Financial steps to take in a career transition

There are countless reasons people leave a job behind, from a cultural mismatch to a better offer with another company. Whether you're anticipating a career transition or just want to feel more prepared during periods of uncertainty, financial planning is essential.

Gregory Wesley-Shanks and Craig Shively, Wealth Paraplanners at First Citizens Investor Services, offer some advice on navigating a job transition—whether or not the choice to leave was yours.

What to do in either case

The following strategies are relevant whether you're just beginning to consider a job hunt, preparing to hand in your notice or adjusting to an unexpected layoff—something that happens to 40% of Americans at some point in their careers.

Get your emergency fund in order

Having emergency savings is essential, even during periods of stability. But if you're in the market for a new job or think there may be a layoff in your future, it's vital to have a healthy emergency fund in place. Most financial professionals recommend keeping at least 3 to 6 months of expenses saved in an accessible emergency fund. Wesley-Shanks says it's best to err on the high end if possible.

"I like clients to get closer to 6 months—especially for couples, if one person is working and one isn't—just to have that additional cushion," he says.

Having a budget can help identify areas where you may be able to save money to build an emergency fund. If you don't have a line-by-line budget, it's never too late to make one. A budgeting calculator and digital banking tools can make this task easier to navigate.

Talk to your financial advisor

Many people think of financial professionals as resources they use only when they want to build wealth, but both Wesley-Shanks and Shively point out that they're also there to help with any money-related situation—including learning how to organize finances.

Whether you're leaving a job due to a sudden layoff or long-planned transition, a financial planner can help you figure out the smartest ways to tighten your budget or rework your retirement accounts to give you more flexibility.

What to do before switching jobs

Finding a new job—or even pivoting careers—can be exciting and rewarding. But as you navigate the process of accepting a new offer and letting your current employer know your exit plans, keep these financial best practices in mind.

Know your benefits and retirement plan options

Review your new offer carefully and make sure you compare the benefits options at each company. "Number one is understanding any benefits that you may be giving up, plus a solid understanding of when your new benefits start with your new employer," Shively says. "We don't want to have a gap in insurance coverage, for example." What's more, if your healthcare benefits cost significantly more at your new job, that may offset any salary bump.

Shively also underscores the importance of looking at your retirement plan. If you have a 401(k) from your old job, you may want to compare its investment options and other features to your new employer's plan—if they have one—or to an IRA. A rollover of your 401(k) may have advantages or disadvantages. Alternatively, you may be able to leave your investments in your old employer's plan. In any event, you should consult a financial professional to help you compare all of your available options before you make a decision.

Avoid spending extra cash

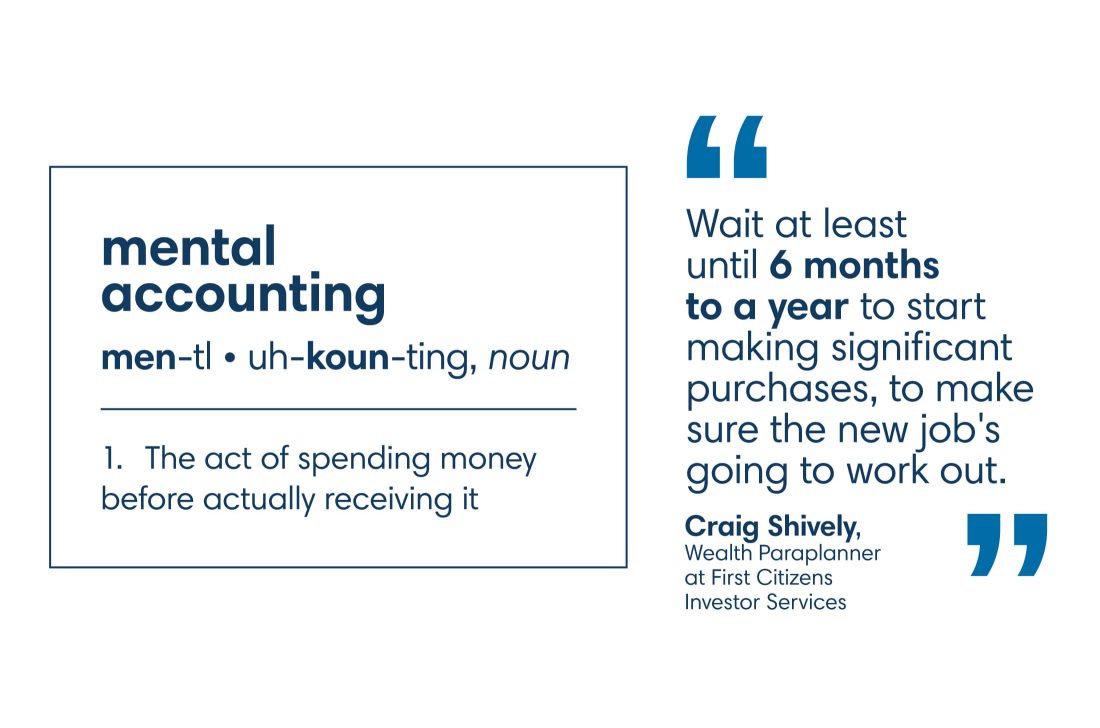

Shively cautions against mental accounting—or spending money before you actually receive it—if you expect to receive a higher salary in the future. If your new job isn't the right fit, this type of spending can leave you in a bad position.

"Wait at least 6 months to a year to start making significant purchases, to make sure the new job's going to work out," he says. In the meantime, consider stashing any cash you don't need in a savings account or retirement fund.

Think big-picture

You might be eager to take the job that offers the highest salary. But if it's in a field you're ambivalent about, this time of transition might be more rewarding if you find a path that aligns more with what you want to do.

"A job change is a major life event, just like having a kid or getting married," Shively says. "It's an opportunity to reflect on where you want to go, where you've been, how you got to this point—and to take note of strengths and weaknesses to realign for success going forward."

What to do if you lose your job

There's no need to think of job loss as the worst-case scenario or to feel like events are out of your control. A transition like this can provide much-needed time to reflect on your passions and career goals and may serve as a springboard for new opportunities. You also may receive severance or unemployment payments, which isn't the case if you decide to quit.

Reevaluate your budget

According to Wesley-Shanks, you should first create a budget that prioritizes needs over wants. "Work on a spending plan, and make sure you're not overspending," he says. "Put as little on credit cards as possible, and find a way to reduce your discretionary expenses as much as possible."

Keep some comforts

While trimming unnecessary expenses from your budget is a must, Shively says you shouldn't make the mistake of cutting every ounce of fun from your life. "I've seen people go to extremes of cutting out everything that's not their electric bill, water bill, mortgage or food. That's not realistic," he says.

In fact, keeping a low-cost but high-reward hobby is a great way to keep you feeling hopeful and optimistic as you search for a new job. "You're still a human being," Shively says. "Keep something to keep your brain occupied. If you've got a hobby, keep it up. Don't totally eliminate your standard of living."

Avoid dipping into your 401(k)

"Many people just aren't fully educated on their 401(k), so they'll leave a job and say, 'I'll just take a full withdrawal,' not knowing the consequences," Shively says. But withdrawing from your 401(k) early can result in a serious potential loss over time—coupled with a waste of many of your hard-earned dollars.

"You're reducing your time horizon for that money to work, and you're also likely paying a 10% penalty on top of any income taxes if you're under 59 1/2," he says. "The long-term harm of that is greater than the short-term good."

Lean on a trusted advisor

Whether you're considering a career change or processing an employer separation, a financial professional can help walk you through all of your most important considerations. They may find financial possibilities you don't see as you leave one opportunity and transition to another. And it's important to be able to lean on their professional judgment during a time that can be both disorienting and emotionally stressful.