Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

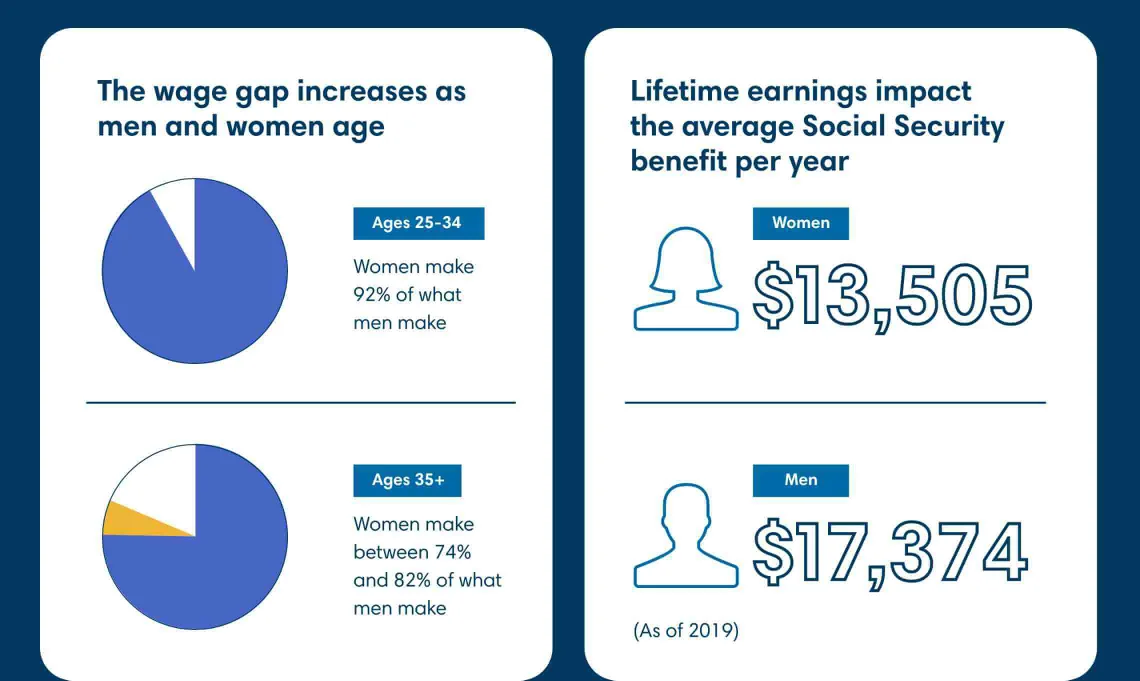

You've probably heard about the wage gap. On average, women earn about 82 cents for every dollar earned by men.

This number hasn't changed much in the past two decades, although there are indications that the wage gap is narrowing among younger workers.

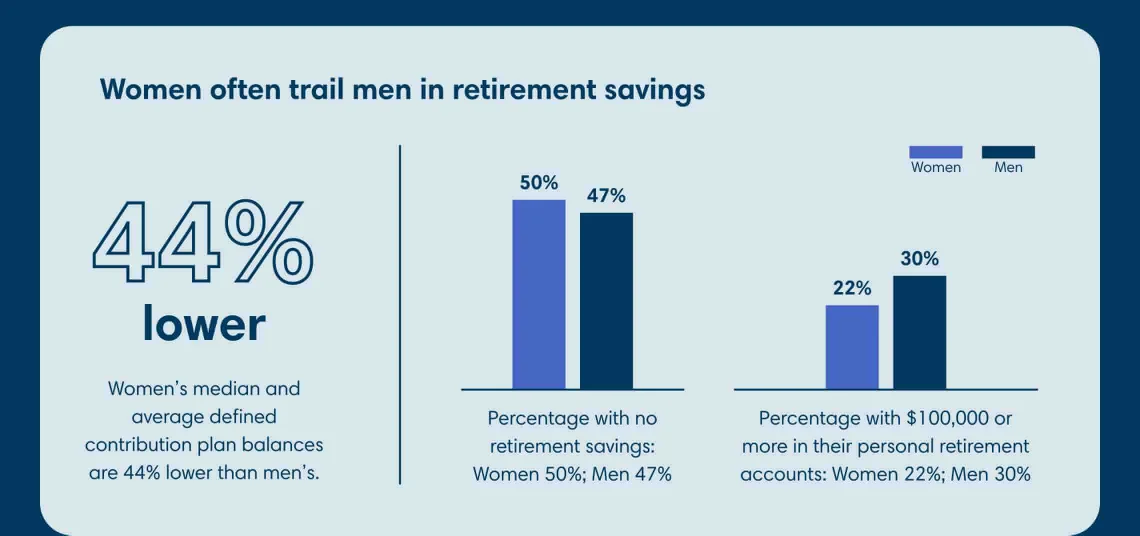

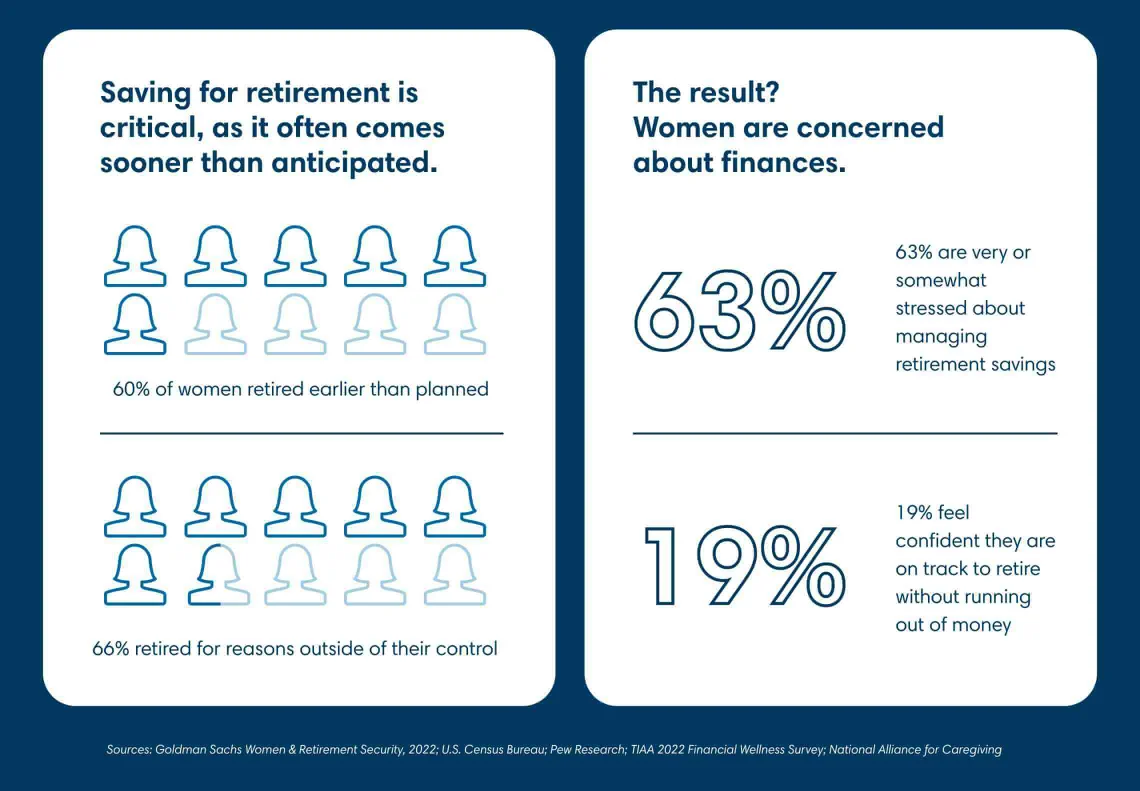

Women face unique challenges when it comes to retirement planning. The wage gap represents one significant challenge for women. Another is that women are more likely to take time away from work to raise a child or care for an aging parent, which has the potential to limit their total earnings, as well as their Social Security benefits in retirement. This can be especially challenging because women on average have a life expectancy that's longer than men, meaning it's critical to have retirement income for a longer duration.

According to a recent survey by the Teachers Insurance and Annuity Association of America, only 19% of women felt confident about retiring without running out of money—compared to 35% of men. Women consistently trailed men by a significant margin in various retirement confidence surveys.

Understanding these challenges—and others—can help women prepare for retirement early and protect their savings across their careers and other key life moments. Working with an advisor or banker can boost confidence and provide a strong sounding board for ideas that can help close the retirement confidence gap.

Here are some additional stats on women, wealth and financial health.

Addressing the challenges women face is essential to ensuring a secure and comfortable retirement. Take action to build your retirement plan. Learn more about the basics of retirement income.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.