Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Identity theft was the top consumer fraud complaint in 2022, making it vital to learn what to do if your identity is stolen and how to protect yourself from being retargeted.

An account on your credit report that you never opened. A notice from the IRS that someone filed a tax return using your Social Security number. A notice about an overdue bill that's not yours. These can all be signs pointing to a thorny problem: identity theft.

Identity theft—when your personal information is stolen and used for malicious purposes—is unfortunately quite common. In 2022, the Federal Trade Commission, or FTC, received 1.1 million reports of identity theft, and that was just the people who reported it.

Identity theft tends to be an underreported crime because many people simply don't know what to do if their personal information is stolen. However, when fraud and identity theft are left unreported, significant damage can be done to your bank account and your credit score.

Thankfully, there are steps you can take to help protect your reputation and finances. Here's what to do if your identity is stolen, from how to report fraud and identity theft to how to protect yourself from being retargeted.

Many people don't know that their identity has been stolen until significant damage has been done. This is why it pays to be proactive—reading your credit reports, checking your account statements, setting up monitoring alerts—to help spot early signs of trouble.

Here are some warning signs that your identity may have been stolen.

You're also at risk of identity theft if you've lost your wallet—or important identification such as your driver license, Social Security card or passport—or if you receive a notice from a company that your information may have been exposed in a data breach. This is an increasingly common problem, with 422 million customers impacted by a breach in 2022 alone, according to the Identity Theft Resource Center.

If you believe your identity has been stolen, your first step should be to carefully review your accounts to look for signs of fraud or suspicious activity.

Read through your most recent credit card and bank account statements, looking for unusual charges or withdrawals. If your bank offers account alerts, now is a good time to set those up. And if you haven't already done so, change your password and enable multi-factor authentication immediately.

If you notice any suspicious charges or transactions, contact your bank immediately.

Request a free copy of your credit report from all three credit reporting bureaus at AnnualCreditReport.com. Review each report carefully, checking for any unfamiliar accounts, loans or personal information. If you notice any issues, contact the credit bureau immediately.

Contact one of the three major credit reporting bureaus and ask them to put a temporary fraud alert on your credit report. Once a fraud alert has been placed on your credit reports, lenders are required to verify your identity before approving credit card or loan applications. While this can make it harder for someone else to open a new account in your name, you'll still be able to do so with a few extra steps. This alert is free, can be renewed annually and only needs to be made with one of the three credit reporting bureaus. If someone has opened new accounts in your name, you may wish to initiate a credit freeze.

If you haven't already set up a my Social Security account through the Social Security Administration at SSA.gov, now is a good time to do so. Through this account, you can review your account history and look for signs of misuse, including benefits you haven't claimed or income history you don't recognize.

To ensure that no one has filed a federal tax return in your name, create an online account at IRS.gov. Through this account, you can review your tax records, including data from your most recently filed return, as well as digital copies of any notices the IRS has sent. If there's something you don't recognize, contact the IRS immediately.

If you believe any of your personal data has been compromised, you should update your passwords immediately and set up multi-factor authentication, particularly for your email accounts, bank accounts and social media profiles. This step is important—even if you don't think these accounts have been compromised.

If you notice any signs of identity fraud, it's important to take immediate action. The sooner you report identity theft, the better you'll be able to minimize damages and protect yourself from financial loss. Here's how to handle identity theft.

If you think your identity has been stolen or if you've been the victim of fraud, contact your bank immediately. Depending on the circumstances, your bank may place an alert on your account to block any suspicious transactions. They may also issue you a new debit, credit or ATM card.

If you're a First Citizens customer, you can call us at 866-567-7760.

The FTC created a tool to help consumers report and recover from fraud and identity theft. It asks a series of questions to generate a customized fraud report—which can be used to file a police report or dispute fraudulent charges with creditors or debt collectors—and a personalized recovery plan. Your fraud recovery plan will outline any additional steps you may need to take based on the type of fraud you've experienced.

Depending on the circumstances, you may wish to place a credit freeze on your account. A credit freeze is more restrictive than a fraud alert, as it restricts access to your credit report. This makes it extremely difficult for anyone—including you—to apply for new credit while the freeze is in place. If you need to apply for a new credit card, loan or lease, you can temporarily lift the credit freeze.

If your Social Security number is being used fraudulently, you can contact the Social Security Administration to request an electronic access block, meaning no one can see or change the personal information associated with your Social Security number. You can also set up a direct deposit fraud prevention block through your my Social Security account. This can prevent anyone from enrolling your Social Security account in direct deposit or from changing your direct deposit information. Both of these blocks can be removed at any time.

The FTC offers sample letters you can use to report or dispute incorrect information or charges to creditors, debt collectors and the three major credit reporting bureaus.

Having your personal and financial information stolen or exposed can be unnerving. However, the key to protecting yourself is to remain vigilant, even after you've set up fraud alerts or closed impacted accounts. Here's how to recover and protect yourself from identity theft moving forward.

Keep a close eye on your bank account and review your credit card statements regularly. This may help you spot unusual activity early—ideally before any significant losses occur. Sign up for account alerts to be notified of changes to your accounts or requests for your information.

If you're a First Citizens customer, you have access to a wide range of security features. Start protecting your account.

Criminals often wait months—even years—before using your information or selling it on the dark web. Keep a record of all fraudulent transactions and hang onto any official reports you may have submitted. You should also take notes based on conversations or letters you receive from credit reporting agencies, debt collectors or creditors.

It's easy to ignore that towering pile of snail mail or let emails go unread. However, that's often where you'll find warning signs of identity theft—in account statements, bills and account change notices. Also, invest in a cross-cutting shredder—some identity thieves gain personal information by sifting through garbage.

Be sure to look at your credit reports periodically. At AnnualCreditReport.com, you can access one free credit report from the three major agencies each year. But rather than requesting reports from all three agencies simultaneously, consider spreading the requests out. This way, you'll have a better idea of what your credit history looks like throughout the year. In addition, consider signing up for a credit monitoring service—some credit card companies even offer this service for free.

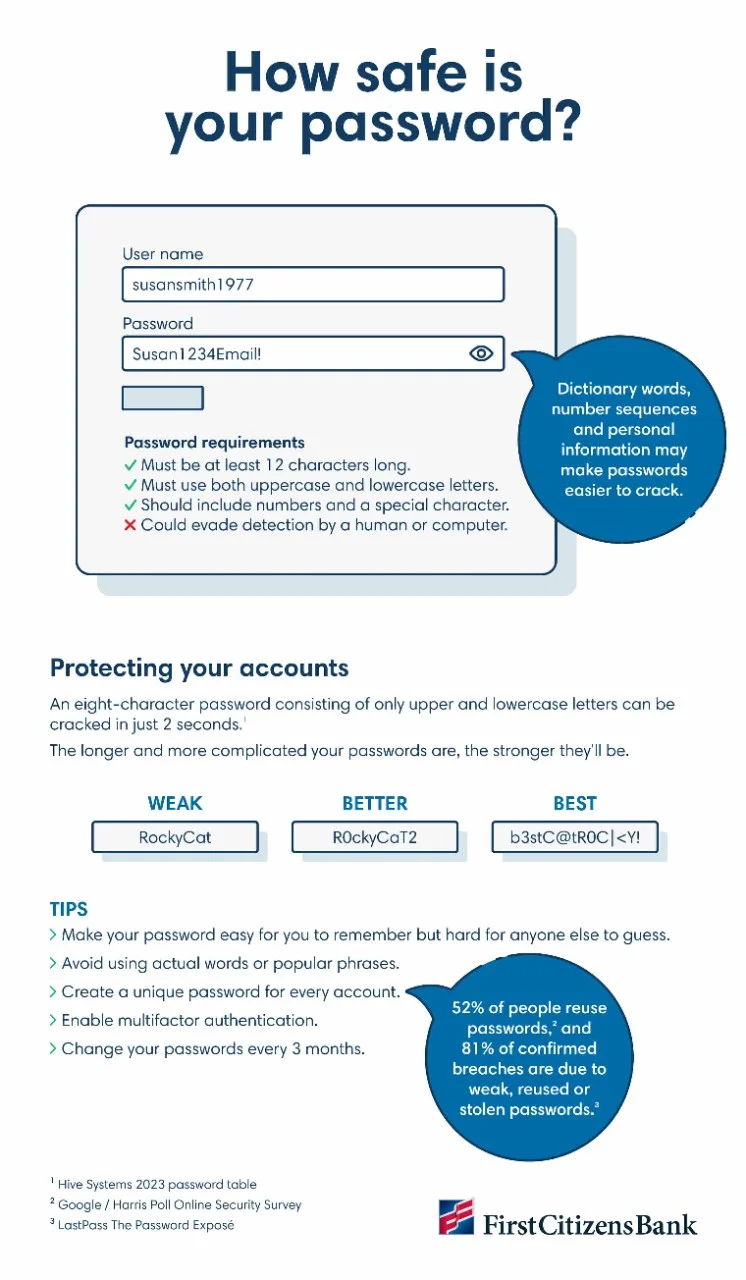

It's important to practice good password hygiene. This includes using unique passwords for every website and changing your passwords often. Whenever possible, you should also set up multi-factor authentication on your accounts—particularly your bank, email and credit card accounts.

Learn more about how to create a strong password.

Filing your federal tax return early is one way to prevent someone else from trying to file one in your name. You can also use an Identity Protection PIN when you file to make identity theft even harder. Also, periodically review your Social Security and IRS accounts to check for any suspicious activity.

Finally, be on the lookout for suspicious requests. Unfortunately, it's not uncommon for criminals to retarget their victims with new attempts. The best way to protect yourself is through awareness. Stay abreast of the latest scams targeting consumers and learn how to spot the signs of a scam.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.