFs and are aimed at institutional and high-net-worth investors only. There are two main types of funds: evergreen and drawdown.

An evergreen fund will take the entire investment amount upon subscription and continue to manage it until investors decide to redeem the fund or the fund returns capital.

A drawdown fund will acquire commitments from investors and ask for that capital over a period of several years when needed for a new investment. Capital will be returned to investors when the investment is realized. The primary benefit of this structure is to allow for investments in private or complex securities for extended periods of time with the goal of outsized returns.

Access to these nontraditional markets comes with a long list of challenges, including minimums, fees, taxes, access and risk. We recommend consulting with your team of financial professionals to navigate these types of investments.

The bottom line

Investment options have come a long way since the first mutual funds were introduced back in 1924. Now it's easier than ever for investors to build portfolios that fit their needs, such as risk tolerance, liquidity preferences and financial goals. Investment vehicles like mutual funds, ETFs, separately managed accounts and limited partnerships continue to expand, bringing more robust access at lower costs.

First Citizens has a team of dedicated and experienced investment professionals to help get you up to speed on the options that align with your financial goals and objectives. To learn more about building a more effective investment portfolio, speak to a First Citizens Wealth consultant today.