The fundamentals of self-directed investing

In the age of smartphones, the ease and affordability of self-directed investing is greater now than ever. But even as tools like direct-investing apps and robo-advisors have become increasingly popular, many investors are realizing that doing it yourself is as much of a responsibility as an opportunity.

We've sought helpful tips from two First Citizens Investor Services experts—President David Biliter and Senior Vice President Patrick Lane—to help provide the fundamentals that will benefit DIY investors' chances for long-term success and help them avoid common investment mistakes.

An education in discipline

Downloading investing apps may be straightforward and there are many choices these days, but building a successful approach to self-directed investing isn't so simple. "Investing is an education in discipline, and the first lesson you have to learn is how to combat greed and fear," Lane says.

Less experienced investors can easily make mistakes like chasing trends, following hot stock tips, buying in at the top of the market and selling off at the bottom. Even the best tools and technical analysis will mean little if investors can't avoid these emotion-driven actions.

This key insight has allowed generations of professionals to lay the groundwork for financial plans that have consistently safeguarded customers' investments across every income bracket. Even if you're investing on your own, it may be wise to emulate this approach.

How to build a self-directed investing plan

Just like the strategies designed by investment professionals, the long-term success of your portfolio depends on laying the foundations of a plan that can withstand impulse decisions. To accomplish this, Biliter and Lane highlight some considerations that should be your starting point for building an emotionally shock-resistant self-directed investing plan.

1Set goals

The more well-defined your investment goals are, the easier it will be to craft a strategy you can stick to when emotions run high and markets fluctuate. Whether socking away for a dream vacation or building up savings for your retirement, the more details you can provide, the more you can fine tune your plan.

Is your vacation for a week or a month? Are you using self-directed investing to cover inevitable healthcare costs in retirement or to buy a boat before then? These specifics are crucial to crafting the parameters around other considerations that follow. If you have multiple goals, you may need to set different investing strategies for each.

"Self-directed investing is a great way to take maybe 5% to 10% of your wealth and embark on your own decision-making, but to make the most of it you have to get detailed with your goals," Biliter says. "The specifics of your aims dictate every other aspect of your approach."

2Create a timeline

Without a solid timeline, emotion will likely creep into your decision-making even if you have a detailed goal. You need to determine a realistic time frame for how long you have to achieve a goal, as well as how often and how much you'll need to invest to accomplish each goal.

"The types of rules a more mature investor is going to set for growing their grandkids' college fund won't be the same as a younger person who may need to hit the target of buying a home in 8 years," Biliter says. Aligning goals with age and stage of life ensures you focus on time in the market instead of attempting to time the market.

Building a strategy pegged to a certain age or date will enable you to combat impulse decisions. To avoid this fate, Biliter has one straightforward piece of advice for every self-directed investor. "Once you've set a timeline for your goal, invest as early and often as possible to ensure you achieve it," he says.

3Assess risk tolerance and dollar amount

Time and money go hand in hand. Once you have an idea of the former, you'll need to address the latter. The dollars-and-cents figures that lead to successful self-directed investing aren't how much you could gain, but how much you're willing to spend and how much you're prepared to lose. A clear assessment of these factors will provide you with your level of risk tolerance—and this alone will define your plan's rules in a way that allows you to stick to them through up and down markets.

"The most important step to figuring out your risk tolerance is asking what the money is for," Lane says. "If you've got the mortgage and retirement squared away and the money you're investing is to buy something like a vintage car, you'll be willing to risk more than if it's for building up your kid's college fund."

Your risk tolerance doesn't just dictate how much you're willing to invest but also where and how you're willing to invest it, Lane says. Funding a spur-of-the-moment vacation might mean you're more willing to roll the dice on a medium-sized investment in one or two particular stocks. Creating savings for day-to-day costs in retirement might lead to a significant investment in a more stable bond or exchange traded fund, or ETF. But it's also important to remember that all investments carry some risk.

4Establish rules

With a clear understanding of your goals, timeline and level of risk exposure, you now have the information necessary to craft well-defined rules that will check your emotions and secure your investments.

"Start by writing down decision rules around things like what information you must have to buy and sell," Lane says. "These are going to be dictated by the three previous factors, but the important thing is to have these rules and to define them as clearly as possible."

"There's so much noise out there, and in my experience the only way to cut through it is to stick to your rules," Biliter adds. "For instance, I sell when it goes up 20% and I also dump it when it goes down 10%. Everybody will have a different set, of course, but their rules need to be clear and easy to follow."

Ways to benefit from self-directed investing

With solid foundations of a plan, you'll have a stable point to begin looking into the different tools and technical methods for investing. While there's no one-size-fits-all approach, Biliter and Lane offer a handful of guidelines to help get more from your self-directed endeavors.

Keep it simple

The internet is filled with videos and articles on how and where to invest. Deciding where to start and what information is relevant to your plan can be confusing. Whatever sources you choose to go with, keep your approach simple.

"Find a few trusted sources, and make your focus narrow," Lane says. Whenever you come across a source, be sure you understand what their motivations are. Are they really trying to educate you, or do they have some connection to what they're promoting? This is a great first step to filtering the noise.

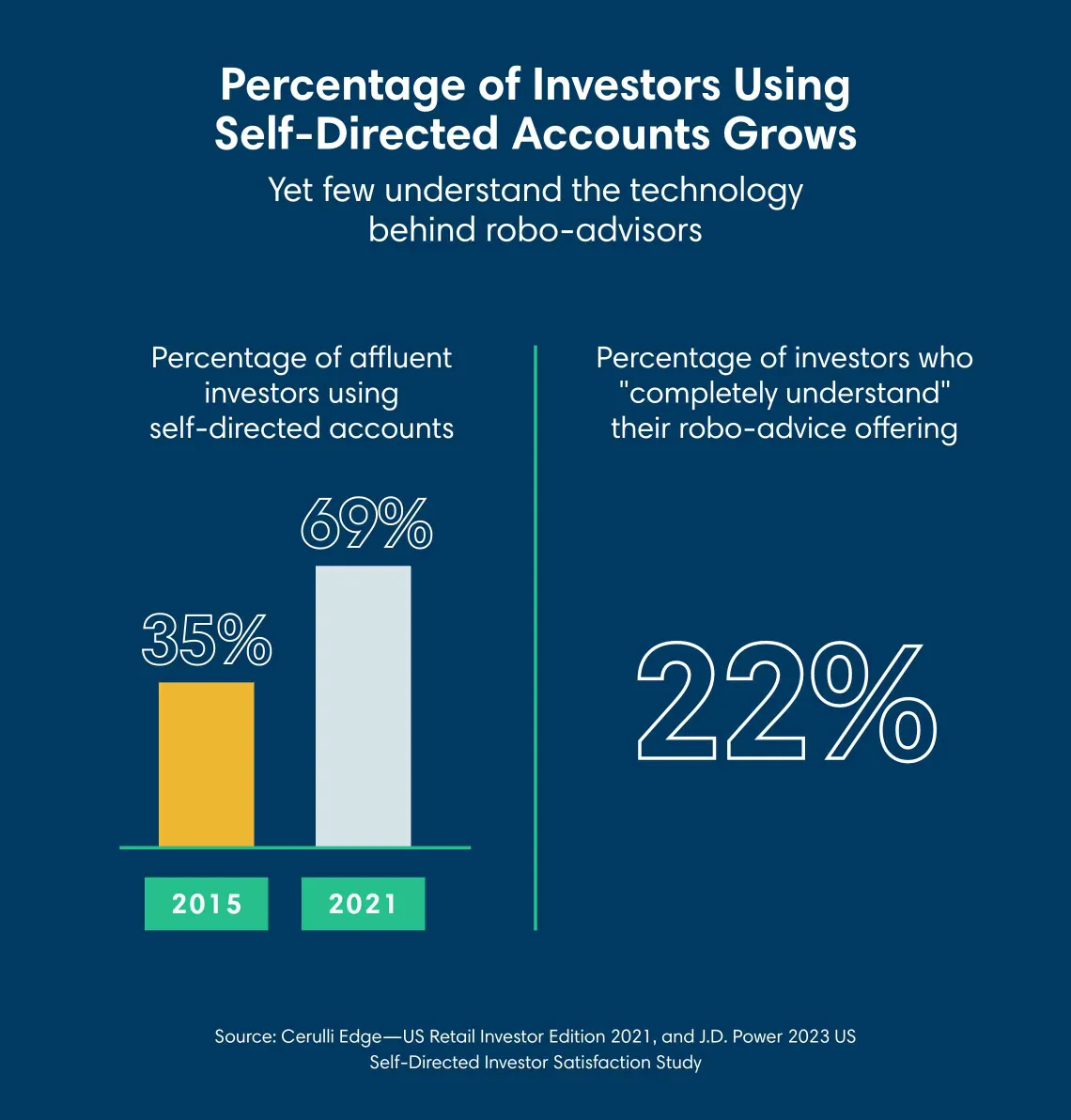

Research shows that few investors understand the technology behind robo-advisors, even though the percentage of investors using self-directed accounts is growing. The percentage of affluent investors using self-directed accounts rose from 35% in 2015 to 69% in 2021, according to the US Retail Investor Edition from Cerulli Associates, a financial industry consultant. According to JD Power's 2023 Self-Directed Investor Satisfaction Study, only 22% of investors say they completely understand their robo-advice offering.

Treat investing as an educational opportunity

No method of investing comes with guaranteed financial returns. From a learning standpoint, however, people who put in the effort with a self-directed approach will receive an education in investing.

"Very little in our mainstream education process is focused on teaching us how to manage the money our jobs create," Biliter says. "With self-directed investing, I think the opportunity to learn is there, not only for adults using those apps but also for their children and grandchildren."

Choose methods and services that fit your schedule

Your personal circumstances mainly determine the strategies and tools you select for your investing plan. When choosing them, one of the top criteria is the time you have in your schedule to pursue self-directed investing.

Your daily schedule and investment plan may suit regular stock trading, or a set-it-and-forget-it strategy involving ETFs or target-date funds may align better with your goals and work-life demands. Remember, self-directed investments don't just involve your money. They also require your time. If you're not quite sure which digital tool fits best, robo-advisors are a simple starting point. You can learn the fundamentals, make easy adjustments and let the technology rebalance your portfolio without you needing to be an investing expert.

"If you don't have or can't invest the time, robo-advisors are a great way to check if something is a good portfolio that will work for you, while also charging a maintenance fee that eliminates exit penalties if you want to switch to something like an app or traditional advisor," Lane says. "They're reasonably priced, you can manage and automate deposits and contributions in a way that fits your schedule, and some subscriptions even come with access to financial professionals who can lend support."

Achieve balance with your money

No matter what your investment plan and portfolio look like, self-directed investing is likely only one portion of your overall finances. You'll need to understand how it fits in with your budget, savings and other investments like retirement plans to build your approach and adjust it as your finances and circumstances change.

"From a discipline standpoint, ensuring you've got a holistic view of your finances is essential—you don't want to operate in isolation," Biliter says. Striking a balance is important not only for your current finances but also for your future. "Knowing how another piece of your finances—like your 401(k)—fits with your investments matters because when that retirement plan becomes an income stream later in life, you'll need to adjust your self-directed plan to grow with things like projected life expectancy, healthcare costs and your housing situation."

The bottom line

Following these guidelines may help you more accurately navigate the world of self-directed investing, regardless of the digital investing tool, approach or trusted sources you choose. If you find it difficult at times to keep your emotions in check, maintain your education, align your schedule or balance your allocations, talk with a trusted professional.

"Correlating every aspect can be hard to do on your own," Lane says." But if you get the basics down and still need a bit more guidance, a professional can help."

Apply for an easy-to-open First Citizens account today.