Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

With hectic schedules and busy routines, families may find it challenging to spend quality time together. However, the holidays can offer a precious opportunity to do so, and many families will likely fill the later part of December with making memories or simply catching up with relatives. Here are two more activities to consider adding to your list: Discussing family finances and introducing your children to your advisor.

While this may not be as much fun as hanging holiday decorations or opening presents, keeping the lines of communication open around family finances is a thoughtful gift you can give the next generation and an important part of your family wealth management. There are many benefits to such a meeting, including streamlining estate planning, communicating your financial values and showing your kids the value of guidance in managing your money.

Even if a meeting between your kids and your advisor doesn't take place during the holidays, simply discussing the idea—perhaps even scheduling a virtual or in-person session for a later date—can be a great first step. If you have a strong connection with your advisor and want a smooth transition for your kids, the earlier you can schedule a meeting, the better.

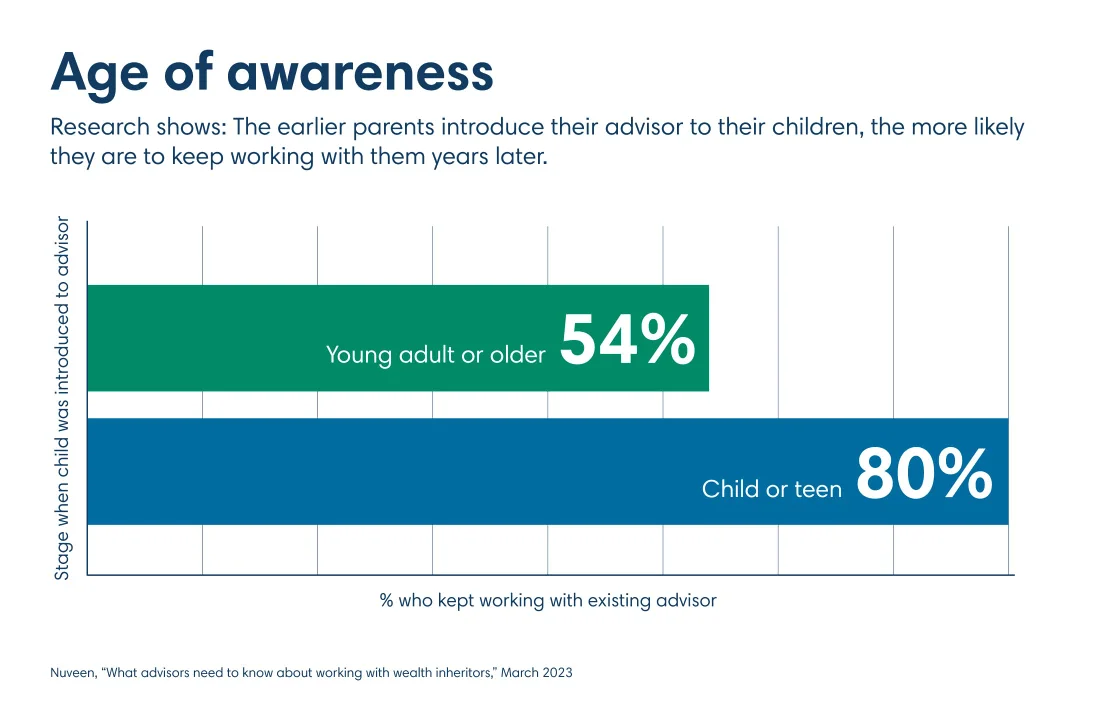

Recent research from Nuveen shows that only 54% of heirs retain the services of their parents' advisor if they meet the advisor as a young adult or older. If the introduction happens when the inheritor is a child or teen, the likelihood of maintaining the relationship rises to 80%.

Advisors say it's never too early for children to meet the family financial advisor, but those encounters—and their benefits—will look significantly different depending on your children's ages. Here's how an advisor might connect with your kids at various stages in their lives.

When you're introducing a younger child to your financial advisor, the event will usually be informal. Clients often bring their children to meetings before they're able to fully understand the topics being discussed. A great deal of financial literacy for kids is absorbed through exposure to their parents' financial values and approach to money.

Kids are naturally curious, so involving them in some financial meetings may be an excellent opportunity to discuss age-appropriate money topics, such as the importance of budgets or the difference between needs and wants. Parents could also let their children participate in the family's charitable giving strategy by allowing them to choose causes they feel passionate about.

"The kids might not know exactly what's going on, but seeing these meetings happen may instill in them that having an advisor for their money makes sense," says Gregory Wesley-Shanks, a wealth paraplanner at First Citizens Investor Services. "Catching them at that very early age can really have a big impact."

As your children reach adolescence and start thinking beyond high school, you might bring them into meetings to discuss college savings and the ways your family plans to help them financially. Your advisor can help facilitate an understanding of college costs and affordability for your children, contributing to a targeted application process and strong financial preparation for the entire family.

After your children have launched their careers as young adults is another great time to schedule a meeting with your financial advisor. As they start to make new and important decisions—such as saving for retirement at their first full-time job or paying down student loans—your children may naturally become more interested in considering and discussing financial matters.

A meeting during this chapter in their lives may also increase their openness to guidance and support. Even if your children know you have their best interests at heart, they may hold some biases or emotions that make it harder for them to take advice from you.

"Sometimes they hear their parents say, 'do this, do this, do this,' but it doesn't quite sink in," Wesley-Shanks says. "But if you have an objective third-person advisor saying the same thing, then they may think, 'Hey, maybe I really should do this.'"

Before the meeting, you may want to let your financial advisor know why you invited your children and which details about your financial life you're ready to share. Your level of transparency may depend on a variety of factors, including your children's maturity levels and your comfort level. Many clients use this opportunity to broadly discuss some of the significant financial decisions they've made in their lives and how those decisions did—or didn't—work out over time.

Opening this line of communication may also help adult children feel empowered to approach you or your advisor to ask questions about a specific money situation or to get feedback on their progress toward their financial goals. While talking about money with your children may feel awkward at first, the more you discuss financial issues openly, the easier it will become.

At this point in their lives, your children may have established some roots with a career and perhaps a family of their own. At the same time, you may be winding down your career or considering how you'll spend your retirement and the type of legacy you'd like to leave behind. Bringing your children into the conversation with you and your advisor can help align everyone's current understanding and minimize potential confusion down the road.

While you may have shielded your children from the details of your financial picture in the past, you may consider giving them more specifics in this stage of life. This can range from basic information—such as the location of your assets and important documents—to a broader discussion about your overall wealth and your plans to distribute it when you're gone. Be aware that failure to communicate this information early on can create conflict, resentment or other preventable challenges in your absence.

Timely communication may be particularly important for those with more complicated financial situations, such as owning a business or maintaining multiple homes. Explaining your plans for these assets with the assistance of an advisor can help your children make more informed decisions about their own financial lives and provide a roadmap for the steps they'll need to take in order to settle your affairs in a worst-case scenario.

"Once someone is already slowing down a little bit—physically and cognitively—it really helps for the advisor to have another point of contact for the client," says Craig Shively, also a wealth paraplanner at First Citizens Investment Services. "And once you have your legal plan in place, it helps for the children to know what's going on with powers of attorney, wills and trusts."

The key is to begin such discussions while you're still able to explain the intentions behind your long-term wealth plan. Financial advisors can help lead a family meeting to review any potential issues and explain how that plan might work over time.

"The greatest thing that we're able to help with in multigenerational situations is just making sure that everybody's on the same page," Shively says. "That we know what the succession planning process is and what steps we need to take if something happens to mom or dad. That gives the kids peace of mind to know we are on top of that as their trusted advisor."

You've already done the hard work of finding a trusted specialist and working with them to develop a thoughtful plan for your finances. Connecting your advisor with your children—at the age that makes sense for your family—is another important step to ensuring you and your children are empowered to carry out your plan according to your wishes.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.