Financial Considerations for Buying a Second Home or Investment Property

If you have a special place you love to visit during the summer, does it make sense to purchase the property as a second home? Or, if you want to bolster your passive income with a residential rental property, what should you consider when looking into a mortgage?

The approach to purchasing a second home should be different than the one you used to purchase your primary home.

"There are so many things to consider when buying a second home," says Perry Bailey, director of Premier Client Services at First Citizens. "The process is ongoing, and in the course of it there will be a lot of questions worth asking."

To help answer these financial questions and provide first steps to consider, we've sought help from Bailey and teammates Jamie Barron, senior vice president of mortgage banking, and Premier Client Banker Kathleen Mason.

Seek preapproval

When you buy a second home, the process may initially look similar to buying your first home—but there are key differences. "Second homes and investment properties require higher reserves and more of a down payment than a primary home, and you need to be prepared for that upfront," Barron says.

Working out how to meet these requirements while already holding one mortgage isn't always easy. For this reason, mortgage preapproval is much more significant when you buy a second residence.

"Whether it's a vacation or investment home, before you even start looking rule number one is getting preapproved," Barron says. "Budgeting for multiple properties can be difficult, and the preapproval process gives you a detailed view of your finances, helps establish your comfort level and enables lenders to come up with a borrowing number that aligns with both. It helps estimate your maximum buying capability and identifies the types of loans most suited to your needs, as well as which among those you're most likely to qualify for."

Consider your circumstances

From jumbo and home construction loans to traditional mortgages, the types of loans for which you may qualify—as well as the terms you can get—will vary based on individual circumstances. But during the preapproval and approval process, there are a few tips they recommend to help increase your chances of getting the mortgage you need for the second home or investment property you want.

1 Gather loose ends in your finances

Long-forgotten 401(k)s from previous jobs, neglected cryptocurrency holdings, paper certificates for pre-digital brokerage accounts—all of these can help you qualify for a mortgage.

2 Include retirement funds to help meet reserve requirements

Reserves are the assets you must have on hand after making a down payment and paying all closing costs. In addition to property holdings and brokerage, savings and checking accounts, retirement savings can sometimes be included in the balance. "Typically, we can count as much as 70% of a retirement plan's value toward reserves," Barron says.

3 Consider a partner for your purchase

If you and your spouse don't have enough assets to meet the down payment or reserve requirements, you can take on another partner. "A joint loan can work with family members or friends who want to go in on a property together," Barron says. "They'll need to fill out separate applications, but after that the income and assets of all three are pooled to help qualify."

4 Weigh today's market conditions against expectations

Mortgages fall into fixed and adjustable-rate types, and you'll want to consider which best fits not only your long-term financial plans and goals for the property but also the current and projected economic environment. If rates are currently high but you expect them to drop in the future, an adjustable-rate mortgage, or ARM, may be a good consideration. But if you want to lock in a rate that seems more favorable today than it's likely to be in a few years, a fixed rate may be more attractive.

And remember, if you don't get the mortgage you really want, you're not necessarily stuck with it indefinitely. "If you find the perfect property for you and your family now but don't get the exact loan or terms you'd like, keep in mind that if you take the mortgage offer in adjustable-rate form, you'll likely be able to refinance for better rates down the road," Barron says.

Tally hidden costs for a second home

Before putting in a bid on the beach or mountain getaway you've set your heart on—particularly if you're heading into retirement—there are some important post-mortgage details you'll want to sort out.

"It's not uncommon for retirees on a fixed income to focus on mortgage costs when thinking about buying a second home, but there's so much more to consider," Mason says. "Property taxes on a beach home are going to vary by state and county, and no matter where you decide to buy, insurance by the water will be higher. Even when the mortgage is paid off, your retirement income will still have to cover these expenses. To ensure they can, you'll need to carefully factor in these ongoing costs when shopping for a second home."

It's also essential to take matters of inheritance into account. Building a second home at your cherished vacation spot allows you to bring family together in a place where you've already made countless memories. But unlike with an investment property, your heirs may have a tougher time deciding how to split up or maintain the property once you're gone—particularly if their finances can't keep up with the costs.

"Even if the mortgage is paid off, have a conversation with your children about their finances ahead of time," Bailey says. "It's important to know whether they'll be able to cover property taxes and insurance, if they're splitting the property among multiple siblings, and how they'll handle the tax ramifications if they have to sell."

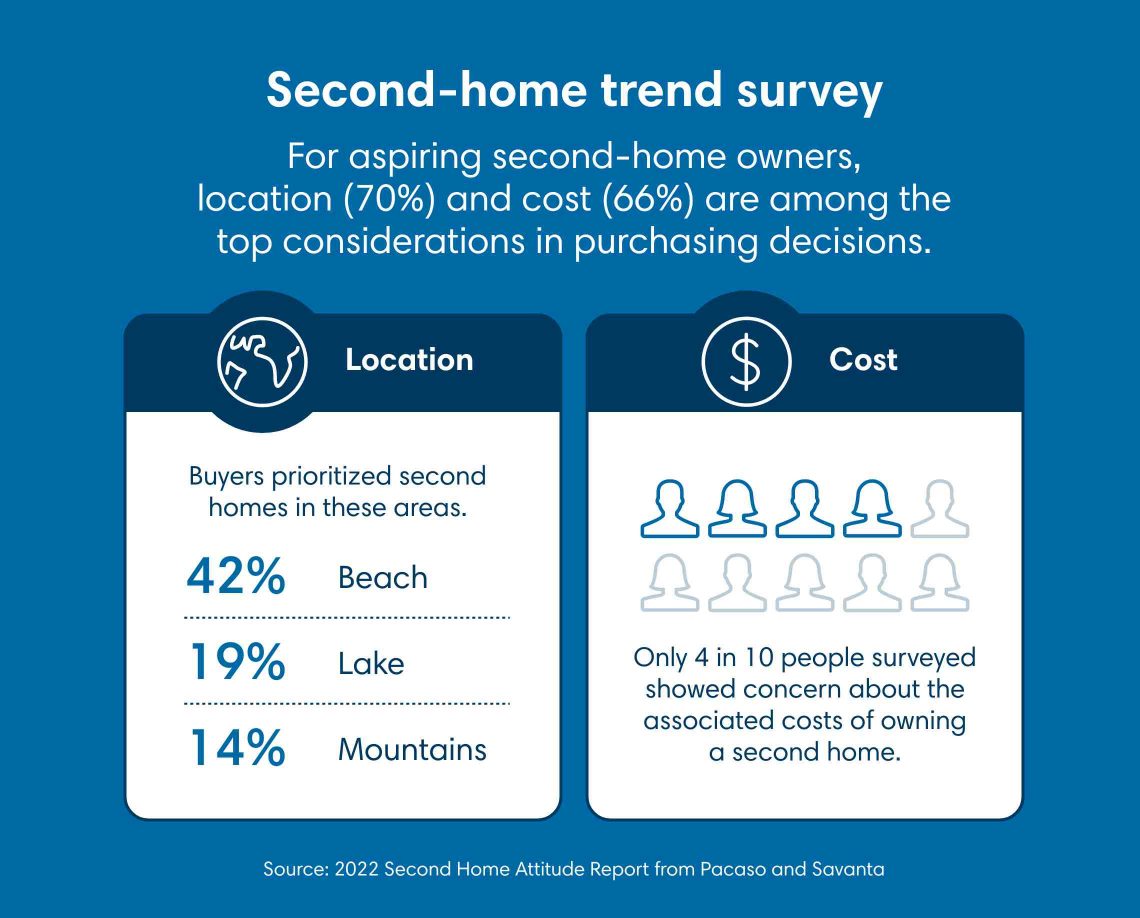

With these factors in mind, location is the top consideration for 70% of aspiring second homeowners, according to the 2022 Second Home Attitude Report produced by market research consultant Pacaso and Savanta, a national co-ownership real estate firm. Cost is the top consideration for 66% of those surveyed. As far as locations go, 42% of buyers prioritize second homes in beach areas, while 19% prefer lakefront living and 14% focus on the mountains. Only 40% showed concern about the associated costs of owning a second home.

Factor in vacancy scenarios with investment properties

If you're purchasing a second residence as a passive-income stream, focusing on reserves is important regardless of the type of mortgage you have. In a rental scenario, you'll have the same concerns with taxes and insurance that you would for a first or second private home, but you'll also need to factor in things like short- or long-term vacancies and property management.

"With an investment property, you're weighing everything because the condition of the property and your ability to pay the mortgage is likely to be partially dependent on other people," Mason says. "Have at least 6 months of reserves to cover everything associated with them, because there are just more variables."

Investment properties do come with advantages, however. "Following a market analysis of the property, buyers can use up to 75% of projected rental income to help qualify for certain types of mortgages," Barron says. "And after they have the property, they can file rental income under Schedule E of their tax returns, allowing them to write off a host of expenses."

Consult with a qualified tax professional to determine which, if any, tax breaks your investment property might qualify for.

Stay in touch, even after purchase

Ongoing communication with your lender is one of the most important—if often overlooked—parts of purchasing a second home or investment property.

"Folks have life events that affect their finances, and because of that I recommend an annual mortgage checkup," Barron says. "For example, if you've paid down your loan and are getting ready to send two kids off to college, you're sitting on an enormous amount of equity that's built over the years but is earning nothing. Giving this information to a lender during a mortgage checkup allows them to help you access tools like a cash-out mortgage or an equity line to help fund that life event."

Ready for that second property?

Whether in person or online, our mortgage bankers are here to help take care of the details.