Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Income, goals, health, family dynamics—these are just a few of the many topics affecting your investing approach when saving for retirement. But one question may be just as significant: What's your risk tolerance?

Craig Shively and Gregory Wesley-Shanks, wealth paraplanners at First Citizens Investor Services, offer their thoughts on how to determine your risk tolerance—and how it plays a significant role in achieving your retirement goals.

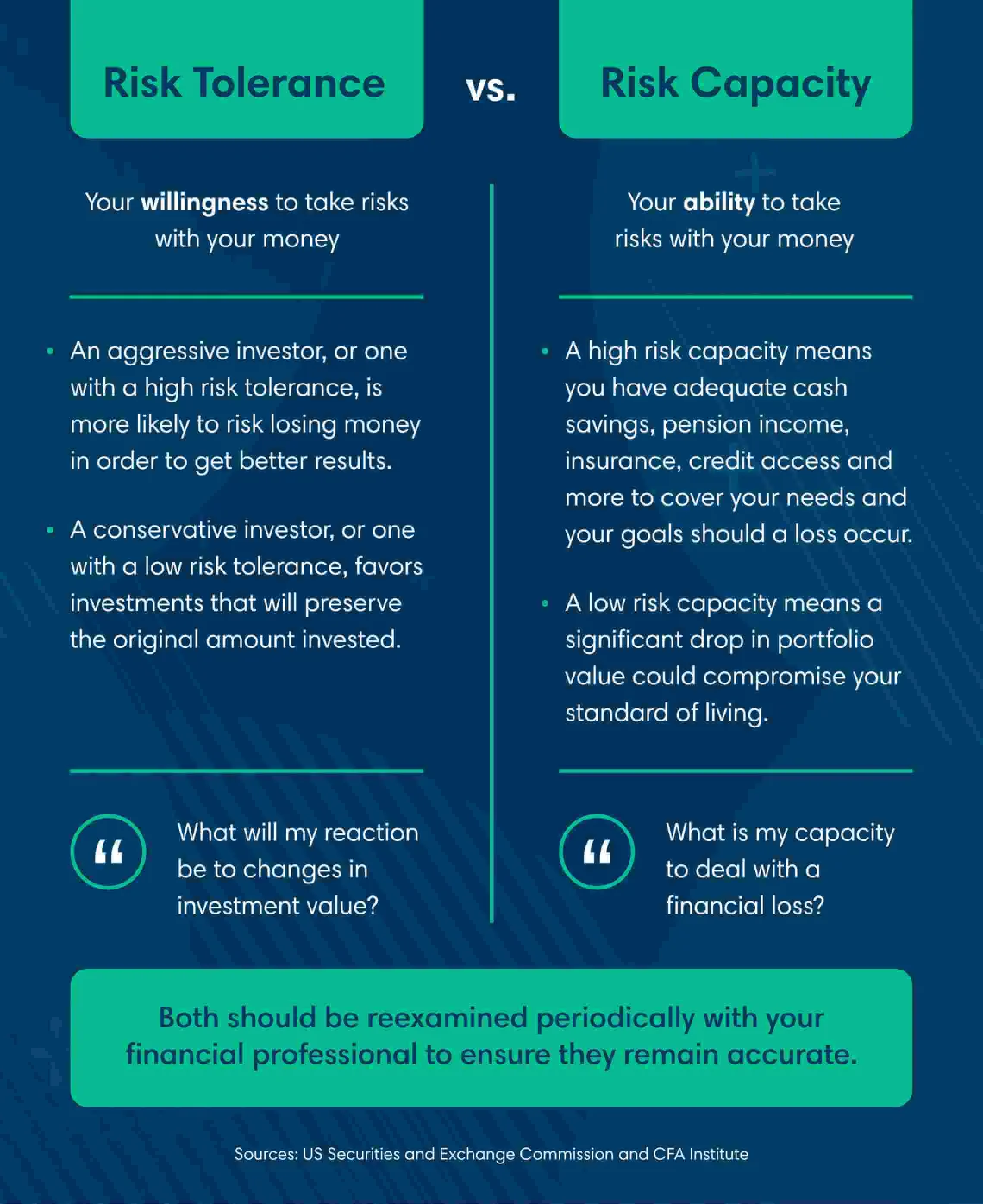

Many people believe risk tolerance is simply a matter of being either aggressive or conservative, but there's much more to it than this. To map out a plan for how to reach your goals, it's important to first understand the difference between risk tolerance and risk capacity.

Both Shively and Wesley-Shanks define risk tolerance as your willingness to take risk, while your risk capacity is your ability to take risk. A failure to distinguish between the two has led to more than a few financial headaches in retirement investing.

Risk capacity goes beyond whether you simply have enough money to take risk. It's also about how other goals impact your capacity. You may see a certain amount of money in your account and believe you can afford to take risk to pursue one goal, but if a loss impacts your ability to not only pursue that first goal but others as well, you don't have the capacity you think you do.

To illustrate, Shively lays out the example of an investor in their mid-60s with a substantial amount of inherited funds as their sole income. Considering only the amount of money at their disposal, they decide to invest over half of their inherited or investible assets into high-risk, potentially high-return equities, working on the assumption that they can expect a potentially higher average return to fund the goal of buying a boat.

"Hypothetically, this client could invest in riskier equity securities, or stocks, in the hopes of achieving higher gains in the market," Shively notes. "But the risk they're taking by doing so—in addition to buying a boat with retirement funds—is that they're near retirement age. Because of this, they have less time to make those funds back should the market take a downturn, and they may need to rely on those funds later in their retirement years to fund their lifestyle."

Avoiding these scenarios, he says, comes down to knowing the difference between tolerance and capacity and the factors that determine them.

There's one hard-and-fast rule for identifying risk tolerance: The more financial and personal questions you answer, the better chance you'll have of accurately calibrating your risk tolerance. However, financial professionals know that beyond initial inquiries about your financial comfort level, additional questions must be accurately and consistently presented to help ensure you'll maintain objectivity as you make decisions throughout retirement.

The initial step to understanding your risk tolerance is a questionnaire. For self-directed investors, several versions of these multiple-choice forms are available online. If you're partnering with professionals, they'll likely have proprietary, highly calibrated versions with weighted questions fed through an algorithm to produce a precise mathematical calculation.

These calculations are then used to help assign you a risk category. Categories typically start with three primary classifications: aggressive, moderate and conservative. While there are personal or scenario-based questions that may slide you from one category to another, the overarching considerations used to generate your position are factors like your age, current finances and goals. In general, the more time you have until retirement, the more risk you can take on because you have more time to adjust and save more if the unexpected happens.

"If you're younger, earning well and in stable financial shape, there's a better chance a questionnaire will rank you aggressive, as you're able to take on more risk," Wesley-Shanks says. "If you're in your 50s or older and are transitioning into the fixed income of retirement, you're not as likely to ride the ups and downs of the market and stand a better chance of being assigned conservative—with moderate falling between those."

Questionnaire results aren't the final word on assigning your risk tolerance. There are certain nuances of your life that multiple-choice options may not capture. For instance, if you're in your 30s or 40s and are investing for retirement, the questionnaire may ask how many family members you're currently caring for, at which point you'd add how many children you have. What it may not ask is whether you'll be caring for two generations—both your children and your parents—at some point during retirement.

"Feedback on a risk-tolerance questionnaire may indicate moderate or even aggressive styles of investing well into our 50s," Shively says. "But answers on a risk-tolerance questionnaire are designed to gauge your tolerance for risk, not necessarily your capacity or ability to take risk. Everyone's situation and needs are different. Things like time horizon, caring for loved ones or asset levels can change someone's ability to take on extra risk. Speak with your advisor before you make substantial changes to your portfolio to weigh life's competing priorities."

No matter how well-calibrated and useful, the results of a risk-tolerance questionnaire are only a starting point. As time progresses, you may receive an inheritance that changes your risk capacity before retirement, start a passion project that provides additional income or requires additional expenses, have a child move back in with you, or add and remove goals to your post-work plans. Unlike the questions you filled out, life isn't static.

"If you're categorized as aggressive but the market is trending down, ask yourself things like, 'What's more important to me—earning the highest return possible or optimizing my standard of living in retirement?'" Shively says.

Similarly, the recent bout of high inflation may cause you to reconsider your risk tolerance.

"Say you're in your 50s and one of your goals is to maintain a certain standard of living in retirement, but inflation keeps rising and prices go up," Wesley-Shanks says. "If this trend continues and you've taken a very conservative approach and have a lot of cash in a savings account earning less than 1%, based on that, you have to ask yourself a few questions. Will your current approach allow you to maintain your lifestyle 20 or 30 years from now, or do you need to consider taking more risk to keep up with inflation and rising prices?"

Aligning risk tolerance with goals is an ongoing process that works best when you can maintain objectivity—and when it comes to your retirement investment strategy, this isn't always easy to accomplish on your own.

"Working with an advisor may allow you to be more hands off when it comes to managing your retirement investments if you're not confident in managing it alone," Wesley-Shanks says. "Or if you're more of a self-directed investor, collaborating with an advisor gives you an objective voice. This can help you identify and avoid any investment biases you may have, in addition to keeping your investment strategy in line with your goals."

"With either approach you take, working with an advisor gives you as much input as you want and provides an objective voice to help ask and answer these important questions," he adds.

Successful retirement investing involves answering many financial and personal questions, which starts with the questions you ask yourself—the first of which should always be how you feel about your overall financial picture.

"Before you do anything with retirement investment, ask yourself, 'Am I truly comfortable or satisfied with my overall financial situation today?'" Shively says. "Because how you answer is going to inform your overall approach."

Your retirement should start with a plan. If you're not sure where to start, we're here to help.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.