Mortgage Refinance Guide

Whether you're searching for a lower monthly payment, new loan terms or access to the equity in your home, you're probably trying to decide if now is a good time to refinance your mortgage. The answer to that question depends on several factors.

If you're considering a mortgage refinance, carefully evaluate the benefits alongside costs and other considerations to determine if refinancing will be beneficial for you.

The benefits of mortgage refinancing

If you're like many people researching the pros and cons of mortgage refinancing, lowering mortgage payments motivates you. However, there are other significant benefits of mortgage refinancing to consider.

Switching to a fixed interest rate

If you have an adjustable-rate mortgage, or ARM, you may be interested in switching to a fixed-rate mortgage. By definition, the interest rate for an ARM will fluctuate. At some point, homeowners may choose to refinance to lock in a consistent rate.

Paying off a mortgage faster to save on interest

Another option is to pursue mortgage refinancing to reduce the term of your loan. For instance, if your current mortgage has a conventional term of 30 years, refinancing into a 15-year mortgage makes it possible to pay off your loan faster and potentially save thousands of dollars in interest payments.

Discover repayment savings with the accelerated mortgage calculator

Use our accelerated mortgage repayment calculator to see how a shorter-term mortgage possibly helps you save.

In some situations, making extra payments on your current mortgage instead of refinancing could save you more. Consult with a financial advisor to identify the right strategy for you.

Leveraging any home equity

Equity is the current value of your home minus the balance of what you owe to any lenders. Borrowing against this equity is commonly referred to as a cash-out mortgage refinance, and many people use the extra money to meet goals such as funding home improvements, starting a business or paying for college.

When does it make sense to refinance?

One of the primary factors driving the decision to refinance is the interest rate. Some people choose to purchase a home at a higher interest rate with the plan of refinancing their mortgage once rates fall. This concept is often referred to as marry the house, date the rate.

Your home is a long-term investment, but buying a home when the interest rates are higher than you'd like doesn't have to mean you'll be locked into that rate for 30 years. When it comes to interest rates, what goes up typically does come down, and that's when a mortgage refinance is a good idea.

In other words, making a higher monthly payment in the shorter term is sensible, knowing you're able to refinance your mortgage once interest rates decline.

However, if the interest rate for a potential mortgage refinance is higher than your current rate, you have to decide if now is the right time to refinance. While extending the loan term to maintain or lower your monthly payments is an option, this strategy could increase the amount of interest you'll pay over the life of the loan.

Is there ever a reason to pursue a mortgage refinance that costs more? The simple answer is that most people avoid this scenario unless they need or want access to cash and other options, like a home equity loan.

How to decide if refinancing is right for you

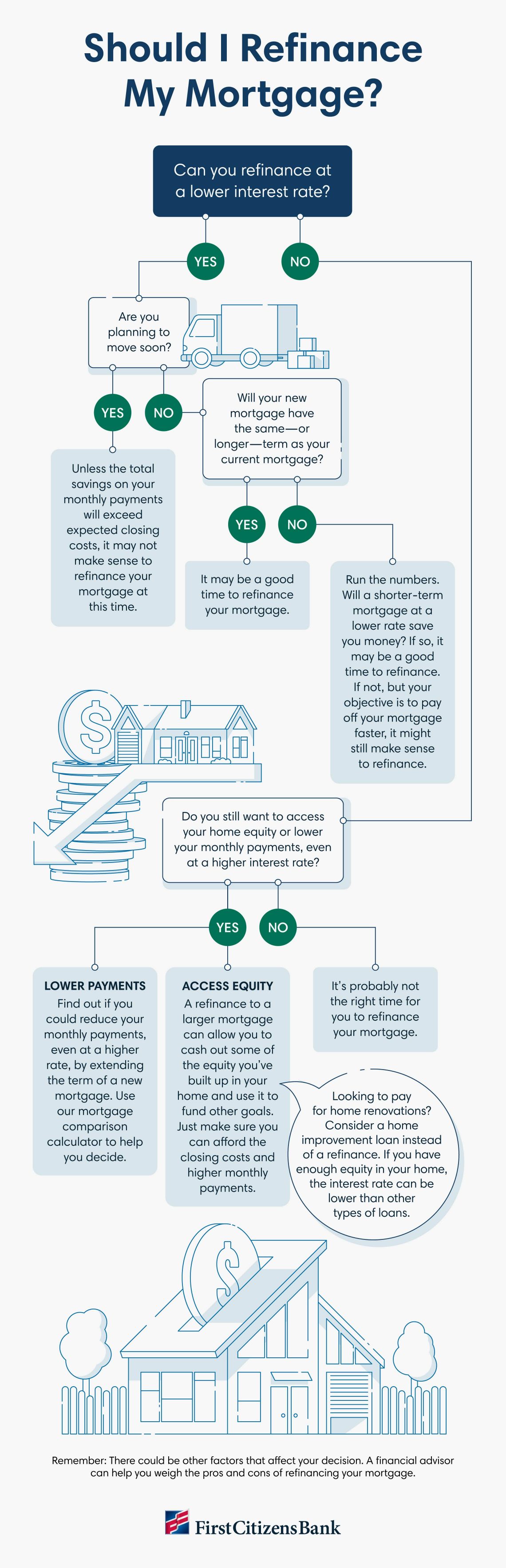

When it comes to deciding when to refinance your home, it's helpful to consider the following questions.

- Have interest rates dropped significantly since you got your current mortgage?

- How long do you plan to stay in your home?

- Do you want to change the loan terms of your existing mortgage?

- Would you like to access your home equity for a large expense?

- Will the benefits of refinancing outweigh the costs?

Once you've considered these questions, follow the logic in the flowchart below to help you determine if now is a good time for you to refinance your mortgage. Be sure to have your current mortgage terms handy and refer to them as you answer the questions. This is key to determining what changes would be most beneficial.

Costs to refinance a mortgage

As you decide whether to refinance your mortgage, consider the impact of closing costs. When you refinance your home, expect to pay roughly the same fees you paid when you took out your original loan.

The size of your loan and the state and county where you live impact how much you pay. However, all-in costs often total between 3% and 6% of the loan amount.

Fees associated with mortgage refinancing include:

- Loan origination fees

- Government recording costs

- Appraisal fees

- Credit report fees

- Origination fees

- Services

- Tax service fees

- Survey fees

- Attorney fees

Use the mortgage refinance calculator

Use our mortgage refinance calculator to compare the total costs for a new loan versus your current mortgage.

Review your current mortgage terms

As you evaluate the costs associated with refinancing your mortgage, don't forget to take a look at the terms of your current mortgage. Read through them thoroughly so you understand any potential penalties or other unexpected fees you find.

For example, some mortgages have early prepayment penalties. If that's the case, additional prepayment fees are possible, since you're paying off your mortgage early with the refinancing. That's an extra cost you'll need to consider in your overall calculations.

How does refinancing work?

Because you've applied for and received a home loan before, refinancing your mortgage will likely be familiar, with a few minor distinctions. We've broken the mortgage refinance process into 10 steps.

Calculate your equity

Before you begin the mortgage application process, determine how much equity—the difference between your home's market value and your mortgage balance—you have in your home. When calculating how much equity you have in your home, be sure to include any other debts against your home, such as a home equity loan or line of credit. To qualify for the best terms and options when refinancing your mortgage, you typically need to have a minimum of 20% equity in your home.

Check your credit score

One of the primary factors that determines your interest rate for the new mortgage is your credit score. If your credit score is less than perfect, a higher interest rate is possible. While criteria varies between mortgage lenders, credit scores above 700 typically qualify for more competitive rates.

Find the right loan option

As you shop for mortgages, choose which type of loan is right for you. our options include fixed-rate mortgages, adjustable-rate mortgages, and government-backed alternatives like Federal House Administration, or FHA, and Veterans Administration, or VA, loans.

Choose your terms

You'll want to select a term for your loan—15 or 30 years—based on your goals. If your goal is to pay your mortgage off more quickly and save on interest over the life of your loan, then a shorter loan may be right for you. However, you may decide on a longer term if you aim to reduce your monthly payments.

Decide on discount points

You'll need to determine if you want to pay for any discount mortgage points, which are upfront fees that lower the interest rate on your loan. The fee for each point is typically equal to 1% of the loan amount. Some lenders may allow you to purchase fractions of a point.

Choose the right mortgage lender

Compare lenders to find the best rates and terms. It's helpful to look for an experienced lender to walk you through the process and offer you personalized guidance on ways to meet your financial goals.

Beyond experience, the type of lender you choose is another consideration. Whether borrowing from a traditional bank or an online mortgage broker, selecting the one right for you and your circumstances potentially impacts your experience over the loan term. Traditional banks are less likely to sell your mortgage to another company for servicing, and for many people, having access to that type of ongoing, trusted support is crucial.

Start the application process

Once you've chosen the lender, your next step is to complete the application process. Expect your lender to ask you to provide information about your employment history and finances, including tax returns and bank statements.

Weigh estimated loan terms

Within 3 days of receiving your completed application, the lender must provide you with a formal loan estimate. This is a standardized form with details about the loan, including the estimated interest rate, monthly payment, total closing costs and other essential information.

Schedule an appraisal

Your lender's appraiser will need access to your property to assess its condition, size and location. Be aware that appraisal results can affect the terms and conditions of your refinancing.

Review closing documents

At least 3 business days before you close on the mortgage, the lender is required to provide you with a closing disclosure form detailing all final terms and costs. Compare this document to the initial loan estimate and review it carefully for accuracy.

Use the mortgage shopping guide

Use the mortgage shopping guide to navigate the homebuying process from application to closing.

Key takeaways

- When the timing is right, refinancing your mortgage is a sound financial decision.

- While there are many potential benefits, it pays to arm yourself with information and advice before you take the leap.

- When making your decision, be sure to evaluate the pros, cons and costs associated with refinancing your mortgage.

- If you think refinancing is an option for you, a good first step is to talk to a mortgage banker and ask about current refinancing rates and terms.