How do donor-advised funds work?

Hank Dunbar

Charitable & Philanthropic Services Manager

For those looking to amplify their philanthropic impact, donor-advised funds, or DAFs, are an increasingly popular option thanks to their flexibility, low administration costs and streamlined giving.

While donor-advised funds are often a tax-smart way to maximize charitable giving efforts, there are several factors to consider. Learn more about the benefits of DAFs and how they can aid in your charitable planning goals.

What is a donor-advised fund?

A donor-advised fund is a charitable giving vehicle that allows individuals, families or businesses to make tax-deductible contributions to a sponsoring organization—typically a community foundation or nonprofit.

Donors may contribute cash, stocks or other assets and receive a tax deduction during the tax year the assets are contributed to the DAF. Contributions may be invested until the donor requests a grant be made to an IRS-qualified charity of their choice.

There are two types of donor-advised funds—endowed and non-endowed funds. Endowed funds only distribute income, leaving the principal invested for long-term growth. Non-endowed funds allow the donor to distribute both income and principal.

The benefits of donor-advised funds

Donor-advised funds are generally known as a flexible, tax-advantageous way to structure charitable contributions. Donors can contribute more in a high-income year when the tax-deduction threshold for charitable contributions is higher and disburse those funds to a nonprofit at a later date. This gives the donor flexibility with the timing of their donations.

While the ability to maximize tax deductions while maintaining flexibility of timing of charitable distributions is a key advantage, DAFs typically offer a range of other benefits.

Donor-advised fund tax deduction

A contribution to a DAF is treated as a gift to a 501(c)(3) charity, so the deduction is generally the fair market value of the asset contributed. There are different deduction limits depending on the gift and your adjusted gross income, or AGI. A 5-year carryforward deduction applies to gifts above the following AGI thresholds.

- Cash-only: Tax deduction up to 60% of AGI

- Cash and appreciated property: Tax deduction up to 50% of AGI

- Long-term capital gains assets: Tax deduction up to 30% of AGI

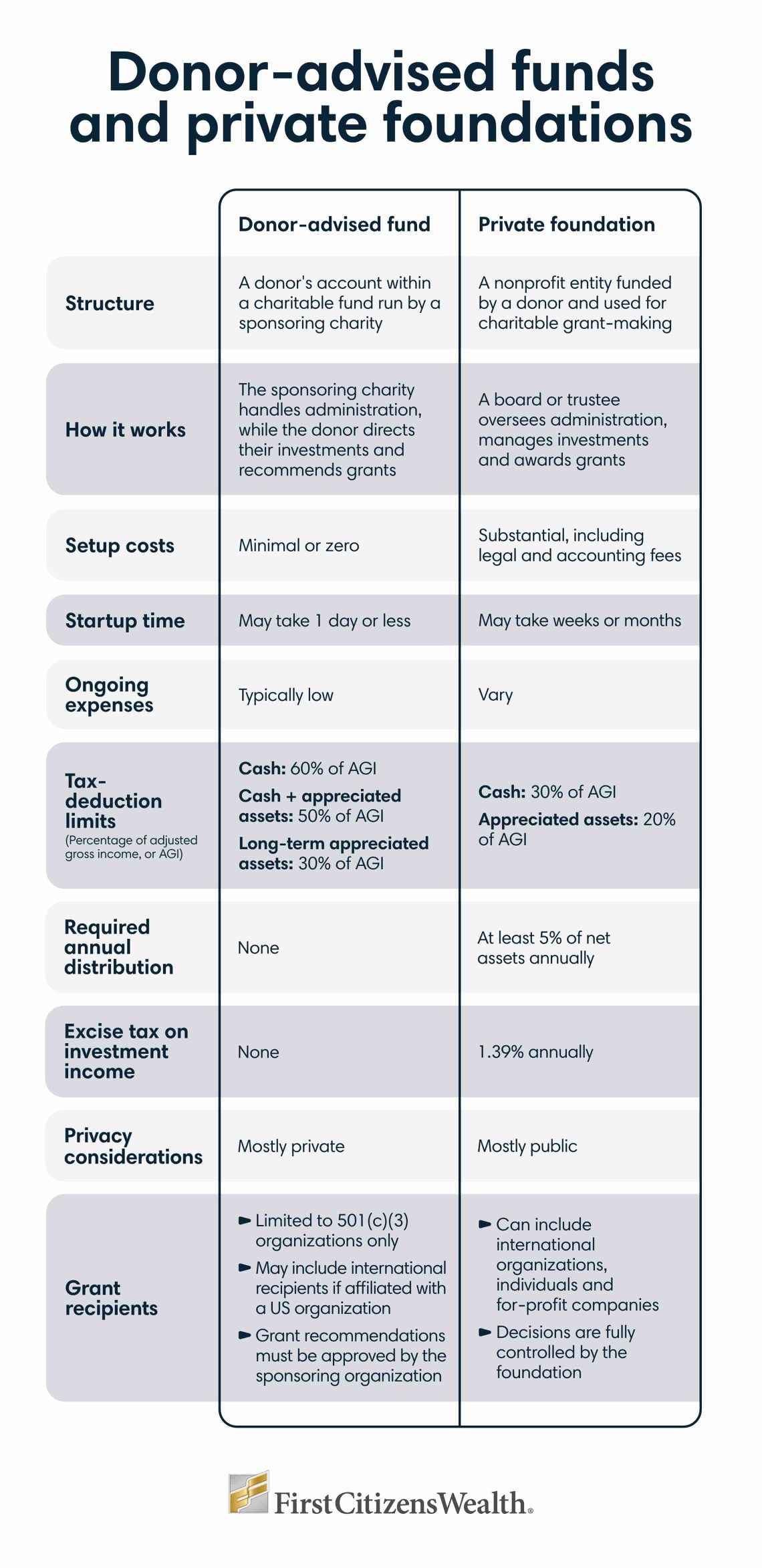

A donor-advised fund versus private foundation

A private foundation is a nonprofit entity set up for charitable purposes. Unlike a public charity, a foundation doesn't engage in fundraising. Instead, it's funded by an individual, a company, or a family or other group of like-minded individuals. This is one aspect that makes foundations similar to DAFs, but there are a few key differences.

For one, foundations can be expensive to set up and maintain—with ongoing legal and tax reporting requirements. DAFs typically have lower startup costs and fewer ongoing administration expenses than private foundations.

Likewise, donor-advised funds also receive more favorable tax treatment than private foundations, which carry a limit of 30% of AGI for cash contributions and 20% of AGI for donating appreciated property.

One of many charitable-giving strategies

If you or your organization is qualified, a donor-advised fund may offer a number of benefits, but it's important to keep in mind that it's just one way to achieve your philanthropic goals. In addition to establishing a private foundation, other options include funding a charitable gift annuity or a charitable trust. Both of these alternatives may even provide you or another beneficiary with a series of income payments during your lifetime.

It's a good idea to talk with a financial professional to evaluate your options. They can assist you in developing a plan that helps you achieve both your charitable and your financial goals.