Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

Q4 Quarterly Market Review: Available now

The Making Sense team reviews changes in the market during Q4 2025.

It's common to feel overwhelmed and uncertain during and after a divorce. But there's a tool you can use when preparing for divorce—proactive financial planning. A solid strategy may help you find some peace of mind during this major life change.

"There are many things throughout the legal process of divorce that are completely out of your control," says Richard Houston, Senior Wealth Planning Strategist at First Citizens. "Creating a plan and being sure you're making decisions about everything that's in your control at this time is critical."

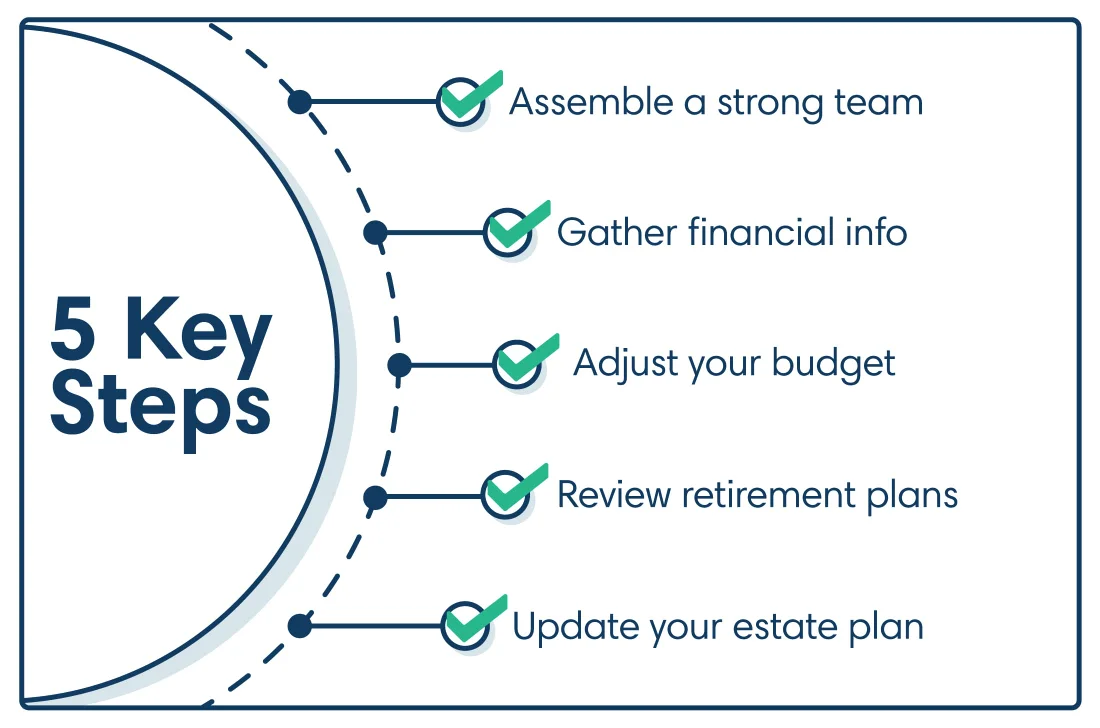

To help position yourself for financial stability as you move forward independently, consider these five steps.

The emotional aspects of divorce can make it an overwhelming time, so it's important to have a strong team in your corner. Ideally, you'll build a good rapport with a team that can guide you collaboratively.

One of the most important members of this team is a divorce attorney.

"Legal counsel is the first step, and the earlier you get them involved, the better," Houston says. "They're the ones who are ultimately going to be leading you through this process."

Your team might also include a tax professional and an estate planning attorney. If the divorce agreement includes decisions about real estate, you might also want to employ a real estate agent to help you understand the market value of properties.

It's also important to engage the support of a financial advisor. They can help you evaluate the financial impact of your divorce, create a holistic plan and coach you on how to prepare for the costs of divorce.

To ensure you and your spouse are equipped to make informed decisions, you'll need a clear picture of your combined finances. For this, you and your team should review various financial documents, including tax returns, bank statements, investment and retirement account information, loan statements and real estate or personal property information.

In addition to understanding the value of your assets, you can use these documents to get a handle on your household's debts. This is also an opportunity to review all your accounts to confirm ownership and titling, as well as to update any named beneficiaries.

It's important to maintain and protect your credit during this time, particularly if you and your spouse have joint accounts that will need to be closed or separated. Pull your credit report to check for errors or unfamiliar charges, and continue to monitor your report over time. It may also be a good idea to establish a credit card in your name if you don't have one already.

Your income and expenses are likely to change after your divorce, so you should think about creating an updated spending plan that works with your new financial situation and lifestyle. Start by looking at your annual expenses and breaking out those that are discretionary or nice-to-have costs versus nondiscretionary, must-have costs. The latter category should include expenses, such as rent and utilities, as well as financial goals, such as paying down debt and saving for retirement.

Then you can determine whether those expenses will change once you've finalized your divorce and see how they compare to your post-divorce income, Houston says. If the expenses exceed your projected income, you'll need to adjust. That might require cutting back on discretionary expenses or looking at ways to increase your income.

In addition, speak with your financial and tax advisors to ensure you understand the long-term tax implications of dividing assets and how any spousal support will be taxed.

After a divorce, you'll likely need to reconsider many aspects of your retirement plan. You may need to recalibrate your savings goals and investment strategies or maximize contributions to retirement accounts. It's also important to understand the impact of divorce on your Social Security benefits and adjust your savings strategy as needed. The older and closer to retirement you are at the time of divorce, the more important it is to focus on these planning details.

No matter your age, you should aim to save at least 10% to 15% of your income for retirement, ideally in tax-advantaged accounts like a 401(k) or an Individual Retirement Account, or IRA. If saving at this level isn't realistic right away, start by putting away whatever you can with a plan to increase the amount you're saving over time.

If you're receiving retirement accounts as part of a divorce settlement, it's advisable to speak with a financial professional about the best strategy to handle those assets.

In addition to updating beneficiaries, you'll likely need to revise the rest of your estate plan to ensure it reflects your current wishes. This may require changing fiduciary appointments, such as executor, trustee and agents for powers of attorney or healthcare directives.

"If your estate documents still identify the spouse you're divorcing as the primary person handling your estate and making financial decisions on your behalf, that may be a big problem," Houston says. "Those need to be updated as soon as possible."

Divorce often takes an emotional toll—but it also presents an opportunity to reshape your finances and head into your new life with confidence. With the right team in place, you'll be better able to protect your assets, manage your expenses and keep yourself on the path to financial security.

The information provided should not be considered as tax or legal advice. Please consult with your tax advisor.

Your investments in securities and insurance products and services are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands and Services Offered: First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares are the entities through which FCW products are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. ("FCIS"), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. and SVB Wealth LLC, all SEC registered investment advisors. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions or to all investors. Insurance products and services are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products and services are offered by First-Citizens Bank & Trust Company, Member FDIC and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

For more information about FCIS, FCAM or SVBW and its investment professionals, visit FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.