Securing Funding to Start a Business

Launching a small business is an incredibly rewarding experience—one that comes with its own unique set of challenges. Perhaps unsurprisingly, obtaining funding to start a business is the biggest hurdle most entrepreneurs face, according to a survey by the US Chamber of Commerce.

Fortunately, there's good news if you're wondering how to get business funding: There are multiple options for financing a business, each with its own pros and cons. From identifying the right source of funding to navigating the application process, here's everything you need to know about funding to start a business.

Bootstrapping versus outside funding

One of the first decisions to make when starting a small business is whether you want to seek outside funding, use your own money—also called bootstrapping—or pursue a mix of the two. What you decide ultimately comes down to a matter of tradeoffs, and there are several to consider.

Control versus access to support

- Bootstrapping can allow you to retain control over significant decisions and avoid seeking buy-in from investors or other financial stakeholders.

- Funding your business on your own might come at the cost of limited or no access to the seasoned expertise of investors.

Increased equity versus financial risk

- Avoiding dilution of your personal equity is another significant benefit of bootstrapping.

- While all types of funding carry some degree of personal liability, self-funding your business might create a financial burden, particularly if you're exhausting your personal savings or tapping into your 401(k) through a rollover for business startups transaction. Plus, a recent survey by Pilot found that entrepreneurs who bootstrapped their businesses typically collect significantly lower salaries compared to their venture capital-backed counterparts.

Debt avoidance versus missed growth opportunities

- You can avoid debt and interest payments if you're funding your business with cash.

- Depending on how much you're willing and able to invest, self-funding may inhibit your ability to scale your business as quickly as you'd like. Investor funding, on the other hand, may provide you with the capital necessary to steer you toward grander ambitions.

Options for financing a business

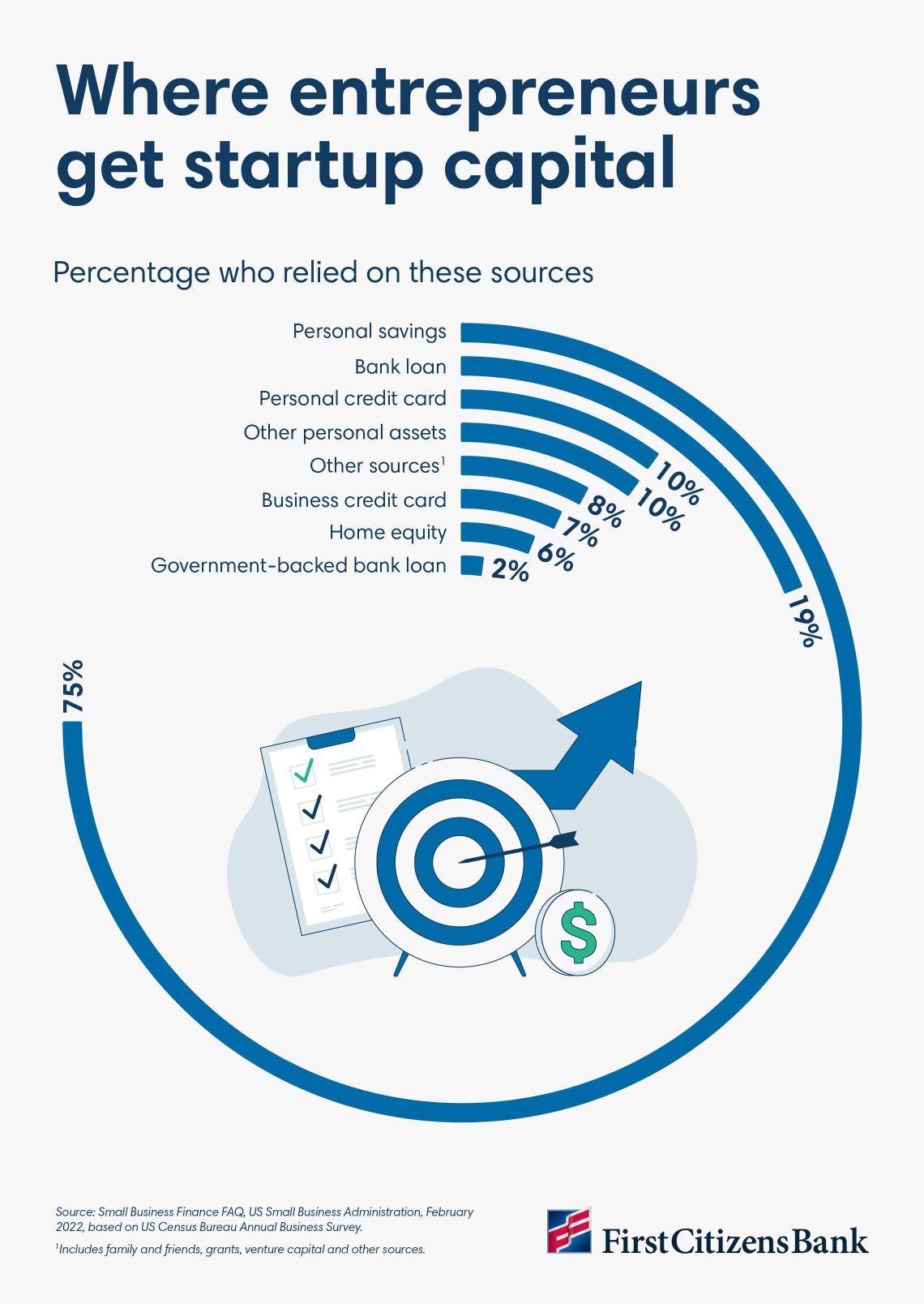

If you decide to engage others for startup capital, the next step is to explore possible sources. Some of the most common outlets include crowdfunding, professional investors and bank financing.

Crowdfunding

Crowdfunding is a recent term for an age-old practice—asking friends, family and others in your network for funding to start your business. Some crowdfunding initiatives might cast a wider net, using online platforms to ask the general public to contribute.

There are a few drawbacks to this fundraising method. For one, it relies on contributions from people who aren't professional or institutional investors so you'll miss out on this insight. You also might find it difficult to meet funding goals or feel uncomfortable asking friends and family for money.

Online platforms may help avoid this risk, but each one has its own set of rules around the type of fundraising it allows and the terms for contributions.

Venture capital or angel funding

Seeking funding from venture capital, or VC, firms and angel investors—typically wealthy, experienced individuals—in return for a percentage ownership stake in the business is a popular option for entrepreneurs who require a significant amount of startup capital. Not only can VC or angel funding be appropriate if you have aggressive plans to scale your business, but investors with the right expertise may also help open doors and introduce you to potential mentors or customers.

The drawbacks, though, are worth taking seriously. Professional investors are likely to want significant equity in the company, which means diluting your ownership. Investors may also have ideas of their own, which could potentially impact your business's fundamental identity and mission.

If you consider going this route, evaluate the tradeoff between capital infusion and loss of control. Conduct due diligence on investors, scrutinize their track record and seek legal guidance to help ensure you're making an informed decision.

Startup business loans

Under the umbrella of startup business loans, there are several options for financing a business.

- SBA loans: Loans offered by the US Small Business Administration, or SBA, are typically issued by a bank and partially guaranteed by the federal government. Because the government will cover part of the debt if the business fails, banks are more likely to lend to new business owners through the SBA program. There are several types of SBA loans available, with 7(a) loans a popular option among early-stage small businesses.

- Business lines of credit: A line of credit is another popular option for funding a business. Similar to a credit card, a small business line of credit allows you to borrow up to a certain limit, repay the loan and tap into your available credit again. Small business lines of credit may come with higher interest rates than term loans, which makes them more ideal for small, short-term financing needs.

- Term loans: These types of loans provide a large lump sum and are typically used for major purchases, like an expensive piece of machinery or fleet of vehicles. A small business term loan may allow you to buy what you need now and pay it off over time. Because term loans tend to have more favorable rates and higher borrowing limits than business lines of credit, they usually have more stringent approval criteria.

How to apply for business funding

Once you've considered which types of funding are best suited for your goals, it's time to lay the groundwork for your loan application or investor pitch.

Anyone injecting capital into your business—especially investors and banks—will want to see a comprehensive business plan. It should clearly outline your plans for the next 3 to 5 years and share insights about your customers, competition and industry. This is the primary way for you to share your strategic vision with potential investors.

What documents do I need?

If you're applying for loan through a bank, you may need to provide additional documentation. The US Chamber of Commerce recommends having the following documents:

- Bank statements: These will provide prospective lenders with an overview of your company's finances, including deposits, withdrawals and cash balances.

- Income statement: Also known as a profit-and-loss statement, this shows your business's revenues and expenses, highlighting its gains or losses over a specific period.

- Budget: Your budget can help forecast expected income and break down how your company plans to spend the money. A budget that shows wise spending habits and robust earnings will likely attract lenders.

- Income tax returns: Lenders will want to see your tax returns to verify the income you report on your other financial statements. They can offer insight into your business's debt-to-income ratio, or DTI—which is your monthly debts divided by your gross income—as well as your debt service coverage ratio, or DSCR—which is your organization's cash flow divided by its debt payments. Lenders will have their own criteria, but many may hesitate to offer financing for businesses with a DTI higher than 43% and a DSCR lower than 1.2.

- Credit reports: Banks will want to see your business's—and in some cases your personal—credit report to get a sense of how much debt you carry and whether you've recently declared bankruptcy. For this reason, it's important to build a strong credit history and take steps to improve your credit score.

Seek a business banking partner

Once you have these documents in hand, it's time to research potential banks. Think of the bank you choose as a business partner. You're working together to shepherd your business to greater profitability and growth.

With your completed business plan, you can present your business with clarity and professionalism. In turn, you can ask banks what they'll offer your business in terms of industry-specific expertise to address common hurdles and concerns.

If you still have questions about how to get business funding, talk with a banker. They can guide you through your funding options and offer the financial expertise needed to ensure your small business will thrive for years to come.