Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

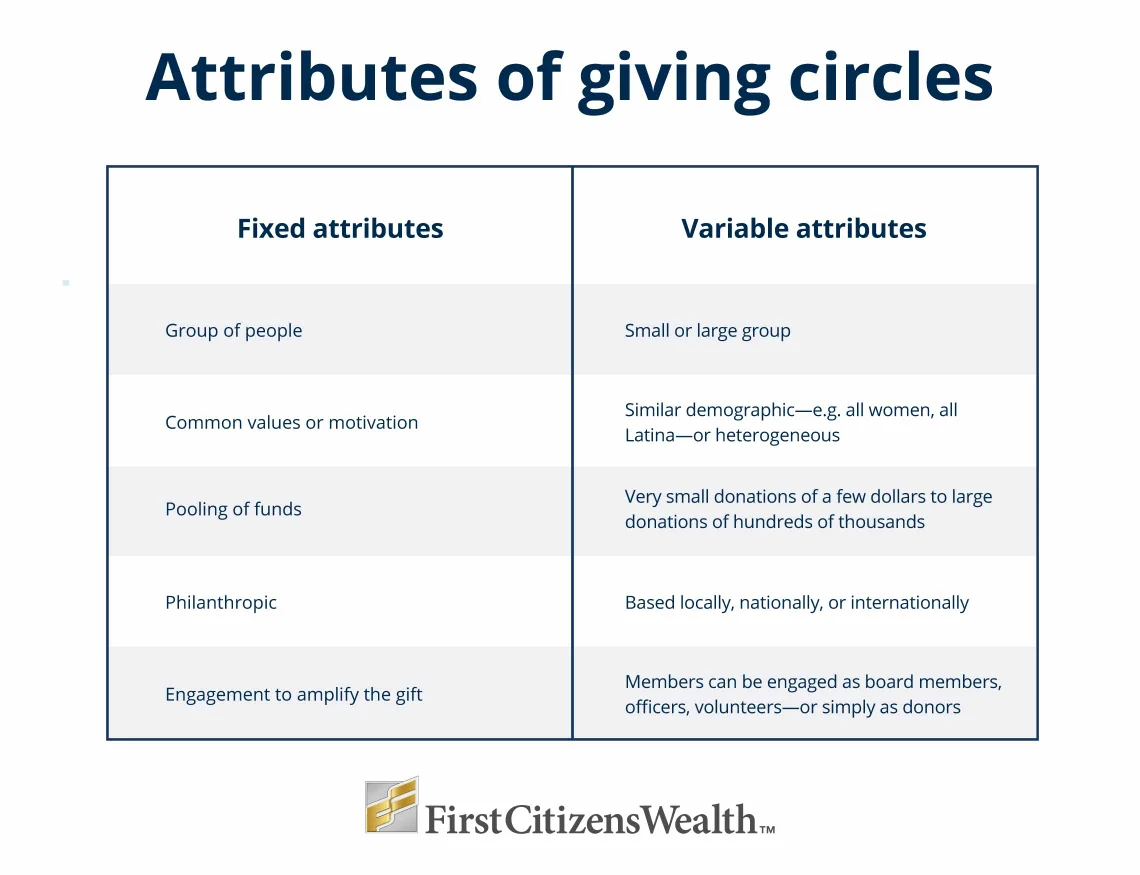

Sometimes described as participatory philanthropy, a giving circle is a group of people who come together for intentional, pooled giving. They have shared values and charitable objectives and are seeking social change.

Giving circle members may decide to form them to become more proactive and focused in their giving, instead of reactively responding to donation requests from friends, colleagues or social media campaigns.

According to Philanthropy Together, there are an estimated 4,000 active giving circles today. Women tend to be at the forefront of these groups, with 60% of them being women-only groups and females making up most of the memberships.

While giving circles benefit their chosen charities by increasing their capability to provide services and meet needs, benefits also flow back to circle members. Activities such as advocacy, volunteer work and activism on behalf of a nonprofit or social cause drive their social engagement, with networking groups sized from a few friends to hundreds of like-minded people. Connection can happen face to face at get-togethers of various kinds or via video calls.

Combining their gifts also generates increased visibility and influence, and members acquire greater social cachet in their communities because of their direct role in resource allocation. Charitable giving solutions specialist Foundation Source states that being in a giving circle changes gifting behavior. Members contribute more—and they do so more strategically. This includes multiyear gifting instead of one-off donations.

The emotional reaction to give something away now to help today often evolves into a more structured approach. As part of their funding decision process, giving circle members will advance a longer-term vision for change. They'll research the most effective organizations to support. They'll support wider operating expenses, as well as specific programs. And they'll check organizational performance data to evaluate impact while factoring in cultural differences, race, social class and gender.

Many clients involved in giving circles have found that their participation offers purpose after retirement or a business exit. Involvement brings social, educational and engagement aspects that connect circle members to their communities. Members describe how they have more impact joining together than they'd achieve alone, and they feel more effective at enabling positive social change.

Each giving circle operates differently. Some require an application process while others are more flexible, perhaps deciding to give based on a member's suggestion. Some circles give once a year, others quarterly and so on. Organizations seeking funds can use databases to research circles that look like a good fit—either geographically close with similar membership demographics or supporting causes aligned to their own values.

This process could be worth the effort for charities. Total annual household income and giving is higher for members in giving circles, particularly the larger ones. With their greater sense of civic responsibility, members are more likely to respond favorably to a donation request.

Directories of giving circles are available to help you locate one that aligns with your giving preferences. Alternatively, you can start your own. Some giving circles are hosted by a nonprofit. Others are supported by community foundations. They offer services to set up charitable funds and reduce legal and administrative costs and provide a cheaper option than creating a private foundation. Giving circles may also be a part of a wider giving network to further share their support, connections and resources.

Giving circles empower the donor, amplify the impact of the gift and put philanthropy back in the spotlight. If you'd like more information, connect with your tax advisor and financial team. They can help you assess the potential tax impacts of your philanthropic goals and ensure your generosity supports your holistic wealth strategy.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.