Increasing Access to Banking for Hemp and CBD Companies

Ryan Palmquest

SVP, Director of Hemp Business

There are billions of dollars worth of transactions in the hemp and cannabidiol, or CBD, industry, but the majority of companies still lack access to traditional banking services.

With new changes coming to the Farm Bill and a new version of the SAFE Banking Act, along with other new federal and state legislation, hemp and cannabis businesses are likely to soon gain access to more banking services.

"The cannabis industry, for the longest time, has been this stigmatized, underground market that has not had access to traditional banking. It is very much a cash-based business."

Richard Chang

Attorney, equity partner and chair of the hemp products practice at Weaver Johnston Nelson

Challenges in the hemp and CBD industry

Without the products and services provided in a traditional bank relationship, companies face the following challenges:

- Providing bank financial statements for compliance and tax purposes

- Accepting debit or credit cards and receiving electronic payments

- Paying employees, vendors and bills through electronic payments instead of cash

- Obtaining insurance coverage

- Establishing normal merchant services through major payment processors

- Qualifying for loans, lines of credit and leasing—business and personal

In addition, they're often forced to adopt a cash-based business model, making them a target for theft.

"Giving hemp and CBD companies access to traditional banking services is the next critical step to legitimizing them."

JP Connell

Vice President of First Citizens Hemp Business Banking Group

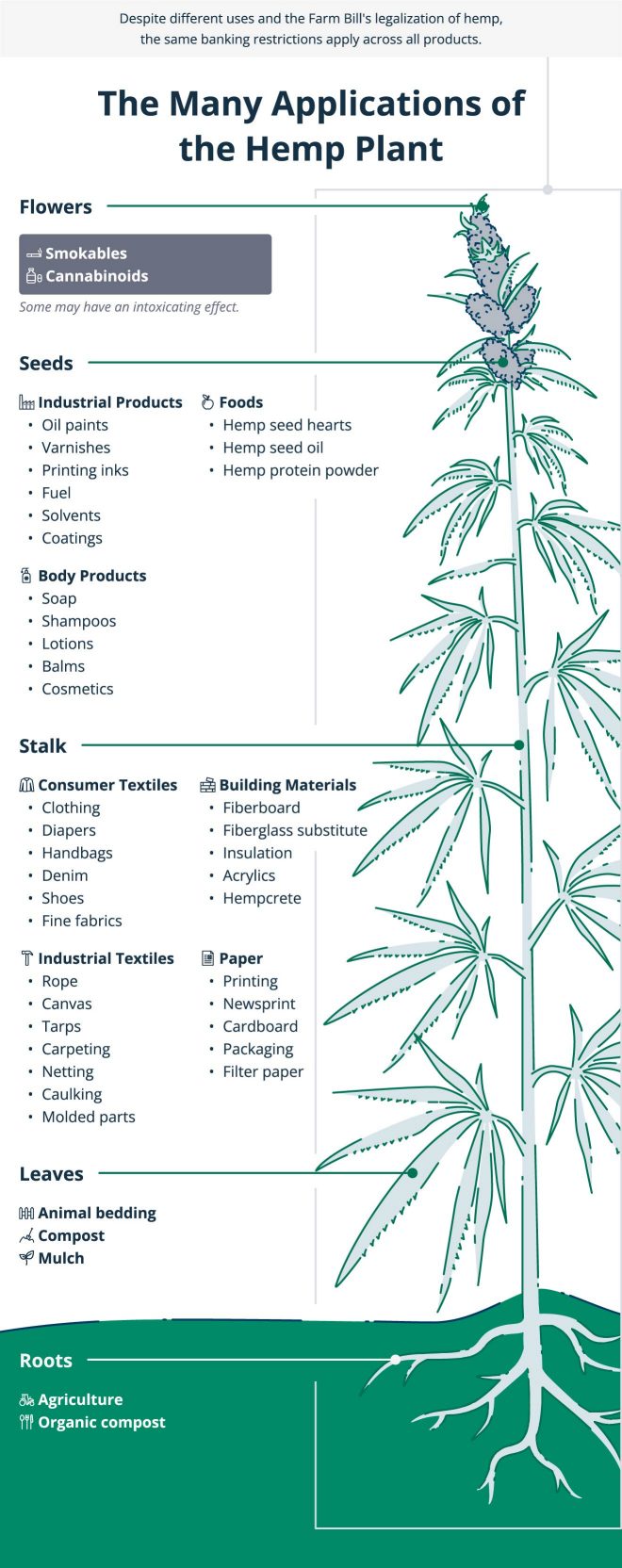

Botany meets banking: Non-intoxicants unfairly restricted

All hemp and CBD products come from the same plant species, but different parts of the plant are used to make thousands of different products. Most of these products don't contain cannabinoids and are non-intoxicating, but current legislation treats them largely the same as products that contain cannabinoids and are intoxicating.

That means whether a company makes non-intoxicating textiles or intoxicating CBD gummies, the same laws and regulations apply, limiting banking options.

Farm Bill pushes for clarity

Both companies that produce non-intoxicating hemp products and companies that produce intoxicating CBD products need access to traditional banking services. But the regulatory roadmaps are different.

For hemp, the best roadmap may be the Agricultural Improvement Act, commonly referred to as the Farm Bill.

"We often say all roads lead back to the Farm Bill. It provides an anchor point in the definition of what is hemp and what is marijuana in other critical pieces of legislation."

Pamela Epstein

Chief Legal and Regulatory Officer for Terpene Belt Inc.

The Farm Bill was first passed in 1933, with a mandatory review every 5 years. It lays out a wide range of regulations for the agricultural industry, from crop subsidies to rural development.

Over the last decade, incremental changes have been made to the Farm Bill advancing hemp and CBD companies as legitimate businesses deserving of access to traditional banking services.

The 2014 version of the bill was passed into law with big wins for the hemp industry:

- More clearly defined hemp as an agricultural commodity, distinguishing it from CBD

- Allowed states to cultivate industrial hemp for research purposes

- Acknowledged hemp's economic and environmental benefits

The 2018 version of the Farm Bill incorporated even more wins:

- Removed hemp from the Controlled Substance Act, where hemp was classified along with cannabinoids as a Schedule 1 controlled substance, a designation many banks won't support

- Legalized the cultivation, production and commercialization of hemp at the federal level

- Replaced the Drug Enforcement Agency as hemp regulator with the US Department of Agriculture, further legitimizing the industry

The 2023 version of the Farm Bill pressed for greater oversight of CBD products to further legitimize them, but it hasn't yet passed. It calls for:

- Tighter guardrails for downstream CBD products, further differentiating them from non-CBD products and bringing greater regulatory clarity to both product types

- Oversight of CBD products by the Federal Drug Administration for greater consumer and banker confidence

The deadline for passing the 2023 Farm Bill was extended through September 2024, and proponents of change are working toward its passage.

SAFE Banking Act and cannabis-based businesses

The SAFE Banking Act was first introduced in 2019 to widen access for businesses by reducing the risk to banks.

Its key aims are to:

- Give CBD-based businesses access to traditional banking products and services

- Prevent federal banking regulators from penalizing banks, credit unions and other financial service providers for working with legitimate cannabis businesses operating in compliance with state laws

The most recent version of the bill, SAFER, includes a mandate that the director of the Financial Crimes Enforcement Network give testimony before Congress about progress on initiatives to prevent money laundering. A requirement for financial institutions to increase access to banking services for rural, tribal and other underserved communities has been removed, but the requirement to report on access remains.

Stay up to date

In addition to the Farm Bill and SAFER Banking Act currently in flux, other federal and state legislation supporting banking services for hemp and CBD companies is always in motion. Check back with us for updates, connect with a hemp banking specialist and explore these other resources:

Grow your business with First Citizens

As a cannabis-friendly and hemp-friendly bank, we understand the unique legal and logistical challenges of cannabis-related businesses. Our experienced financial professionals have a deep knowledge of both the cannabis and hemp industries and are dedicated to making your banking experience as convenient and efficient as possible. That way, you can focus on what you do best—growing your business.