How to Manage Your Student Loan Debt

You just received a promotion, you paid off your auto loan and your kids no longer need day care. Aside from your mortgage, you may only have one large debt remaining—student loans.

As you enter your prime earning years and make some progress on your financial goals, you may find that you have more disposable income than you had earlier in your career. While it's tempting to splurge on a boat or vacation home, it may be worth taking a step back and looking at your student loan debt.

According to Craig Shively, an investment advisor with First Citizens Investor Services, with wise budgeting you may be able to pay off your student loans earlier—freeing up time and money to do more of the things you love. Here, he discusses some ways to help manage student loan debt so you can have more discretionary income later for retirement, splurge-worthy indulgences or other financial goals that arise.

Explore your options

When it comes to repaying your student loans, there are a variety of federal repayment plan options available. And President Biden recently announced up to $10,000 in federal student loan relief for single borrowers who earn less than $125,000 per year and joint filers who earn less than $250,000. The relief rises to $20,000 for borrowers who also had Pell grants. The presidential order also extended a moratorium on payments through December 31, 2022. After this time, borrowers may be required to make payments again.

Federal student loan borrowers under an income-driven repayment plan may be eligible for forgiveness after making payments for 20 to 25 years. If you work in the public sector, for a nonprofit or as a teacher, you may also qualify for forgiveness, depending on your state.

If you're paying down a six-figure medical school debt, several loan forgiveness programs will repay certain amounts of loan debt in exchange for participation in a service program.

Prioritize retirement savings

It's a good idea to think of your budget as a pie. Carve large slices for living expenses, retirement savings and student loan debt. Carve thinner slices for emergency savings, college savings plans and fun money. With this in mind, you can eliminate debt as quickly as possible without sacrificing retirement savings in the process.

"After daily living expenses, retirement savings should absolutely come first," Shively says. "We have student loans with low interest rates, but there's no such thing as a retirement loan."

When it comes to saving for retirement, it's ideal to contribute the maximum amount to your 401(k) in your higher-income years—in 2022, that amounts to $20,500 per year or $27,000 for adults ages 50 and older—and make student loan payments well over the minimum. The ideal, however, isn't always reality.

"Contribute at least a percentage of your paycheck up to the employer's match point, if they offer one," Shively advises. "Apply any leftover discretionary income toward student loans."

Refinance your loans

The Federal Reserve raised interest rates by 0.75% in June and could potentially raise them two more times this year. If you know it'll take you a while to pay off your student loans and any of them have variable rates, you may want to consider refinancing them into fixed-rate loans. You may also be able to consolidate multiple student loan balances into one fixed-rate loan.

Before refinancing any student loan debt, weigh the pros and cons. Refinancing federal student loans into a private loan means losing perks like forgiveness and income-based repayment. You'll also need to evaluate interest rates and terms to find the best fit for your life. A refinancing calculator can help you decide.

It's also a good idea to avoid paying off student loans with a home equity loan. "Use home equity only as a backup emergency fund or for when you're tackling a home improvement project," Shively advises.

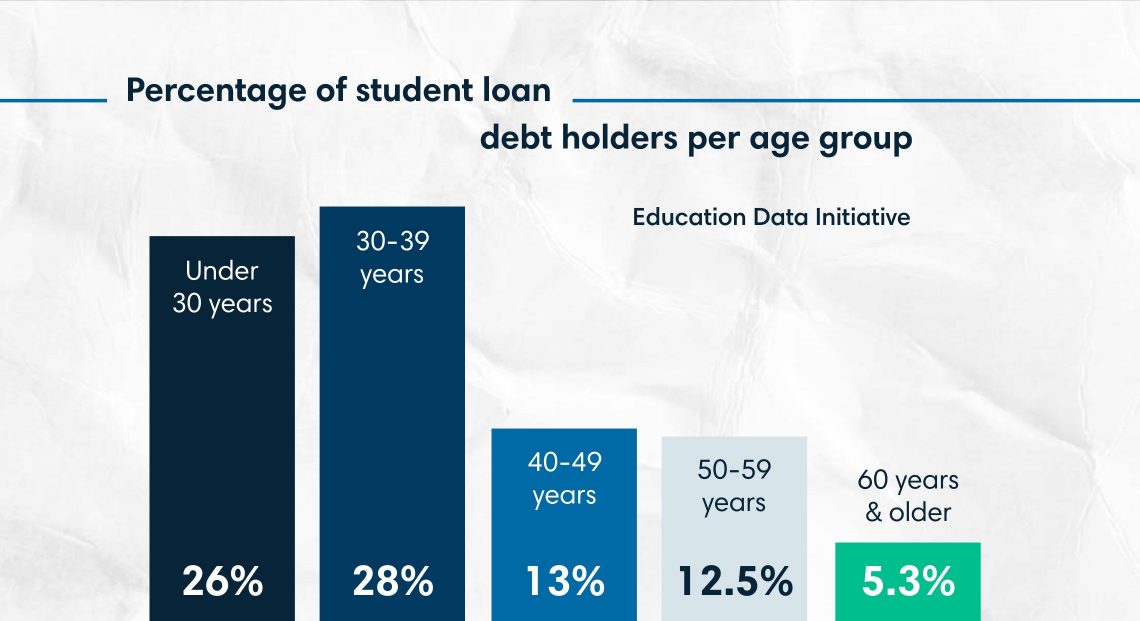

Percentage of student loan debt holders per age group

- Under 30 years: 26%

- 30 to 39 years: 28%

- 40 to 49 years: 13%

- 50 to 59 years: 12.5%

- 60 years and older: 5.3%

Source: Education Data Initiative

Make your payments on time, and then some

If you've been paying down your student loans for several years, you likely already know how much discretionary income you can use for them. Now that you've freed up more income, you can put some of it toward these loans. Check with your lender to make sure the extra payment amount goes toward the loan balance instead of next month's payment.

"There's no penalty for paying early on most student loan products," Shively notes. "If the student has the ability to make payments while they're still in school, they should pay as much as they can toward their student loans so there's less of a shock 6 months after graduation."

Get a financial plan in place

It's a challenge to determine how to balance multiple financial priorities under the best of circumstances. Factor in geopolitical tensions, a turbulent stock market and the effects of a pandemic—not to mention medical emergencies and other surprises—and it's hard to know the best way to leverage discretionary income. A financial advisor will help you define or adjust your roadmap to help you build wealth and achieve student loan freedom as soon as possible.

"A financial plan is paramount, regardless of how the stock market performs," Shively says. "The best way for families to mitigate their concerns is to speak with a licensed professional about their goals and develop a plan to achieve them."