What to Consider if You Want to Relocate in Retirement

Many people dream of relocating after retirement to be closer to family or a cherished vacation spot. But as with other dreams, achieving this goal requires foresight and planning that starts with your finances and leads to other considerations in your life.

What are the tax implications of a move? How long do you plan to live in the home? How should future healthcare costs impact your decision?

To provide essential tips for addressing these considerations and more, we sought the advice of Jamie Nesbit, a Pinehurst, NC-based Mortgage Banker at First Citizens Bank.

Sort out your funding

When you consider relocating after retirement, your thoughts may be about purchasing a different home.

"As soon as that comes up, you have questions about qualifying for a mortgage while drawing off Social Security, pensions or qualified retirement plans," says Nesbit. But just because you don't have a job with a regular paycheck doesn't mean you can't qualify for a mortgage if you need one.

"In a retirement scenario, we can count assets to establish income capability. You might not think you qualify, but after you draw me a picture that shows, say, $2 million in liquid assets, I have options where we could count $166,000 of annual income—and suddenly you do qualify."

After you qualify, your next consideration will be selecting the mortgage that best suits your financial circumstances. That choice comes down to two primary factors—the interest rate and terms—and the secondary consideration of who'll provide the mortgage.

The two most common types of mortgages are an adjustable-rate mortgage and a fixed-rate mortgage. Each option offers its own potential financial benefits depending on your unique situation. So, Nesbit stresses having an open, ongoing conversation about finances with your mortgage banker and other financial advisors.

Factor in additional costs and considerations

In addition to mortgages, there are other considerations related to relocating after retirement. And the tighter your budget is, the more planning you'll need to make sure each one lines up to provide a holistic view of what a move will cost you in time and money. To accomplish this, Nesbit points to three main areas:

1 Location

Taxes, transfer fees, closing costs, insurance—all of these fluctuate from state to state and region to region. If you're moving to be near family, your location may be set, so there's not a lot of comparison shopping to be done. But if your move after retirement is primarily focused on finding a nice piece of beach property and you're choosing between states, you'll need to get more specific with your choice of location to stick to your budget.

"Somewhere like Florida or Texas doesn't have an income tax, but they have higher property taxes," says Nesbit. "North Carolina does have an income tax, but most of the time you don't have to pay things like a transfer tax on the title because the seller covers that. And if you're set on a beachfront property in those or any other states, you'll need to talk to insurance agents about rates for each potential location because that's a scenario where something like flood insurance can get expensive—and if you just want to be near the water, somewhere along a lake might be just as great with cheaper insurance."

2 Duration

When you relocate after retirement, how long is as important as the more obvious where and why. You may be moving to be closer to your children and grandkids. But if your destination is far from family or medical care, you may need to consider whether you'll need to relocate again as you get older. Working this out ahead of time is important, even if it's a tentative time frame.

"The first thing to ask before you even consider a general location or specific property is what you're trying to accomplish with the move and how long you expect you'll be there," says Nesbit. "If your answer is 'A couple years' versus 'I'm not going anywhere else,' you'll really want to sit down with a professional to see where you are financially. A single move is expensive enough, but multiple moves can really deplete your assets." It's important to try and forecast possible needs 3 to 5 years into the future.

3 Health

Whether you relocate in retirement or stay put, the state of your health should be a top concern. Questions about the proximity of support networks like family and the accessibility of quality healthcare facilities are important. But if you make a move after retirement, there are equally relevant, if less obvious, points to consider.

"If your knees already aren't that great before you start searching for the beachfront retirement house of your dreams, are you sure you want to buy a two-story that you plan on living in for the rest of your life?" asks Nesbit. "And if your family only lives an hour away and won't be staying overnight, how many square feet do you really need or will you have the energy to clean? After your fourth hurricane of emptying everything out of the beach house and putting it in again, how is your back going to feel? It might not seem like it at first, but these are all health considerations."

Buying isn't your only option

With interest rates and home prices up from a few years ago, you may decide to stay in your current home, where your rate is much lower—if you even still have a mortgage at all.

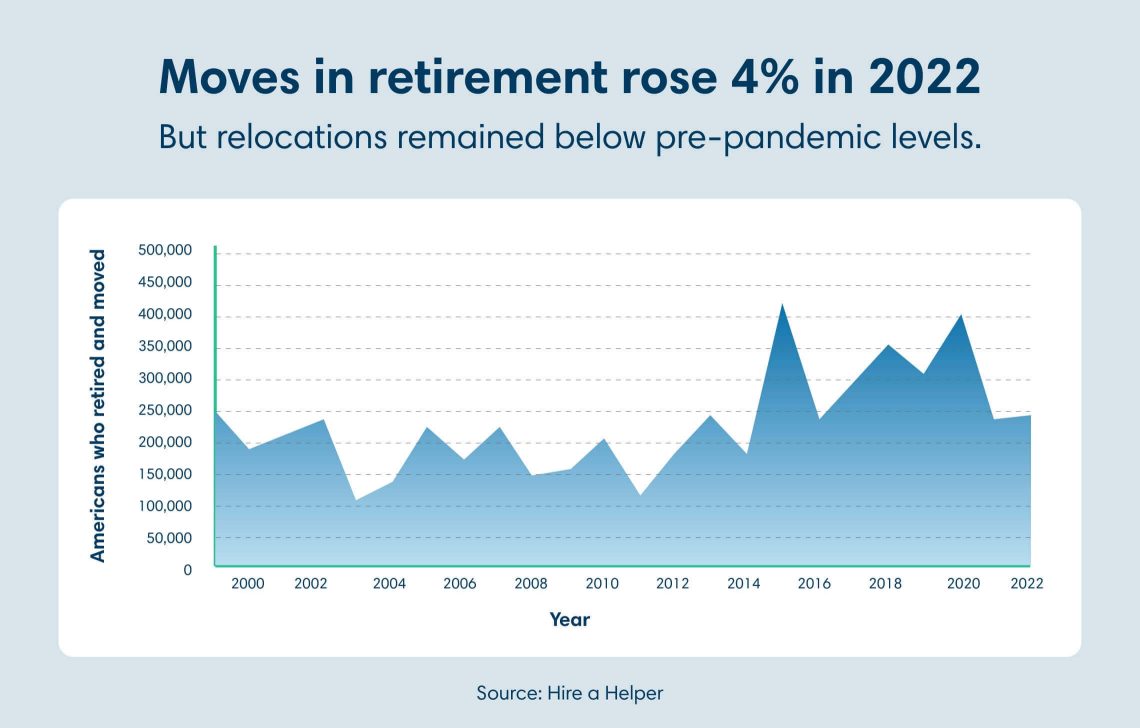

Possibly influenced by rising interest rates, statistics from moving company Hire a Helper show that the number of moving retirees rose 4% in 2022 to a little less than 250,000. But they remained below pre-pandemic levels, where they spiked at more than 400,000 in 2015.

There are other options beyond just buying a home, Nesbit says. "More retirees are just finding a piece of property and taking out construction loans." Building your own home avoids inventory shortfalls while also potentially helping you avoid paying $750,000 for a property that was listed at $500,000 a year-and-a-half prior. Building costs have increased as well, but building a home allows you to focus on what meets your family's needs.

"Another tip for everyone looking to relocate in retirement is to consider renting," says Nesbit. "A seasonal rental can be more affordable than a purchase, especially if you're not in for a long duration." Renting for 6 months to become more familiar with the area could help to save you from paying multiple transaction fees involved with purchasing a home.

As for what to do with your current residence—should you choose to build or purchase—Nesbit has advice: be careful with renting it out. "Tax laws often change and switching a home from a private residence to a rental can complicate your tax situation, so you need to check with a qualified tax professional to avoid any surprises. Secondly, on an emotional level, it's not always easy to take a home you built memories in and made cute over the last 20 years and turn it into a rental—especially when your tenants call about a broken air conditioner in the middle of the night."

Be open to conversations—and your options

Most of these factors can be simplified into two main tips: talk to your mortgage banker and financial advisor, and have enough patience to keep your options open.

The destination you'd like to move to isn't going anywhere. Yes—a particular home or property might go off the market before you can rent, purchase or build. However, you don't want to jump into a major life decision just because you're in a hurry to own a home beside your favorite golf course.

Says Nesbit, "At the end of the day, my job is helping to put people in the right place. And if you're ready to relocate in retirement, all it takes to get started is a conversation."

Run the numbers

Use our calculator to see how an adjustable-rate mortgage would work for you.