Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

2026 Market Outlook video: Available now

The Making Sense team reflects on 2025 and discusses key headwinds and tailwinds for 2026.

More than 2/3 of people over age 65 will need at least some long-term care in their lifetime, according to the US Department of Health and Human Services.

If your parents already need significant care—or may soon need more—the time to plan is now, says Kelly Sullivan, Manager of Life Insurance Sales for First Citizens. In fact, the sooner you start planning for how to manage long-term care for your parents and support them as they age, the easier the transition will be. Even if you don't have time to plan because a parent has already developed an unforeseen health issue, you can still be smart about the decisions you need to make in the moment. Sullivan offers three tips for managing long-term care for an aging parent.

Many people assume that long-term care means moving into a facility, but most long-term care actually is provided at home by unpaid caregivers who are family members or through community support programs.

Remember that managing long-term care for your parents may evolve over time. At first, it may simply mean setting up meal delivery, bringing in someone to do household chores and making modifications to your parents' home, such as adding ramps and grab bars. For older adults who need more support, you can hire a home healthcare aide to help with personal care, or take them to an adult day care center while you go to work. Your Area Agency on Aging will have a list of local services.

If a parent needs to move in with you, you may want to consider a home equity line of credit to cover modifications to your house. You'll also have to determine whether the move is permanent enough that you need to sell your parents' current home. This could have a significant impact on the assets they have available to help pay for long-term care, but it also impacts the potential gift of that home to you or another sibling.

You may also want to investigate housing options such as senior apartments, assisted living facilities, nursing homes and continuing care communities. Check accreditation, licensure and other certifications, schedule visits, and ask your friends and colleagues about their experiences.

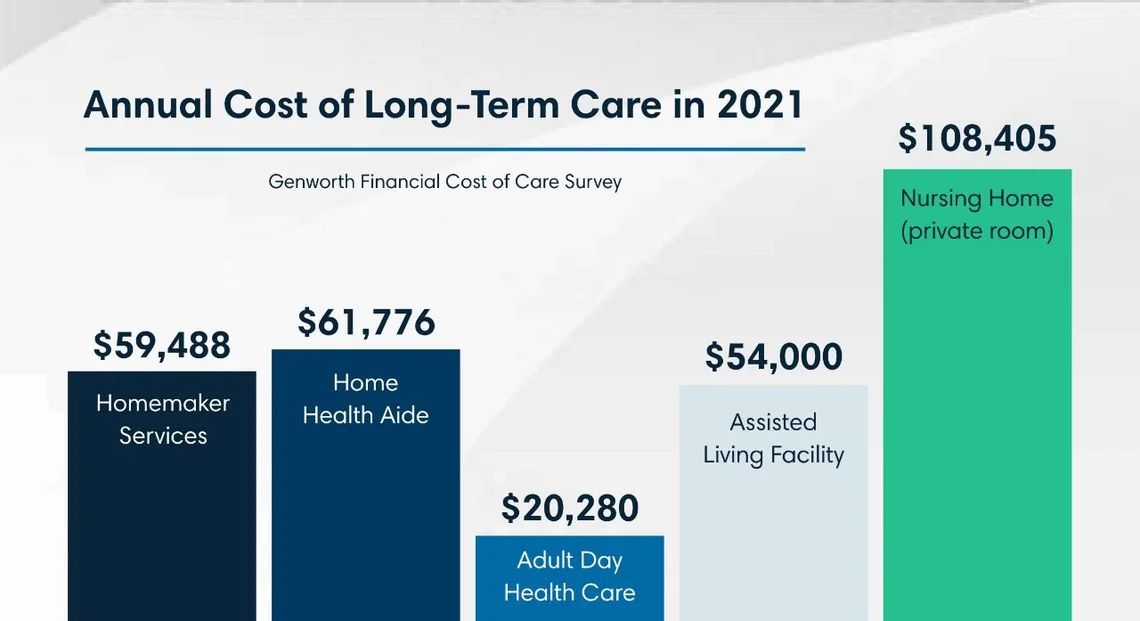

Professional long-term care can be expensive.

The average annual cost for an assisted living facility in 2021 was $54,000, according to the Genworth Cost of Care Survey. Annual costs for other types of care vary widely, ranging from $20,280 for adult day healthcare to $108,405 for a private nursing home room. Homemaker services averaged $59,488 and home health aides averaged $61,776. Ask your parents about their financial resources for long-term care. If you're lucky, they have a long-term care insurance policy. Other options to help pay for long-term care include veterans benefits, Medicaid, a reverse mortgage or selling their home. A financial advisor can help you understand the impact of the different ways of paying for long-term care.

Find out where your parent keeps their will, advanced directives, life insurance policies, military and marriage records, and other important documents. Make sure you know who has power of attorney and healthcare power of attorney.

"You want to have those things in place while they're relatively healthy. Otherwise, it can become quite difficult to follow what their intentions may have been," Sullivan says. If your parents failed to set up these documents before becoming incapacitated, you may need to go before a judge to be granted conservatorship, allowing you to make medical and financial decisions for that parent. Judges may also grant split guardianship, which could allow a family attorney to manage real estate and other assets while you manage other aspects, such as paying bills.

If you're considering having your parent move in with you, make sure your family's on board and consider the physical limitations of your home, Sullivan advises. Where will they live? Is the shower accessible?

Whether your parent lives with you or not, consider how much care you can realistically provide. Serving as your parent's main caregiver can be physically and emotionally draining, especially if you work full time or have young children. Talk to your financial advisor or a banker about the impact of your caregiving, especially if it includes providing financial support to your parent or if it impacts your income from work.

Tap siblings and other family members for support, Sullivan suggests, and take advantage of local services and resources. It's important to remember that you can still actively manage the long-term care of your parents even if you can't spend 24/7 with them yourself. Consider hybrid options, such as providing some care yourself but also relying on an in-home aide, and don't feel guilty about taking the time you need to take care of yourself and be with your spouse or children.

"Taking care of a parent all the time can be overwhelming," Sullivan says. "So, bring them to adult day care or have someone come into their home for a few hours. Giving yourself some rest is so important."

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.