6 tips for caregiver self-care

Caring for an aging parent can be meaningful and fulfilling. But it can also be a drain on your time, resources and emotional health. And when you're trying to balance caring for a parent with your career and your own family, the challenges are multiplied. Practicing caregiver self-care is important for your emotional and physical health.

Caregiving can take a tremendous toll on your physical and emotional health. Informal or unpaid caregiving has been associated with elevated levels of depression and anxiety and declining physical health, with 1 in 5 caregivers reporting fair or poor health.

It's important to find ways to safeguard your financial and emotional health—and the health of your family—if you're providing care to an aging parent or another loved one. Kelly Sullivan, Manager of Life Insurance Sales for First Citizens Bank, offers these six tips on how to practice caregiver self-care.

1Have an open family conversation

Although often difficult, it's important to have a conversation with your aging parents and other family members about expectations, responsibilities and the resources available to help cover care. Healthcare costs can be expensive, and there are several ways your parents may have prepared.

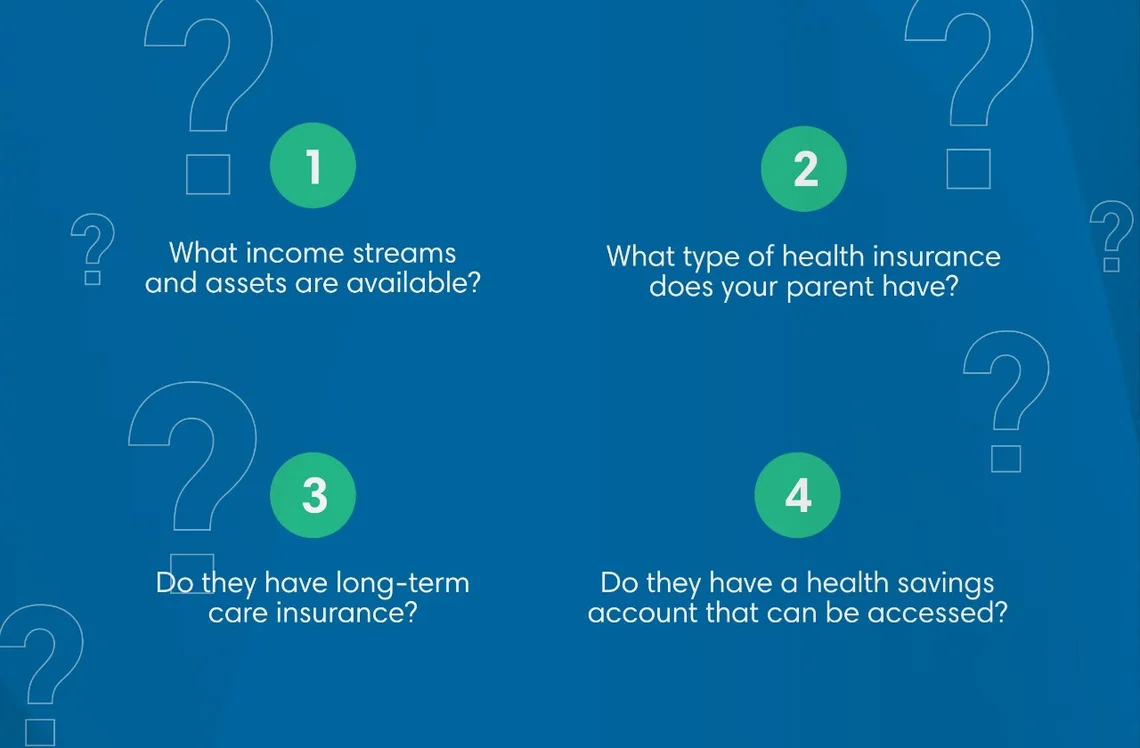

Get answers to these questions

- What income streams and assets are available?

- What type of health insurance does your parent have?

- Do they have long-term care insurance?

- Do they have a health savings account that can be accessed?

2Investigate ways to be compensated

If you're going to be your parent or loved one's primary caregiver, find out whether they have long-term care insurance that provides for caregiver compensation. Cash indemnity policies will often pay for a family member to provide care, Sullivan says. Other types of policies typically pay only if they hire a certified formal caregiver. This could play a key role in determining whether you provide care, hire someone to help care for them or develop a combination of strategies that allows you to help out while still giving you the flexibility to continue your career and care for your family.

If you have to take time off from work, ask if your company offers paid family leave for caregiving. You can also investigate government resources. The US Department of Veterans Affairs offers a program to assist family caregivers of veterans who have service-connected disabilities, while some states have programs that can pay a family member to provide care to a parent who qualifies for Medicaid.

3Enlist other family members

Talk to your siblings and other family members about sharing the responsibilities and costs of providing care to an aging parent. If you're the primary caregiver, consider asking your parents or siblings to pay you as an independent contractor. Without your involvement, they'd probably have to pay for a home health aide or consider a long-term care facility, both of which can come at a significant cost.

Siblings can also provide support in other ways. If you're providing most of the caregiving, can another family member do the weekly grocery shopping or take your parent to medical appointments to allow you to attend your child's school functions? Can an out-of-town sibling pay bills or provide respite so you can take a family vacation?

These are important questions of fairness that affect the lives of many people.

About one in five family caregivers report high financial strain (PDF) as a result of caregiving.

4Protect your financial future

Part of caregiver self-care is making sure your own finances aren't negatively impacted. If you're going to pay for your parents' care, talk to your financial advisor or banker about how to include these costs in your financial plan without jeopardizing your own long-term financial goals. Think twice before withdrawing money for your parents' care from your retirement accounts, which will likely have tax consequences or penalties.

"Look at every other resource you have before you do that," Sullivan advises. "And consider investing in long-term care insurance for yourself as an investment in your future."

5Carve out time for your immediate family

The demands of caregiving can strain your relationship with your spouse and children. You may have to rely on your spouse to pick up more day-to-day household tasks, and you'll likely miss some of your children's soccer games or school events.

Try to keep the lines of communication open. Share with your children and spouse how they can support you, and actively listen to their concerns. Remember to thank them for the things they're already doing to keep the household running while you're caregiving. And make sure to take time regularly to reconnect with your spouse, whether this means hiring a sitter for a date night or simply taking a long walk together.

6Seek outside support

Most communities have resources available to help older adults and their caregivers. The National Council on Aging has a map of partners and programs that can help connect you to meal delivery, transportation services, adult day care and other local resources.

Also try to connect with others in similar situations. Look for a support group focused on the specific disease your parent faces or join one for caregivers. Support groups can be a wonderful place to share practical information and vent frustrations.

"It's important to have an opportunity to vent and have other people say, 'I'm going through that too. You're not the only one,' " Sullivan says.

We can help you navigate life's journey

Life is full of twists and turns—some expected and some not. Fulfilling your hopes and dreams, no matter what comes up, starts with a solid plan.